Elijah returned to Financial Planning in 2025 after working as a summer intern with FP in 2023. He earned an undergraduate degree from Berea College in Berea, Kentucky, and a master's degree in data journalism from Northeastern University in Boston. His work has been published in Bloomberg News, The Boston Globe, The Texas Tribune, WCVB, WBUR, The Drive and Autoblog.

-

Across the industry, financial advisors are anticipating a busy 2026. From consumer protection cuts to AI regulation, wealth management could look very different a year from now.

December 24 -

Overspending, liability risk and emotional strain. Clients who ignore advice can jeopardize their own finances and create real challenges for advisors. But a few key strategies can help limit the damage.

December 22 -

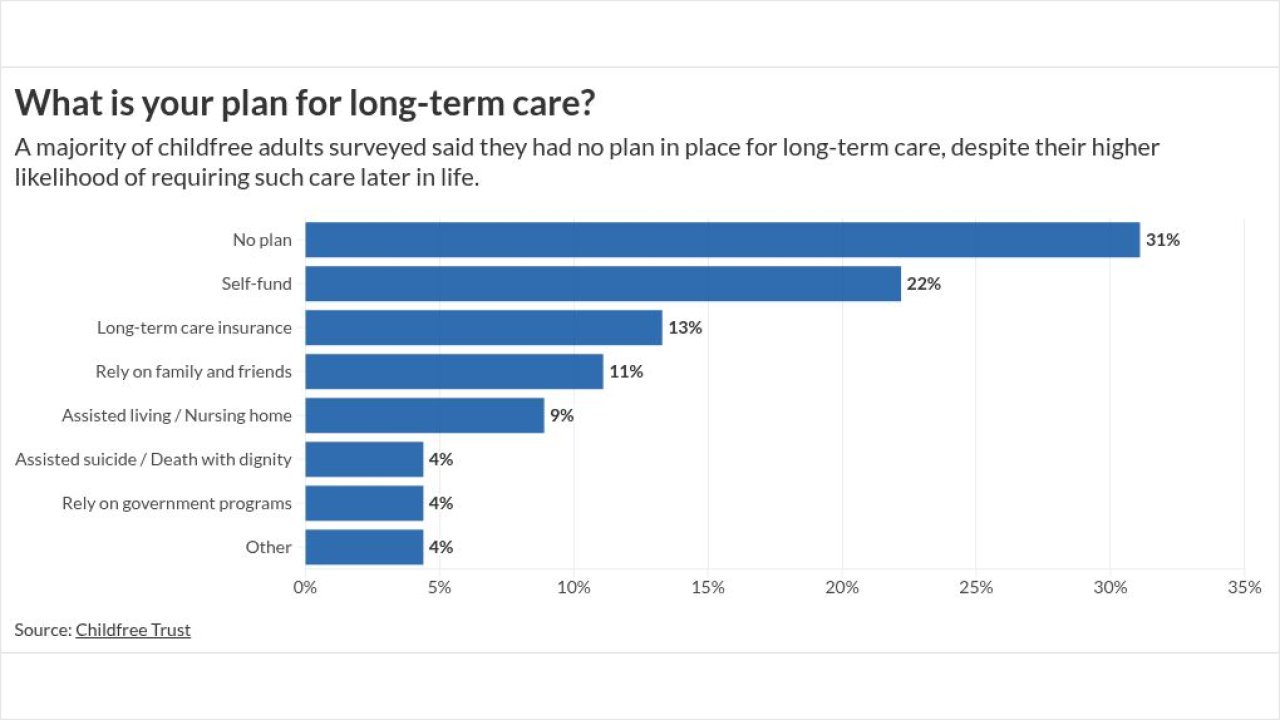

New research highlights a widening planning gap among childfree savers, with lagging estate and long-term care planning exposing unique risks — and opportunities for advisors.

December 19 -

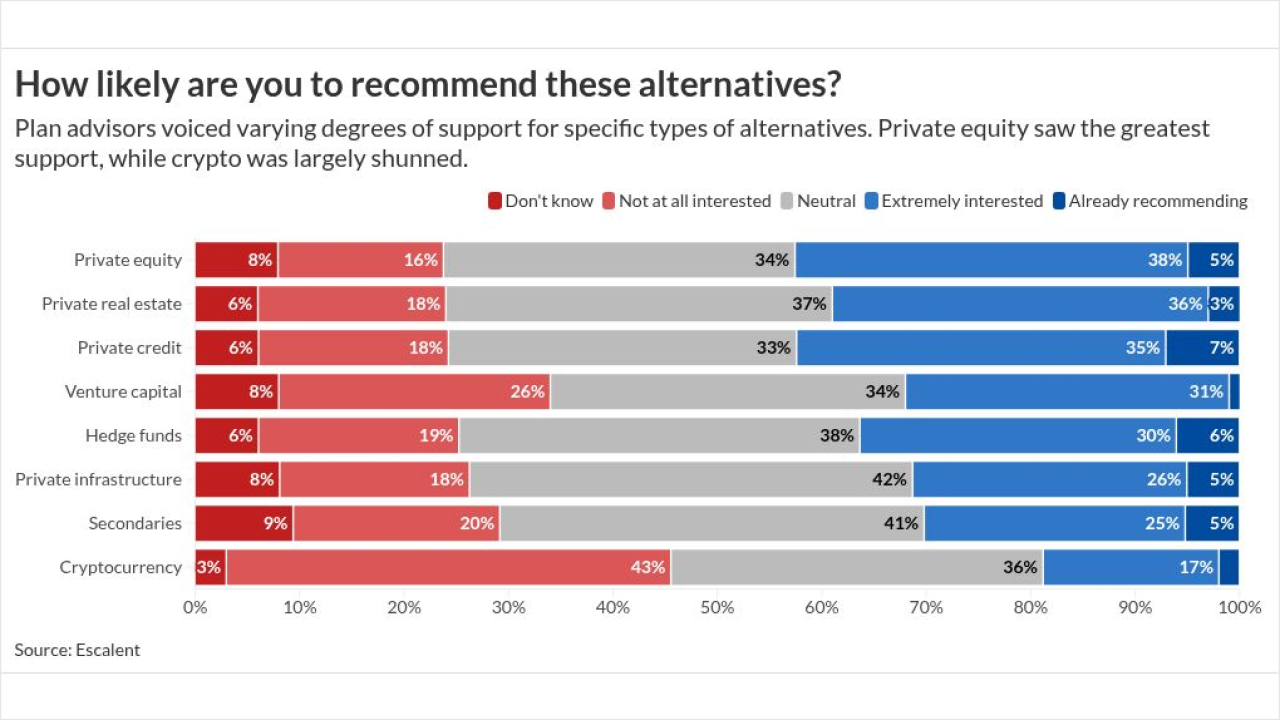

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Paid sabbaticals, employee ownership and a philosophy-first culture have helped Bailard top this year's Best RIAs to Work For list.

December 11 -

This year, 60 RIAs made the cut. See the firms that advisors say excel in culture, leadership and the benefits that matter most.

December 11 -

Retirement savers say they want investment choice, but confidence in navigating those decisions remains low, according to new T. Rowe Price research.

December 8 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3 -

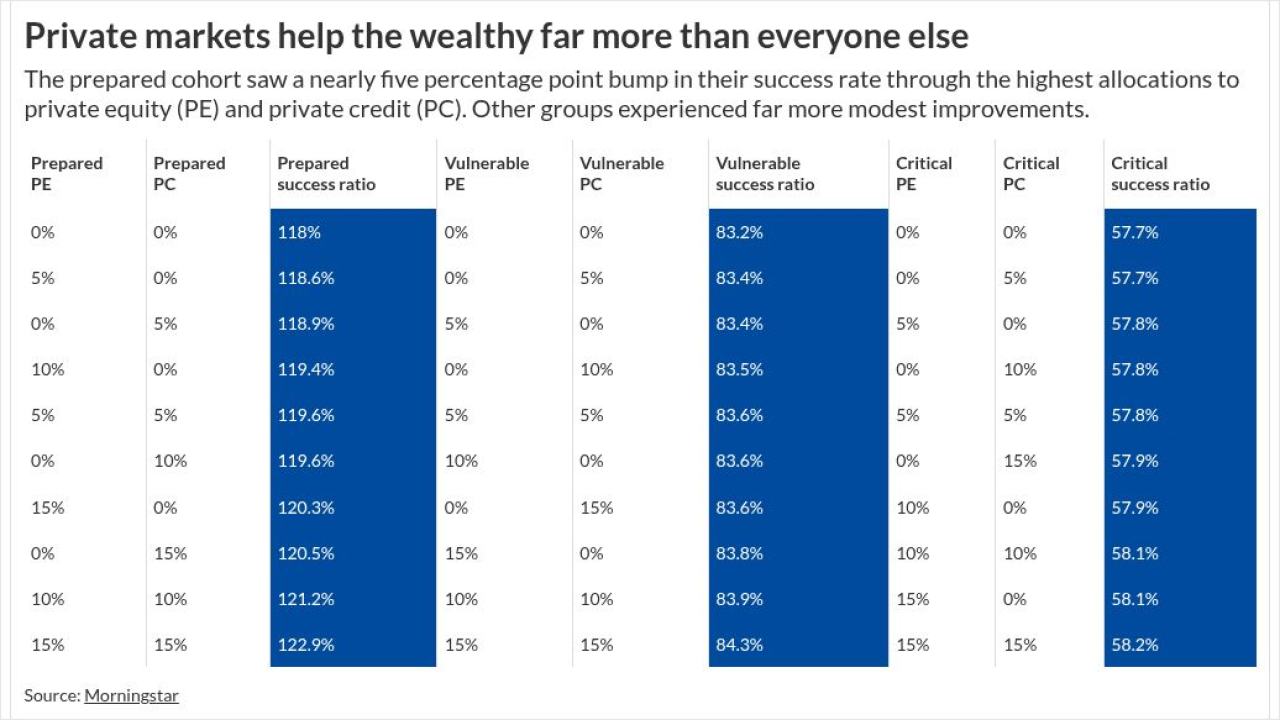

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

With New Year's resolutions on the rise, financial advisors are using the seasonal focus on money goals to engage clients and spark action.

November 21 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows. Here's why younger investors are betting on post-tax retirement savings.

November 20 -

Glide paths may not deliver the highest returns, but experts say they account for behavioral limits that other strategies overlook.

November 19 -

After years of strong market returns, concern over stretched equity valuations is rising. Could a long-overlooked options strategy be the right tool for the moment?

November 18 -

A growing number of RIAs are offering one-time, flat-fee advisory services as part of a broader embrace of advice-only planning. But not all advisors are sold.

November 14 -

A similar measure stalled years ago, but some advisors say the current bill has more momentum among lawmakers.

November 13 -

Americans tend to be overly pessimistic about their own life expectancy — a fact with major implications for retirement planning. But new research shows that certain interventions can help.

November 11 -

Edward Jones added $17B in net new assets despite a sharp slowdown in new client households, reflecting a focus on high net worth clients and specialized services.

November 7