Charles Paikert is a senior editor at Financial Planning. Follow him on Twitter at @paikert.

-

Advisory firms are generating "phenomenal" internal rates of return for PE buyers.

July 9 -

Help them understand distinctive features, especially pricing and leverage.

-

Digital transformation will only accelerate, a technology consultant tells wealth managers.

July 2 -

RegentAtlantic buys Hillview Capital to widen its mid-Atlantic footprint.

June 27 -

Captrust scoops up two more RIAs in the market’s sweet spot.

June 25 -

Former All-Star Tony Parker, newly hired by a planning firm, and top wealth managers offer new pros free financial advice.

June 19 -

Brokers “have become accustomed to this kind of deal structure,” COO Ed Swenson says.

June 11 -

“The amount of capital available to this industry is small relative to the size of the need,” says one new lender.

June 10 -

Dakota Wealth Management’s fourth deal in 13 months brings its AUM close to $1 billion.

May 21 -

Joe Duran outlines the company’s strategy for its mass-affluent advisory push.

May 20 -

The Wall Street giant will use the Main Street advisory firm to further its mass-affluent strategy.

May 16 -

The RIA is the largest firm to depart the protocol in more than a year and a half.

May 14 -

Expect AI to be a growth factor, an expert predicts at Morningstar.

May 10 -

With an eye on a future sale, the $48B RIA wants to build enterprise value.

May 1 -

The 11-person team, which was assisted by Dynasty Financial Partners, was attracted by the raft of technology options in the independent space.

April 29 -

The $22 billion RIA makes its sixth deal of the year in a red-hot market.

April 24 -

The large aggregator faces questions about its future.

April 22 -

The market is expected to remain heated in the months ahead.

April 9 -

The firm is targeting the mid-Atlantic region, northern Virginia, Florida and the Midwest for more acquisitions this year.

April 3 -

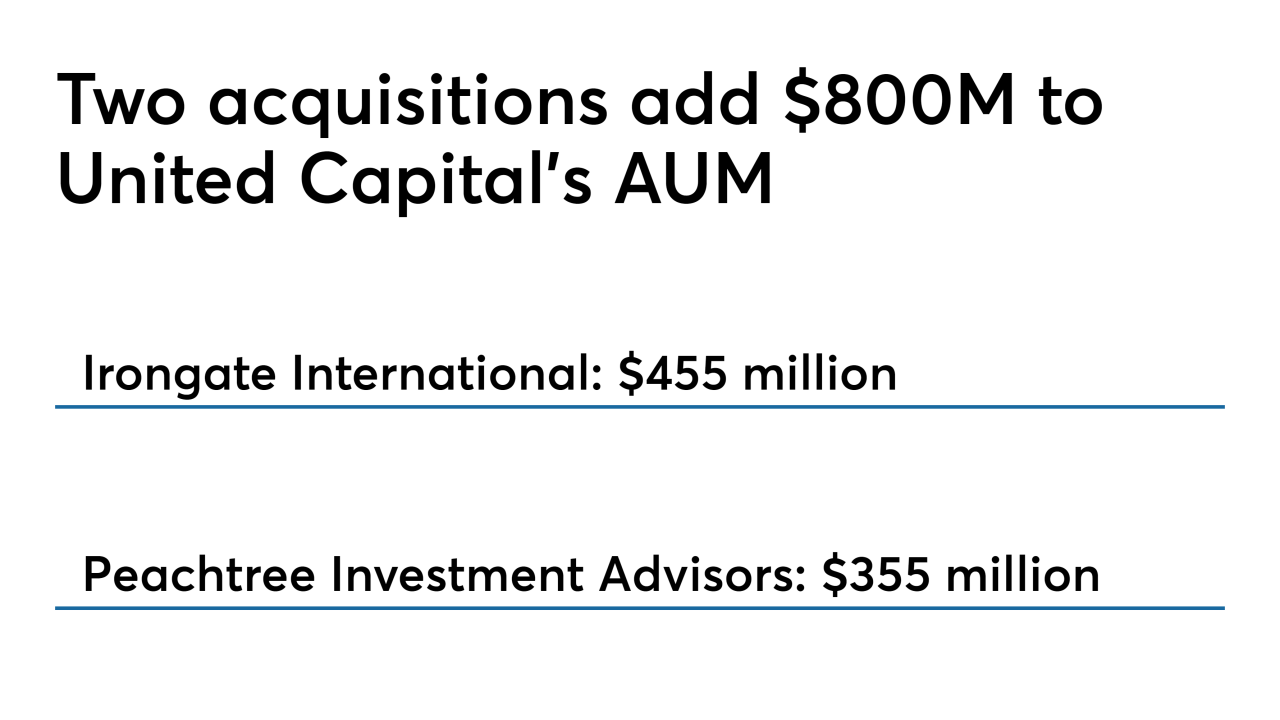

The aggregator buys two RIAs with a combined AUM of over $800 million.

April 2