Andrew Welsch is a former managing editor of Financial Planning.

-

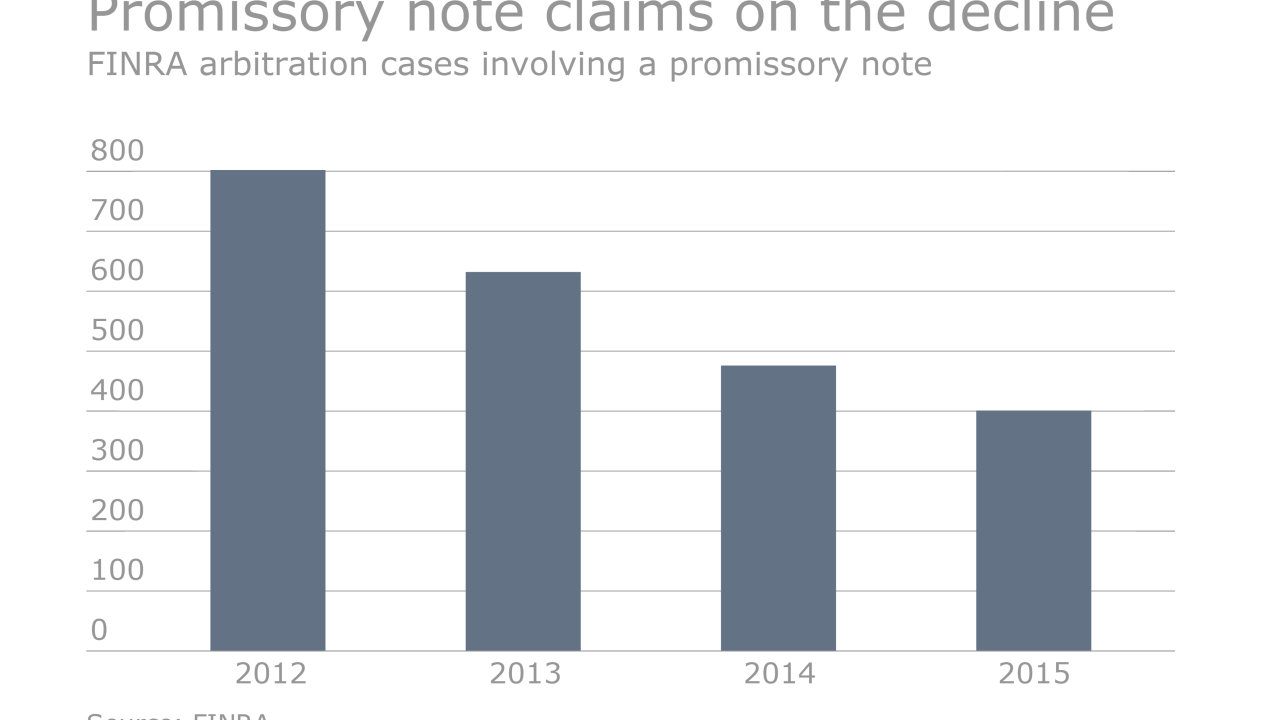

The advisers are also balking at the firm's insistence that former advisers seeking to claim comp go through its dispute resolution process instead of FINRA.

May 12 -

The firm's newest recruits generated $3.5 million in annual revenue.

May 12 -

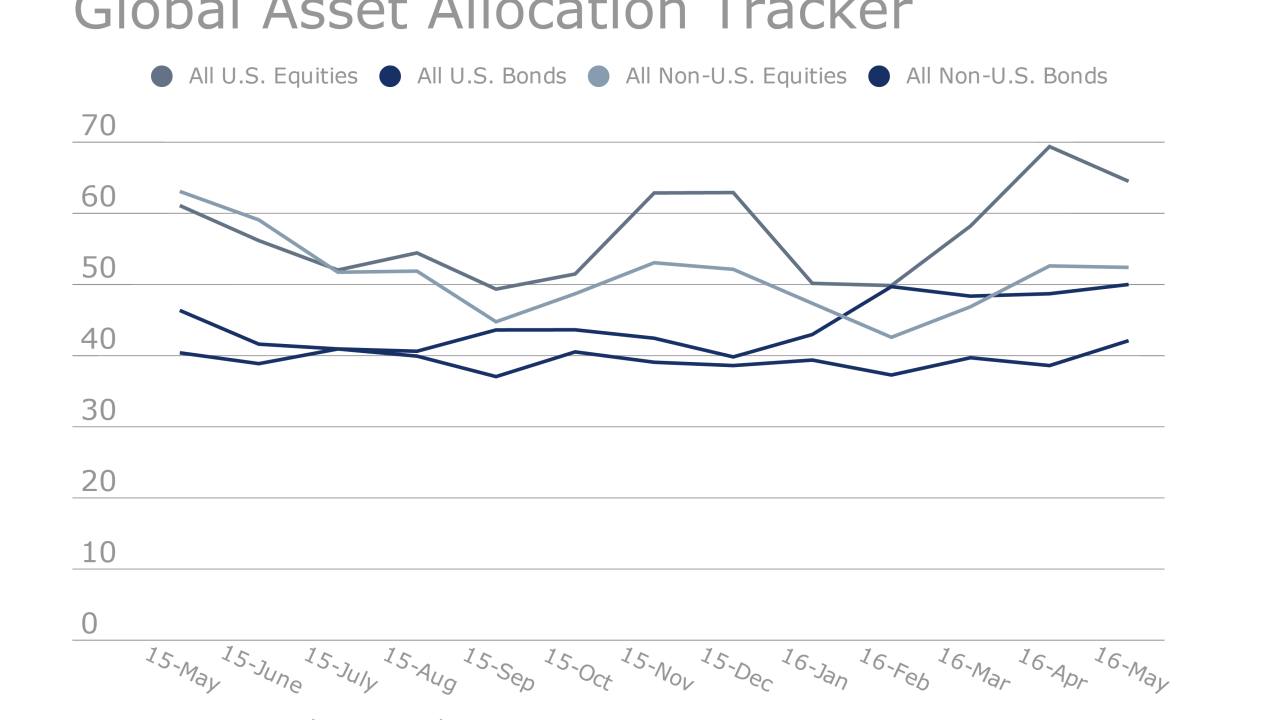

Wealth managers report being divided on whether to allocate more client funds to global or domestic stocks.

May 12 -

The wirehouse terminated the broker two days after losing a $34 million arbitration case brought by the client's widow, who alleged elder abuse and other misconduct.

May 11 -

The acquisition hungry firm added nearly 800 independent and employee advisers over the previous year.

May 9 -

The two veteran wirehouse advisers joined Wells Fargo's independent broker-dealer.

May 6 -

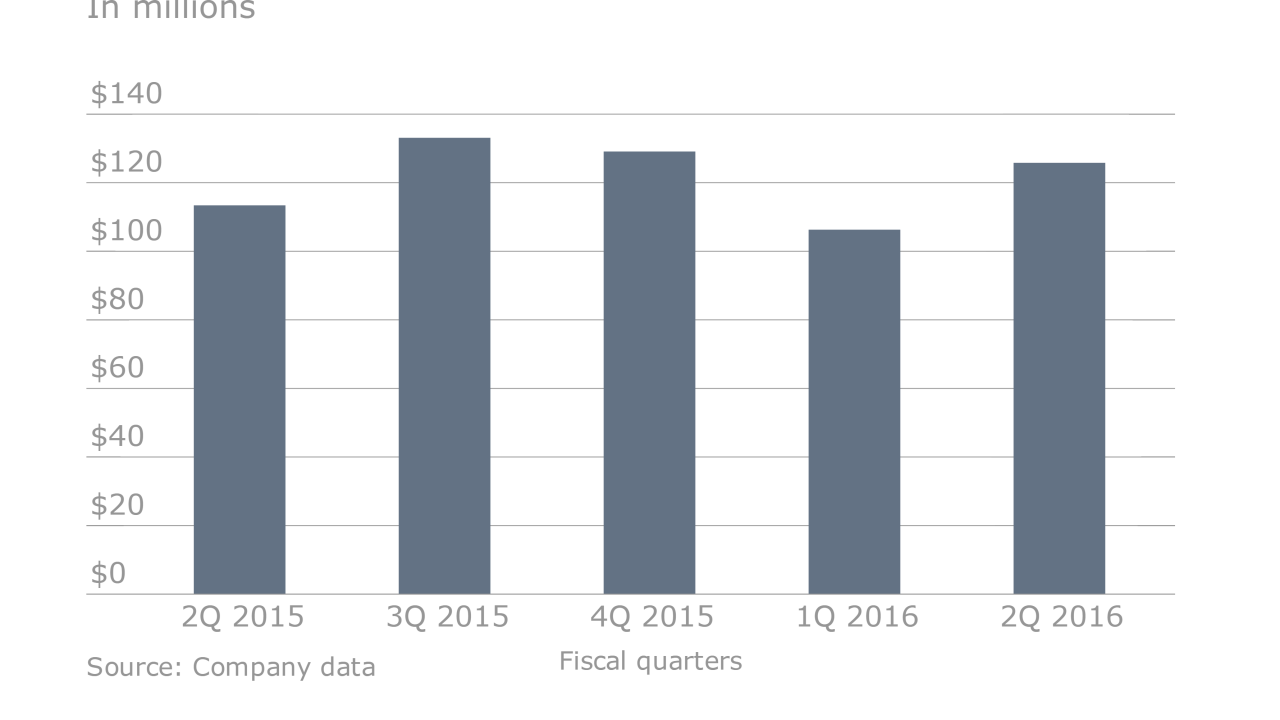

Stung by a 16% year-over-year decline in transaction-based revenue, the wirehouse looks to loans, bank products and a contingent of former Credit Suisse advisers for a bounce back.

May 3 -

Michael Armstrong, who has been serving as Global Head of Wealth Management at Jefferies, will take over as CEO of RBC's wealth management business.

April 29 -

The debate has spread far beyond planners and regulators, suggesting to some that public consciousness, and widespread change, might be on the rise.

April 29 -

Mark Immel had been awarded $450,000 in arbitration but faced further legal battles.

April 27 -

Seeing "great bargains," advisors have been upping client allocations to equities.

April 26 -

Hiring and acquisition misfires can set you back. Here's what RIA leaders say you can do to avoid their mistakes.

April 22 -

Cost controls helped the firm boost revenue.

April 21 -

Raymond James CEO Paul Reilly says firms face higher compliance costs under the rule.

April 21 -

Client assets also rose 3% at the fast-growing firm, which reported quarterly earnings on Wednesday.

April 20 -

Expanded scope for litigation is a cause for concern among wealth management firms, experts say.

April 19 -

The new recruits joined the firm from Morgan Stanley, where they previously generated almost $1 million in annual revenue, according to Raymond James.

April 19 -

The deal also brings $4 billion in client assets under administration and management, according to a spokeswoman.

April 18 -

Edward Jones and Raymond James, among others, are steering clear.

April 18 -

Management blamed falling profits on weak markets and "muted client activity."

April 18