Even before this year’s market crash, the wealth management industry’s richest clients were frustrated about fees.

A third of those with more than $1 million of investable assets were uncomfortable with them in 2019, according to Capgemini’s World Wealth Report 2020. Such discomfort will likely rise in today’s volatile markets. The survey of more than 2,500 individuals found that about one in five plans to switch their primary wealth management firm in the next year, with high fees the top reason.

Even some of the industry’s cheapest products “may be overpriced” in that they’re “mirroring a passive index,” an expert says.

Their main concerns were about transparency, performance and value received. They also said they preferred fee structures to be performance- and service-based instead of asset-based.

It’s the latest sign of the pressure the industry is under as clients balk at costs and digital competitors emerge. The majority of investors weren’t satisfied by the quality of personalized information they receive and about three-quarters of those surveyed said they would consider offerings from non-traditional providers like the big tech firms.

-

The wealthiest clients require teams of professionals leveraging the highest touch service with a global reach, Markus Lammer, COO of Credit Suisse’s UHNW business in the U.S., explains in an episode of Financial Planning’s Invest Podcast.

May 14 -

As much as $16 trillion of global wealth may be wiped away this year as a result of volatility and economic fallout from the pandemic.

June 25 -

The world’s 500 richest people have lost almost $1.3 trillion since the start of the year.

March 25

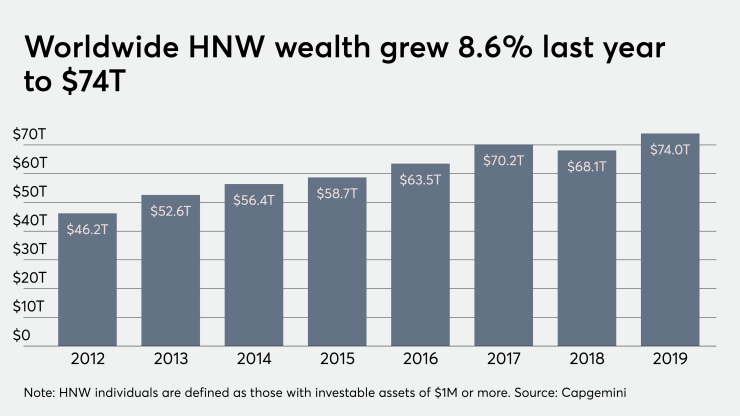

The discontent comes even as the rich get richer: The report estimates that the net worth of wealthy individuals climbed to $74 trillion at the end of 2019, up 8.7% from 2018 and $46 trillion in December 2012. The population of millionaires reached almost 20 million, including 183,400 with a net worth above $30 million, versus 18 million in 2018 and just 12 million in 2012.

For the first time since 2012, the Asia-Pacific region didn’t lead wealth growth last year — it was North America. The U.S. alone had 5.9 million millionaires at the end of 2019, up from 5.3 million in 2018 and more than any other country. Japan followed, with 3.4 million millionaires, followed by Germany, China and France.

The wealthy favored equities in the first two months of 2020. They allocated 30% of their assets to stocks, compared with 17% to fixed income, 15% to real estate, 13% to alternative investments and 25% in cash.

The survey did flag some promising growth areas for wealth managers. Those under 40 were far more likely to be willing to pay for value-added services such as real estate investment advice and tax planning. Sustainable investing is another bright spot, especially for the richest investors. — Additional reporting by Yoojung Lee