Jessica Mathews is an associate editor for Financial Planning. Follow her on Twitter at @jessicakmathews.

-

One thing was made clear at the annual event: There’s more work to be done.

November 24 -

As some firms closed their doors, the regional BD saw a selling point for new recruits and existing FAs in a different approach.

November 23 -

Disclosing such information is rare in wealth management, but long overdue, says Andy Sieg.

November 19 -

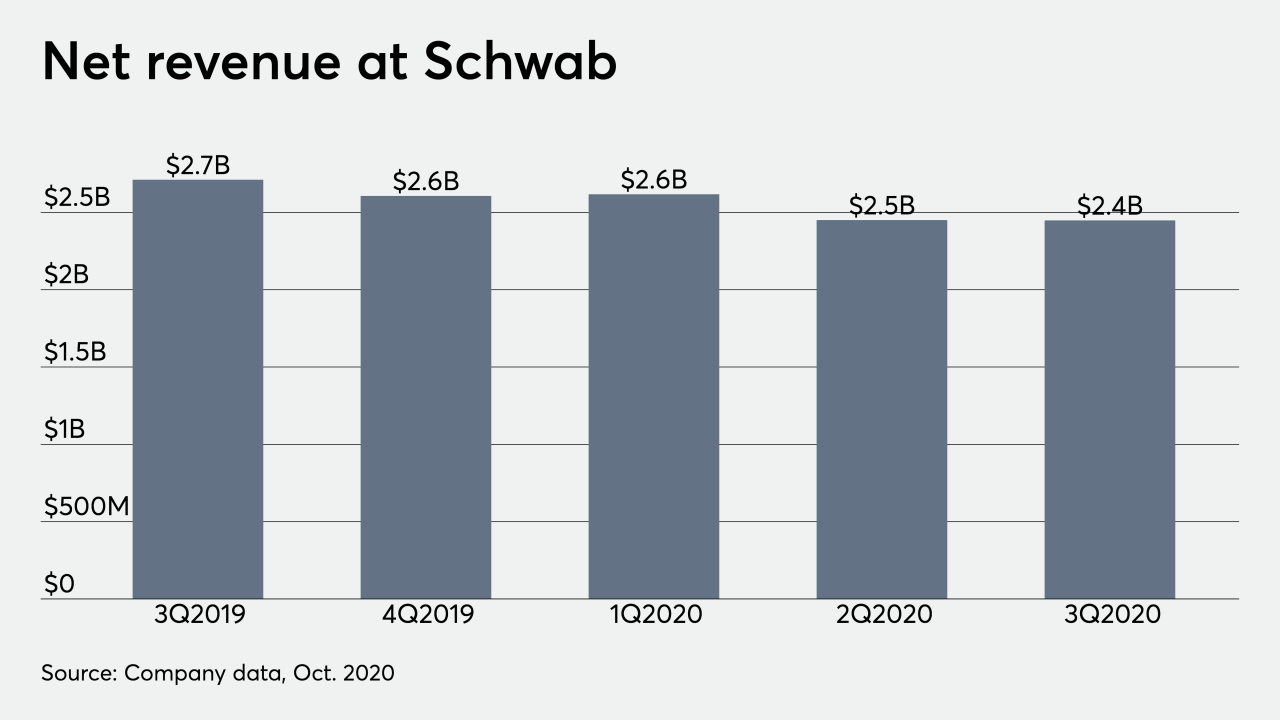

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

Executives provided advisors an update. The company has separately said it cut more than 200 retail branches at the end of last month.

November 12 -

The rule has faced a host of criticism from investors, environmentalists, asset managers and others.

November 3 -

Wealthy clients are the fastest growing segment of the company’s retail division.

November 2 -

Unclear — or no — disclosures were among a number of concerns regulatory officials expressed about initial examinations.

October 29 -

The company said no additional layoffs would take place this year, but it left the door open to future staffing changes at the newly combined enterprise.

October 26 -

Although in-person hearings aren’t banned outright, none have taken place since the onset of the coronavirus pandemic.

October 23 -

BNY Mellon’s CEO also sees a distribution opportunity for the company’s proprietary funds.

October 20 -

The acquisition established a $6 trillion-giant operating as a mutual fund company, RIA custodian, bank, retail brokerage and national wealth management firm.

October 14 -

Among those leaving is Tom Nally, president of TD Ameritrade’s RIA division. He’d been with the company for 26 years.

October 9 -

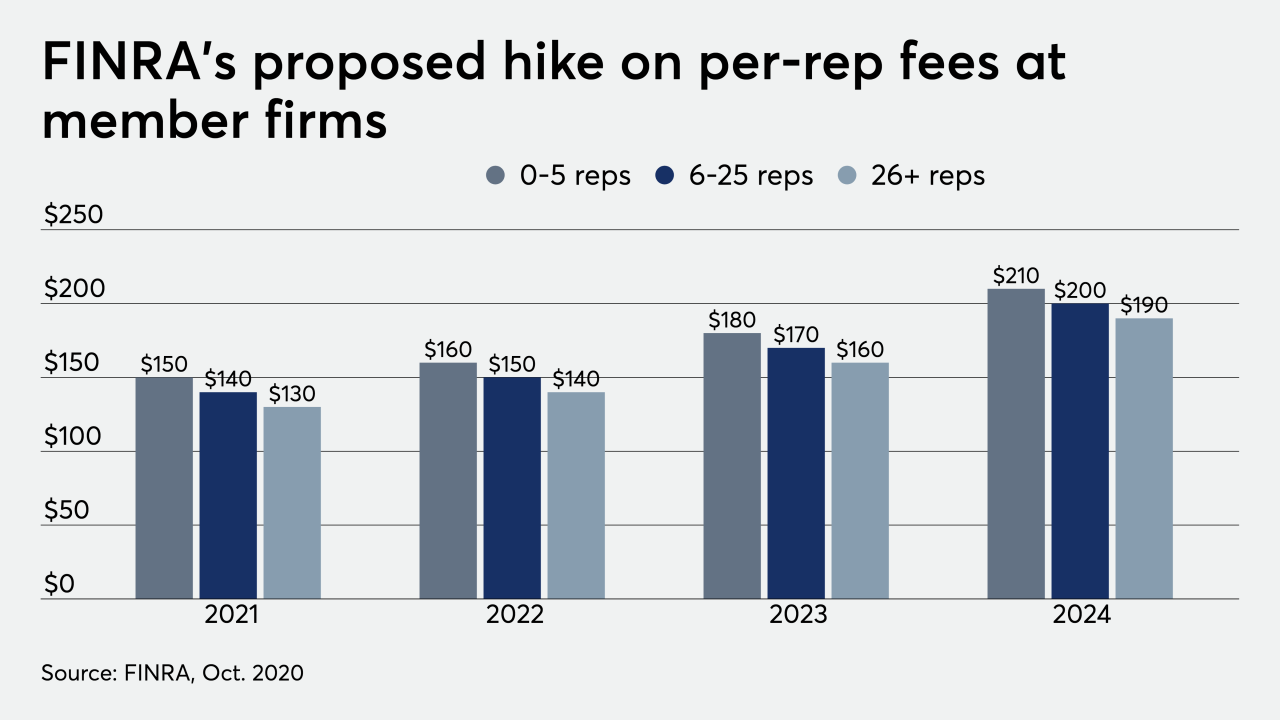

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The custodian had been a key player in the growth of the independent channel.

October 6 -

Charles Schwab is in early stages of its plans for the future of TD Ameritrade’s advisor division.

October 6 -

The newly combined firm is expected to transform the independent marketplace in terms of technology, talent and RIA choice.

October 6 -

Demand from clients has some advisors reconsidering sustainable investing strategies.

October 2 -

The firm is consolidating its broker-dealer and standalone RIA custody units into one division.

October 1 -

The combined company would become a $2 trillion RIA custodian.

September 30