Jessica Mathews is an associate editor for Financial Planning. Follow her on Twitter at @jessicakmathews.

-

A team of four women is moving to LPL in pursuit of what they say is a less difficult, lower-fee alternative.

September 25 -

The company is bridging its bank and wirehouse through training programs, compensation plans and technology investments

September 21 -

Robert DuKate initially stayed behind when his partner, David Katz, switched firms. Eight months later, he followed along.

September 21 -

High-yield notes offering 10% to 18% in annual returns turned out far less lucrative than promised.

September 19 -

New features include health care planning tools and cash reserve buckets.

September 13 -

Carla Wigen joins the senior leadership team at the Seattle-based firm, which advises on about $5 billion in assets.

September 13 -

Computer algorithms could increase portfolio returns by whole percentage points.

September 12 -

It’s the first U.S.-domiciled index ETF of ETFs with access to the global investment-grade credit universe, the firm said.

September 12 -

The regional broker-dealer’s head count jumped up to 1,824 in the third quarter.

September 11 -

The firm allegedly encouraged clients to use an affiliated investment advisor, and benefitted from the fees it charged them.

September 10 -

This is the first move of Joseph Chu’s financial career, but it’s not the wirehouse’s first big loss this year.

September 7 -

An advisor kept working with clients, and impersonated others on phone calls with Schwab, the SEC says.

September 6 -

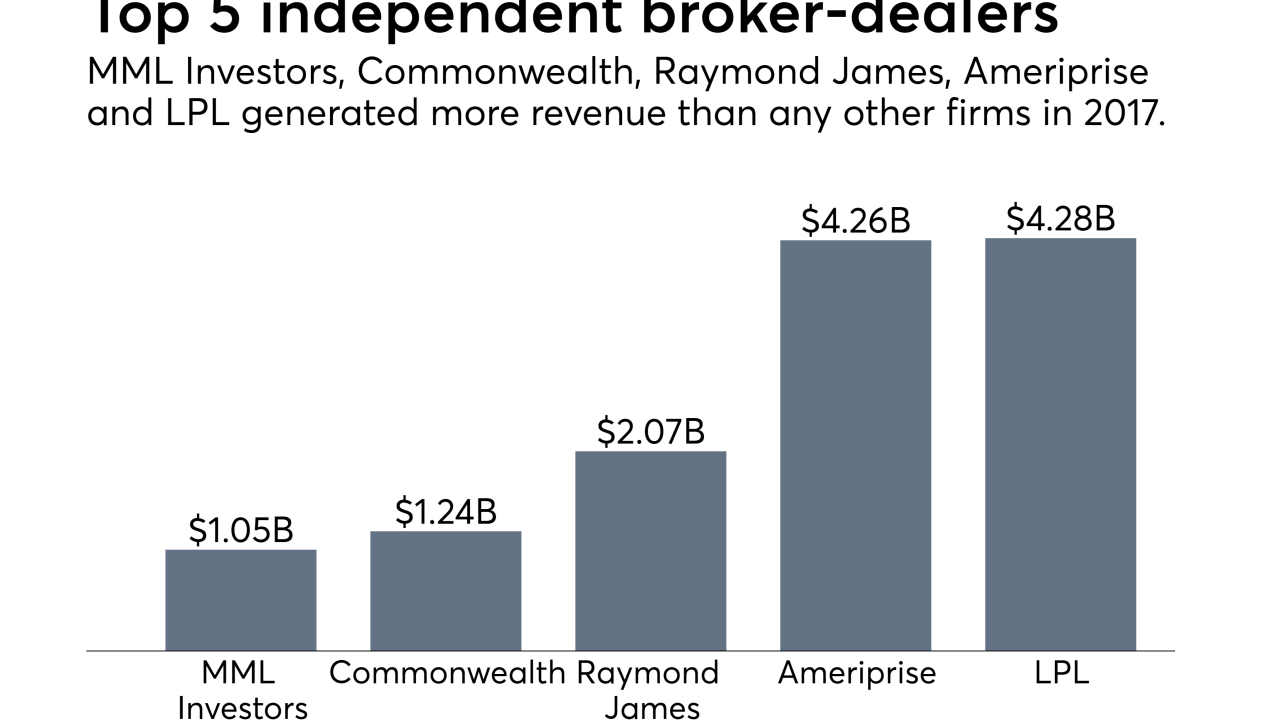

A total of 155 new advisors have joined Ameriprise in the last two quarters, and they keep coming.

September 5 -

Two wirehouse advisors left the Charlotte branch one Friday afternoon, for separate firms.

September 5 -

Just over half of all asset managers either have or are planning a “limited” number of machine learning initiatives.

August 31 -

Robert Graham allegedly solicited clients into risky investments, which he directed to his private company. He is the ex-chief of the Arizona Republican Party.

August 29 -

The liquidations are part of an ongoing process to ensure its products meet their clients' evolving needs, the firm says.

August 23 -

Soon after shuffling C-suite, the independent broker-dealer brings on nine advisors while it continues hunt for a new CFO.

August 22 -

Merrill Lynch’s head count isn’t suffering, but some regional BDs have grown by thousands in the past five years.

August 21 -

The firm’s most recent hires are 2 advisors overseeing more than $550 million in client assets.

August 20