Top consumer spending funds

But in the markets, a week can be a long time. Now there are new worries of market downturns and a possible economic slowdown.

Indeed, the U.S. economy has been in a "plow horse mode," showing strength only in selective areas and plodding along, says Tom Roseen, head of research services at Lipper.

Consumer cyclical mutual funds, which typically ebb and flow with the economy, have shown mostly lackluster returns over the short-term (the past 12 months and year-to-date.) "I'm not all that surprised, given the concerns for a global economic slowdown," Roseen says. "With all the uncertainty, investors just can’t make up their minds."

Taking a longer view, however, there is a small group of consumer cyclical funds that has rewarded investors with double-digit gains over the past three years. Scroll through to see the top performers over that time period. All data from Morningstar.

11. PowerShares Dynamic Leisure & Entmnt ETF

1-Yr. Return: -8.23

3-Yr. Return: 5.71%

Expense Ratio: 0.63%

10. iShares Globl Consumer Discretionary

1-Yr. Return: -5.47%

3-Yr. Return: 6.97%

Expense Ratio: 0.47%

9. First Trust Cnsmr Discret AlphaDEX ETF

1-Yr. Return: -6.70%

3-Yr. Return: 7.81%

Expense Ratio: 0.63%

8. Fidelity Select Leisure

1-Yr. Return: -6.37%

3-Yr. Return: 9.55%

Expense Ratio: 0.78%

7. Fidelity Advisor Consumer Discret

1-Yr. Return: -1.66%

3-Yr. Return: 9.70%

Expense Ratio: 1.14%

6. Fidelity Select Consumer Discret Port

1-Yr. Return: -0.54%

3-Yr. Return: 10.58%

Expense Ratio: 0.76%

5. Vanguard Consumer Discretionary ETF

1-Yr. Return: 0.15%

3-Yr. Return: 11.35%

Expense Ratio: 0.10%

4. iShares US Consumer Services

1-Yr. Return: 0.96%

3-Yr. Return: 12.61%

Expense Ratio: 0.43%

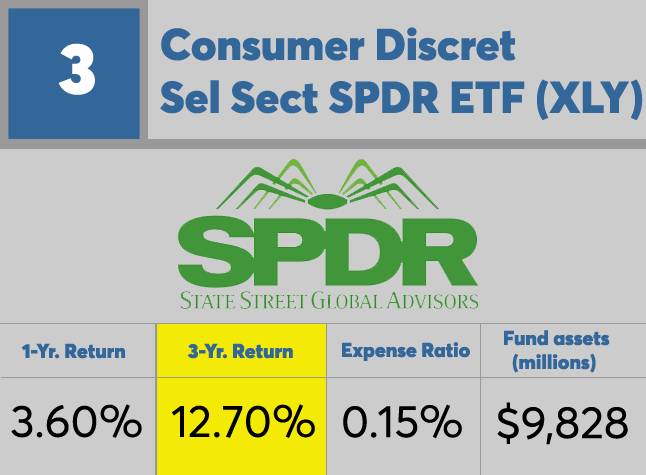

3. Consumer Discret Sel Sect SPDR ETF

1-Yr. Return: 3.60%

3-Yr. Return: 12.70%

Expense Ratio: 0.15%

2. VanEck Vectors Retail ETF

1-Yr. Return: 5.01%

3-Yr. Return: 15.29%

Expense Ratio: 0.35%

1. Fidelity Select Retailing

1-Yr. Return: 11.89%

3-Yr. Return: 17.42%

Expense Ratio: 0.80%