With Amazon about $25 billion away from becoming America’s second trillion-dollar company, investors are piling into an ETF with a whopping 25% exposure to Jeff Bezos’ online superstore.

-

Vanguard, Betterment and Fidelity are among the clients of the tech giant's cloud computing platform.

May 11 -

How technology could continue to disrupt financial planning.

May 22 -

To understand the challenge posed by big tech disruptors, wealth managers should look at how those firms unexpectedly adapt to enter new markets.

April 25

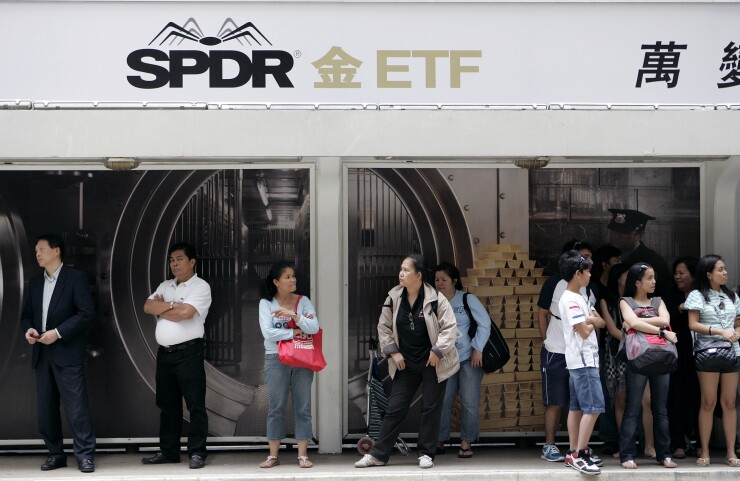

State Street’s Consumer Discretionary Select Sector SPDR Fund (XLY) has taken in over $546 million this week, putting it on track for its best week in over three years. The flows are a continuation from the previous week, when investors poured $524 million into the fund. Its assets have surged more than 23% this year to a record $16 billion. After Amazon, the fund’s second biggest holding is Home Depot at 7.3%.

Shares of the internet giant passed $2,000 for the first time Thursday morning after Morgan Stanley said sales growth remains strong. The bank lifted its price target on the stock by 35% on Wednesday to the highest level among analysts surveyed by Bloomberg. Amazon’s market capitalization is $985 billion, more than any company other than Apple, which is at $1.1 trillion.

More broadly, robust earnings from retailers have shined a light on the health of U.S. consumers, with Target CEO Brian Cornell describing the environment as the “strongest” he’s seen in his career. That’s reflected in economic data released Thursday, which showed that consumer spending continued to rise in July.

“The consumer is doing their part to keep the economy’s engines running strong in the second half of the year,” Chris Rupkey, chief financial economist at MUFG Union Bank in New York, wrote in a note to clients.