Whether or not publicly traded wealth management firms disclose their headcounts of financial advisors in their quarterly earnings, the number represents a closely watched industry metric.

So the below rankings of fee-only registered investment advisory firms with the most advisors in Financial Planning's annual RIA Leaders study reveal which companies are hiring and training at the largest volume. Executives that have

On the other hand, advisor headcount affects each of those other figures. And the firm with more advisors than any other, LPL Financial, proudly shared the size of its ranks of 32,128 advisors at the end of the third quarter.

Fee-only RIAs such as Savant Wealth Management, Moneta Group Investment Advisors and EP Wealth Advisors don't approach that level of scale. However, they're operating in a field with

Technology may solve part of those problems, said David Grau, the CEO of consulting firm Succession Resource Group. He compared the potential of technology like artificial intelligence to the difference between moving a big pile of wood with or without a wheelbarrow.

While there's "obviously a need" to hire more advisors, that dearth of incoming talent isn't "as bad or as out of proportion as we have made it out to be in the past," due to the AI and other tech, Grau said.

"It's really cool to see it starting to be used and adopted where we were already seeing teams coming together to create efficiencies," he said. "I think you're going to be able to see the

Even with the tech resources and hefty investments by private equity firms and RIA aggregators, though, some firms could have trouble if they haven't planned for the future. Firms that have a constrained advisor headcount could "run into some lumpiness" that hinders their ability to sustain their businesses, said Brandon Kawal, a partner with consulting firm Advisor Growth Strategies. With more people expected to seek financial advisors and wealth management in general in coming years, they could fall behind.

"I think that's an overarching trend that's out there is that we do need more talent in this industry," Kawal said. "Firms that are investing in recruiting, training and retention of talented advisors and the various specialists you need in this business — it's a good indicator that these firms are doing something to buck the trend."

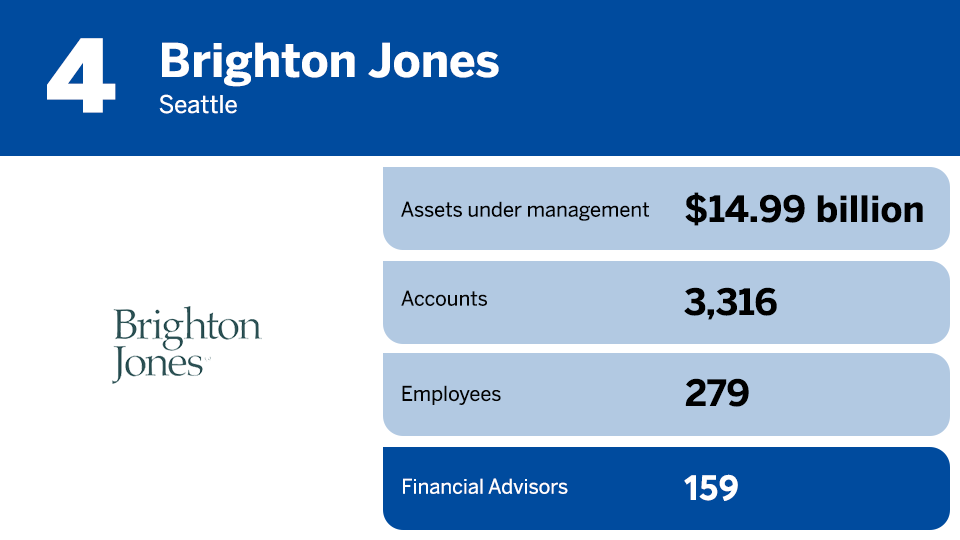

Scroll down the slideshow to see which fee-only RIAs that provide planning services to clients have the most financial advisors. For last year's rankings,

And see other RIA Leaders 2025 coverage:

The oldest RIAs are 85. How did they become a $144T industry? The top fee-only RIAs ranked by AUM in 2025 RIA Leaders 2025: Download FP's list of the 150 largest fee-only RIAs

Notes: FP's data partner for the RIA Leaders feature,

- Firms must have zero registered representatives of a broker-dealer.

- At least 50% of the firm's clients must be individuals or high net worth individuals.

- Firms must not list commissions as a compensation arrangement.

- Firms must have more than zero financial planning clients.

- Firms must not list commission-taking businesses in "other business activities."

- Firms cannot be affiliated under common ownership with commission-taking businesses.

In the absence of an official