Renaissance Technologies, one of the industry’s best performing hedge fund firms, is down 13.4% this year in its biggest fund open to the public despite the surging U.S. stock market.

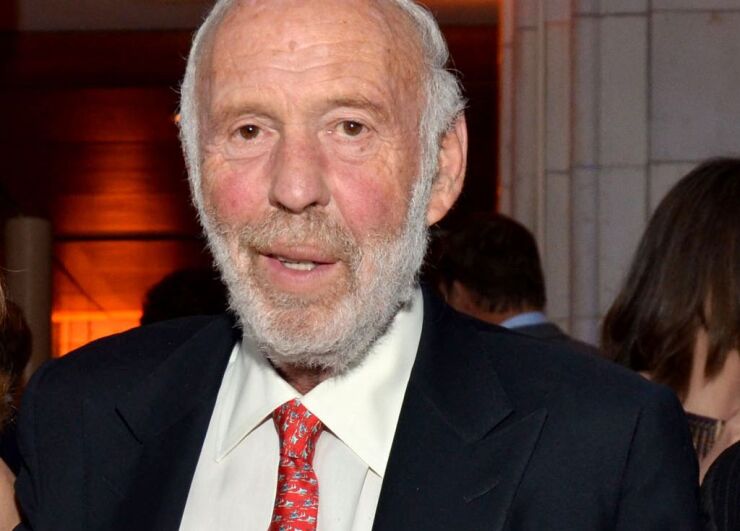

While the Renaissance Institutional Equities Fund gained 2.4% last month, it was still outpaced by equities for the year, a rarity in the four-decade history of the firm founded by Jim Simons. Its two market-neutral funds didn’t fare any better.

Renaissance has struggled to make money this year amid the market volatility sparked by the COVID-19 pandemic. The firm has said it plans to find ways to improve the models that run its stock hedge fund after its biggest money loss ever in March’s rout. The setback shows the turmoil wrought by the coronavirus crisis, which has stalled global commerce and halted the stock market’s bull run.

The market-neutral Renaissance Institutional Diversified Alpha Fund fell 0.6% and the Renaissance Institutional Diversified Global Equities Fund rose 0.4% last month, according to a person familiar with the matter. They’re down about 20% and 18.6%, respectively, for the first seven months of 2020.

The S&P 500 index is up 1.3% this year through July. The market neutral funds balance long and short wagers, while RIEF, which is long-biased, only trades U.S. stocks.

The 20 top-performers have generated gains well over 50% in the first seven months of the year.

Renaissance is the world’s biggest quantitative hedge fund, with about $80 billion of assets. Simons, a former codebreaker for the National Security Agency, has delivered annualized gains of about 40% for the firm’s Medallion fund over the past three decades. That fund is open only to Renaissance executives and employees.

A spokesman for the East Setauket, New York-based firm declined to comment.