-

S&P 500 company pension plans' funding levels increased a mere 1% despite the $40 billion in contributions that these firms made to their plans.

March 29 -

Retirees can suspend and resume their Social Security retirement benefits any time after their full retirement age even if they started collecting the benefit before reaching their FRA.

March 28 -

A Roth IRA would come ahead of a traditional IRA if clients move to a higher tax bracket in retirement.

March 27 -

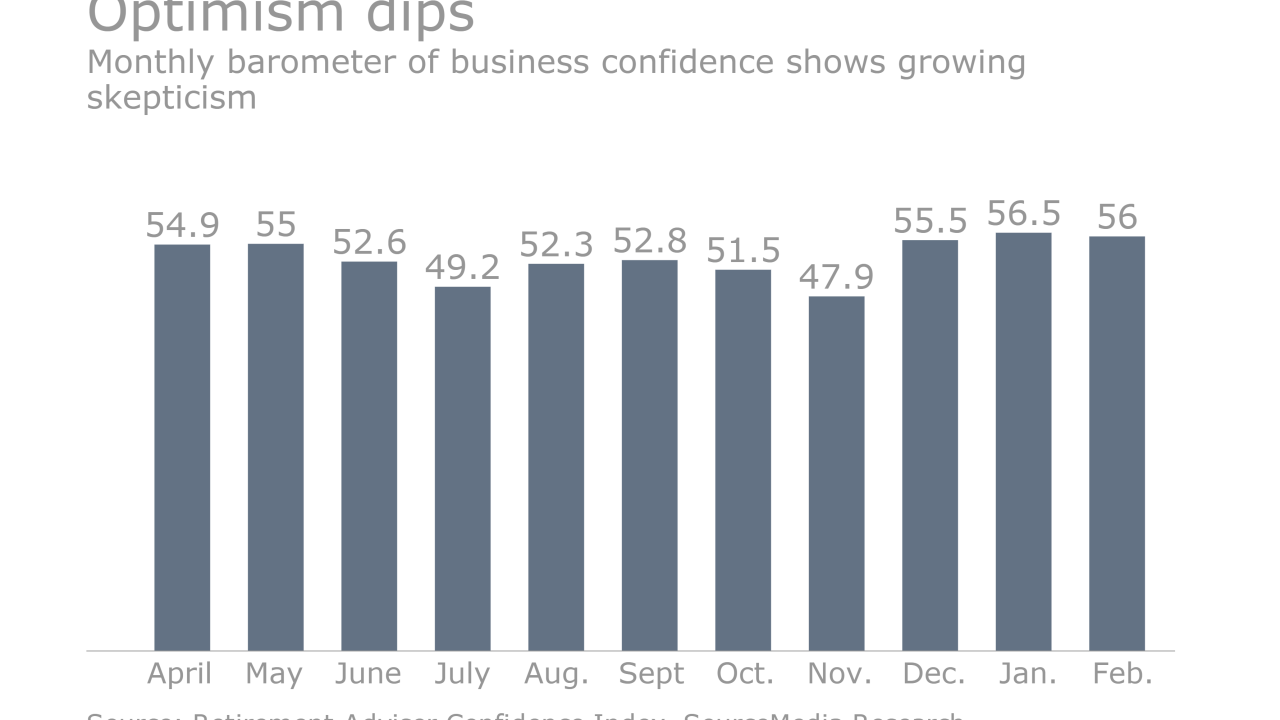

The stock market has been on a tear, writes a financial analyst, which helps explain the rising optimism.

March 21 -

Many seniors are unaware that Medicare premium payments are deductible, while their spouses who are still working can contribute to a spousal IRA and reduce their taxable income.

March 15 -

Investors can expect a tax bill from their traditional IRA or Roth IRA if they hold non-traditional assets, such as limited partnerships, operating businesses and real estate, in these accounts.

March 13 -

The SEP IRA, Solo 401(k) and SIMPLE IRA are just a few options that may help them prepare.

March 10 -

The two firms will offer a “seamless and efficient” solution between compensation and retirement fund allocations.

March 10 -

These products are meant for short- and intermediate-term investing and should carry enough risk to grow and meet the goals over time.

March 6 -

One important somber step for 40-something clients is to consider what happens to their assets when they die.

February 27 -

One easy measure stick is the 25-times rule, which says simply that clients are prepared if they've saved at least 25 times their annual spending.

February 24 -

Advisers might want to steer their practices away from doctors and toward millennials.

February 23 -

A reverse rollover from IRAs to other retirement plans is an option that enables investors to improve their tax efficiency.

February 22 -

The proposed new Roth health savings account is designed to help people cover health insurance premiums and out-of-pocket medical costs.

February 21 -

Retirees who earned at least 40 work credits are entitled to Medicare Part A and can pay for Part B through their Social Security checks.

February 17 -

Blooom CEO Chris Costello says the firm will not develop a white labeled version of its offering, as other robos have done with their platforms.

February 17 -

With an additional $9 million in backing, the online firm's CEO and co-founder Chris Costello says the goal is to grow to 50,000 clients by the end of the year.

February 15 -

Clients who have lost track of old 401(k) accounts may get help from the National Registry of Unclaimed Retirement Benefits, a subsidiary of a firm that processes retirement checks.

February 13 -

A new comment period would give the administration time to prepare for legal challenges anticipated after it puts a delay into place, one expert says.

February 10 -