Even as low interest rates crimped Charles Schwab’s revenue last quarter, the company reeled in more than $51 billion in assets across its RIA custody and DIY investor divisions.

Its fastest growing segment in the retail business? Wealthy clientele.

“Our plan is to continue to add the services and capabilities that the high-net-worth and ultra-high-net-worth investor wants,” CEO Walt Bettinger told analysts on the company’s quarterly earnings call Oct. 29.

Schwab, which

The company will incorporate TD Ameritrade’s numbers into its financial results next quarter.

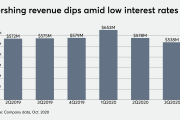

Revenue at Schwab fell 10% to $2.4 billion from the year-ago period, largely due to lower net interest and trading revenue, according to its earnings

Last year, Schwab dropped commission charges on equity trades. For the recent quarter, trading revenue fell 12% year-over-year to $181 million, according to Crawford.

New client assets, meanwhile, surged. Of the $51.2 billion in net new assets that the company brought in, $32.3 billion flowed into the Advisor Services division.

The fastest growing client segment on the retail side are wealthy clients, Bettinger said on the call.

“We have to make sure that we can deliver for them the type of service experience that they expect given their significant level of assets,” Bettinger said. “So, we will continue to expand those capabilities.”

Bettinger said that Schwab, whose co-existence with RIAs in the high-net worth space has sometimes

Schwab, which offers wealthy clients a team to focus on financial planning, attracts self-directed investors who are accustomed to managing their own money, Bettinger said.

The company said its Schwab Advisor Network has referred more than $100 billion in assets from its retail branch network to RIAs since the 2002 inception of its referral program.

Crawford, Schwab’s CFO, says many clients are leaving cash in their brokerage accounts since yields for money market funds, CDs and other fixed income products are low. Schwab has $10 billion more in interest-earning cash than it did last year, according to its earnings report.

However, low interest rates put a dent in Schwab’s revenue. The company earned an average yield rate of .10% last quarter, compared to the 2.16% it earned the same time last year.

On the call, analysts repeatedly asked Schwab executives about the low interest rate environment.

“We know that we're dealing with record low interest rates and those create short-term headwinds,” Crawford said on the call.

Bettinger said the firm would seek to further diversify its revenue stream. The company was “ensuring” that third-party asset managers were giving them “appropriate compensation for the many services that we provide.” (After cutting commissions last year, Schwab dissolved its OneSource ETF platform, which had

Among other initiatives, Schwab is working to launch thematic investing and direct indexing capabilities — of which it says its Motif acquisition should speed along — as well as growing its retail advisory services, Bettinger said. He declined to give any details for when direct indexing capabilities would become available, nor whether it would be released to RIAs or retail clients first.

Schwab said it has already cut approximately $250 million in expenses by laying off employees and eliminating approximately 205 TD Ameritrade branches, most of which will merge into Schwab locations. Last week, the company