Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

-

A new McKinsey report on the future of wealth management identifies a disturbing trend: Younger investors are losing trust in advisors.

-

As AI agents move from theory to reality, some advisors are implementing these tools into their technology stacks, but not without human oversight.

-

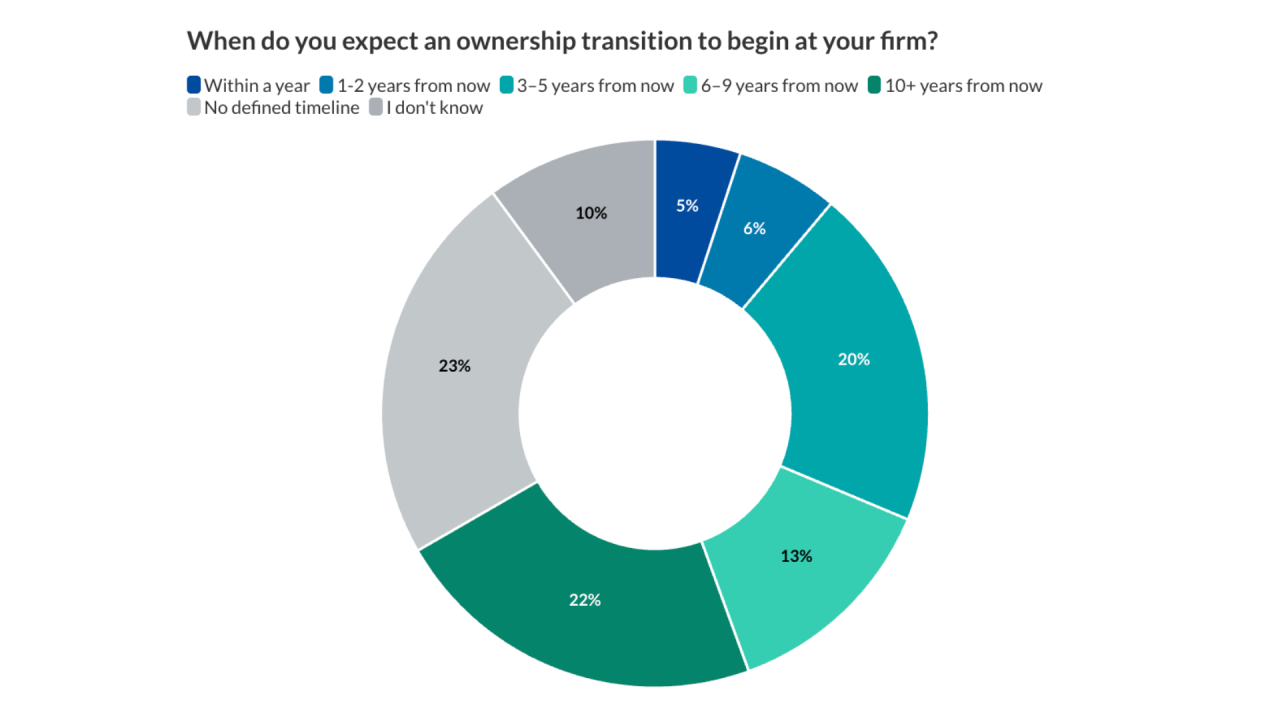

Raymond James tapped industry veteran Mark Buchanan to lead a new ESOP advisory group focused on tax-advantaged succession strategies.

-

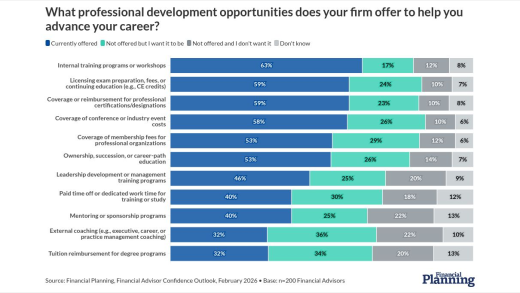

Many advisors haven't yet begun putting together an exit plan. Experts say there are common features and defined timelines that can help make it work.

-

A Financial Planning survey found that advisors believe AI will continue to transform wealth management. But experts say human oversight is still essential.

-

Across the industry, financial advisors are anticipating a busy 2026. From consumer protection cuts to AI regulation, wealth management could look very different a year from now.

-

Advisors know that a transition plan is important, but many fall into the trap of procrastination.

-

- Tax TuesdayEvery TuesdayActionable ideas and savvy strategies advisors can use to guide their clients on tax matters. Delivered every Tuesday.

- RetirementEvery WednesdayAnalysis and strategies for all phases of retirement planning, including Social Security.

- DaybreakDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Best of the WeekWeeklyThe most popular stories of the week.

-

Internal succession planning is messier but aligns with a true fiduciary firm's core values, argues Neela Hummel of Abacus Wealth.

-

Red flags may abound, but so do arguments for an extended equities streak. Keeping clients on an even keel is crucial.

-

Agentic AI will continue to automate financial planner workflows — and that's a good thing.

-

Much like deciding the right client headcount, choosing whether to fire a customer or turn away new business represents an important step in a firm's development.

-

An annual RIA compensation survey suggests that firms are paying a pretty penny for financial advisors — but reaping healthy profits.

-

As a subscriber to Financial-Planning.com, you can earn up to 12 hours of CE credit from the CFP Board and the Investments & Wealth Institute.

-

LeCount Davis, Stanley O'Neal, Maggie Lena Walker, June Middleton and Gerald B. Smith transformed wealth management, investment management and personal finance.

-

This year, 60 RIAs made the cut. See the firms that advisors say excel in culture, leadership and the benefits that matter most.

-

The annual ranking of the fee-only RIAs with the most assets under management — see the top firms.