BlackRock plans to open an office in Saudi Arabia as the world’s largest asset manager seeks investment opportunities in the kingdom and wider Middle East.

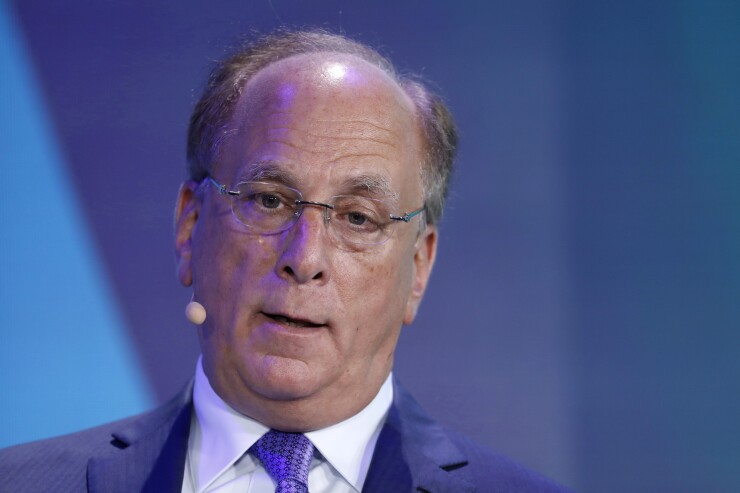

“The changes in Saudi Arabia are pretty amazing,” CEO Larry Fink said at a financial summit in Riyadh on Wednesday. “We are looking at many different opportunities as an investor and we are working with the region in terms of helping them diversify their portfolios outside the region.”

The New York-based company was a “substantial investor” in Saudi Aramco’s inaugural dollar bond, Fink said. The oil giant raised $12 billion this month in one of the most oversubscribed debt offerings in history. “We wanted the Aramco bond to be much bigger,” he said.

Some of the world’s leading financiers are gathering in Riyadh for a two-day summit six months after most Wall Street chief executives skipped a major investment conference in protest over the murder of Jamal Khashoggi. While the U.S. has blacklisted 16 Saudi nationals for their role in the killing, the diplomatic crisis for business has proved to be little more than a blip.

-

For the first time, fund managers must disclose a breakdown of their fees to banks, insurers and other distributors.

January 3 -

Unlike humans, the technology is not able to explain why it made a particular decision.

November 2 -

Investors may be growing impatient with implementation of the administration’s agenda, an analyst says.

November 9

Fink, who skipped a gathering of elites in the Saudi capital last year as the financial industry protested the government critic’s killing, touted the kingdom as a promising market for investors.

“The region is not perfect. No region in the world is perfect,” Fink said. “The fact that there are issues in the press doesn’t tell me I should run from a place, it tells me we should run to a place.”

BlackRock is focused on ways to broaden its global reach as the industry is under pressure to find growth. Fink frequently underscores the money manager’s desire to attract customers outside the U.S. and sees great untapped potential abroad.

The firm saw its assets under management move above $6 trillion again in the first quarter of this year after a drop amid market turmoil at the end of 2018.