-

For some, estimated tax payments are a non-issue. Others may earn all of their income from sources that don’t withhold amounts for federal income taxes.

November 19 -

Younger clients are more savvy consumers who know how to minimize their expenses and are less inclined to spend on material goods, an expert says.

November 13 -

Taxpayers face a 5% penalty if they fail to meet the deadline.

October 1 -

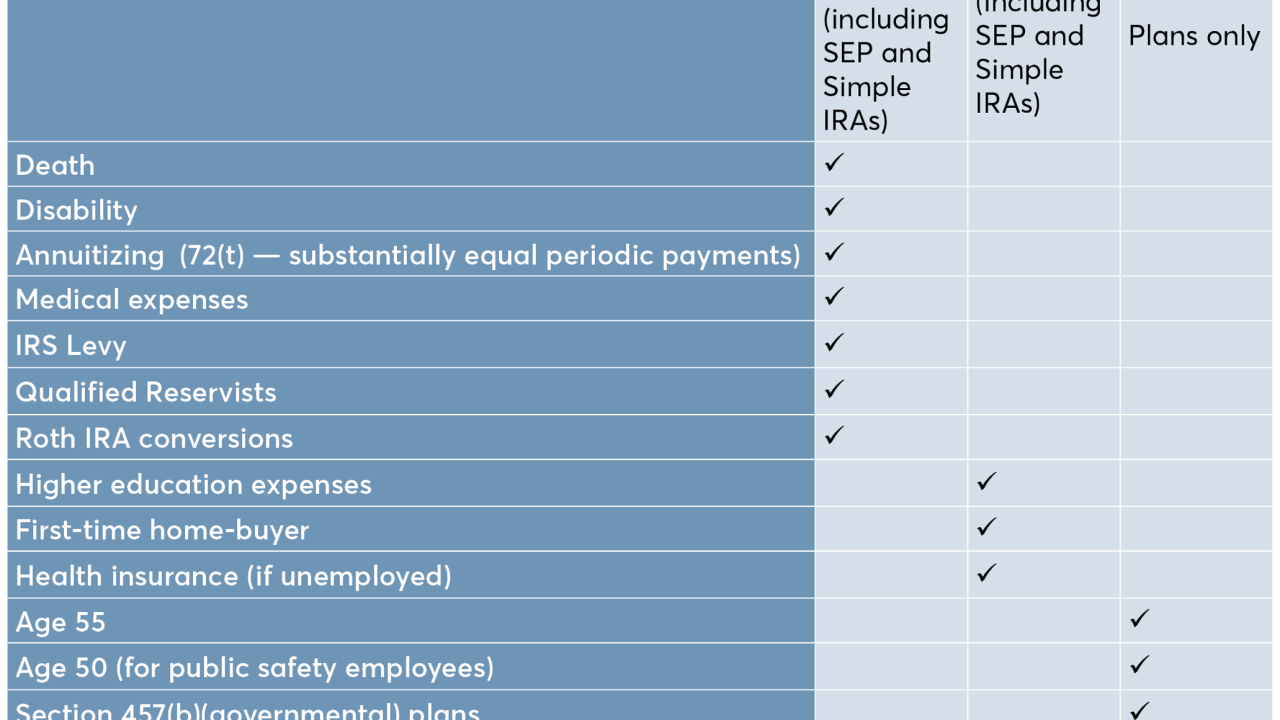

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

The Treasury and IRS are lowering the withholding underpayment threshold to 80%.

March 26 -

Robert Graham allegedly solicited clients into risky investments, which he directed to his private company. He is the ex-chief of the Arizona Republican Party.

August 29 -

Salary-reduction arrangements can exclude up to $520 each month from a client’s taxable income to cover these expenses.

June 26 -

Sometimes the strategy can eliminate a domino effect of other expensive tax problems down the road, Ed Slott writes.

March 20 -

The new law will affect how financial advisors and clients evaluate the pros and cons.

January 23 -

Advisors should contact every client who did a Roth conversion in 2017 to discuss a key change in tax regulations, Ed Slott says.

December 4 - FP magazine

It’s the Roth’s 20th birthday. Where is everyone?

November 20 -

“Your risk of being audited goes up,” says RIA powerhouse Ron Carson.

November 15 -

The breach follows other developments that have made offshore planning methods less attractive.

November 14 -

IRA balances are up, and so are divorces, particularly among baby boomers. These so-called gray divorces have roughly doubled over the past 25 years, according to the Pew Research Center.

August 31 -

When a tax-deferred account is part of an estate, failure to follow the tax rules correctly can result in a financial disaster.

February 17 -

The allegations come a year after the firm paid over $300 million to resolve regulators' claims that it failed to tell wealthy clients it was steering them into its own funds.

December 16 -

Now harsh penalties and taxes on late 60-day rollovers from company plans and IRAs can be avoided, but beware: There are some rollover mistakes that still cannot be fixed.

September 22 -

Knowing how and when to withdraw can save clients big in their golden years.

August 9