-

A firm with no website and a generic name has served internet pioneers Pierre Omidyar and Jerry Yang for decades.

September 29 -

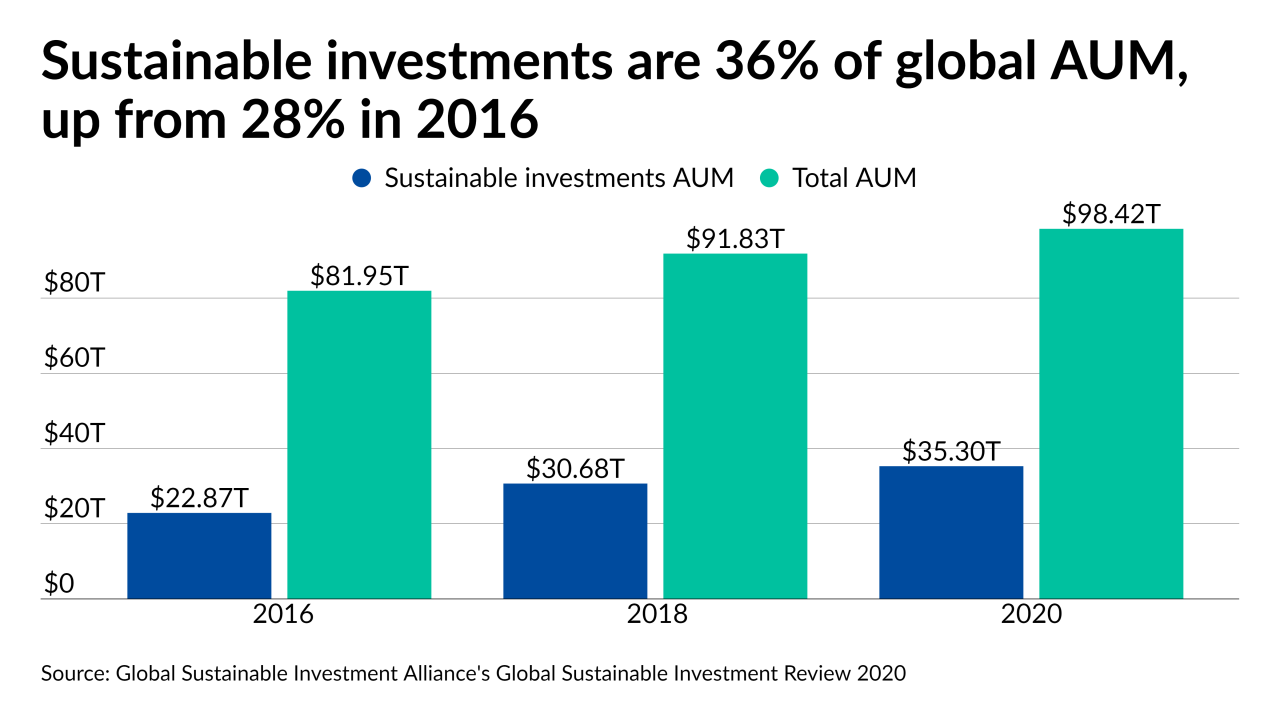

New products constructed on more stringent ESG criteria than the so-called greenwashers often can’t be accessed through large wealth managers.

September 17 -

Kuttin Wealth Management is four years into an ambitious strategy to build offices nationwide using the model of its founder’s practice.

September 14 -

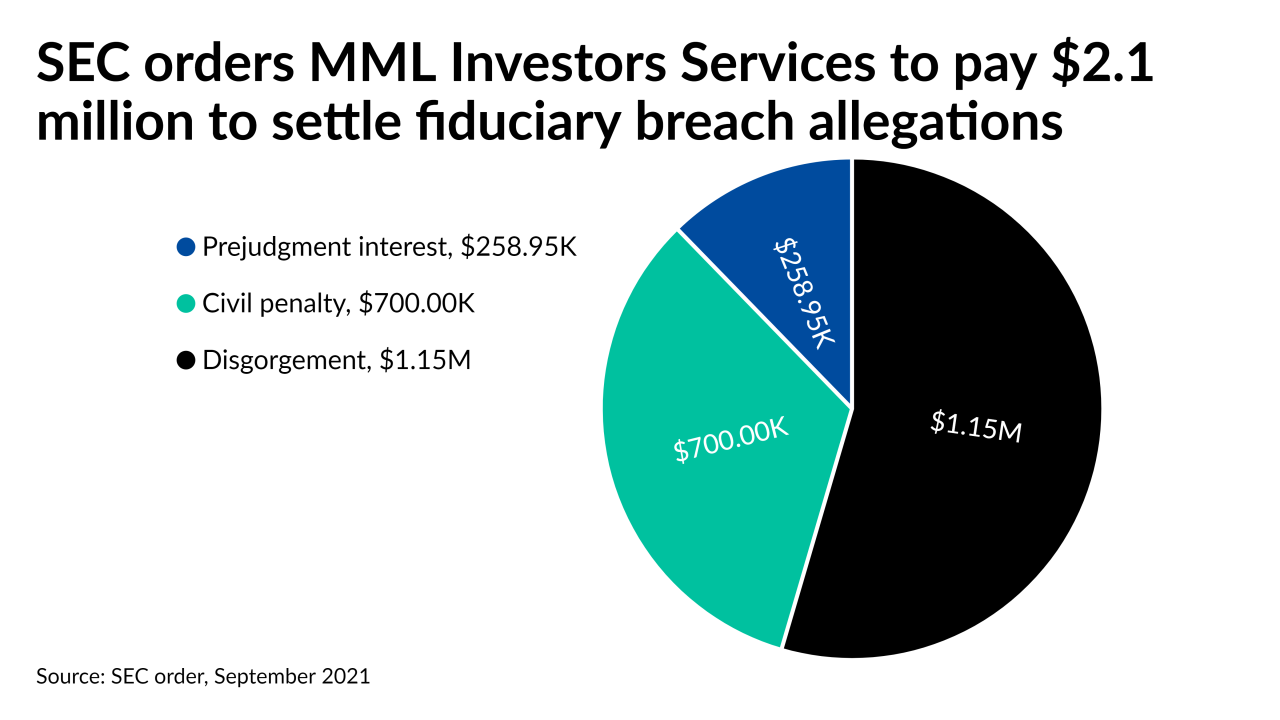

MML Investors Services allegedly breached its fiduciary duty in the same way that the regulator has alleged that more than 100 other firms have in recent years.

September 13 -

Penn Mutual-owned Hornor, Townsend & Kent has completed an executive shakeup after its advisor headcount fell by 10% last year.

September 7 -

A 3-step process can get the planner in touch with their professional and personal origin stories before mastering social media technology.

September 7 Meehan Marketing

Meehan Marketing -

Concurrent is having its best recruiting year ever, and the firm’s new managing director of business development aims to boost its expansion even more.

August 26 -

The longtime director of investor protection at the Consumer Federation of America could signal an overhaul of Reg BI under the Biden administration.

August 25 -

Despite smaller growth amid the coronavirus last year, FP’s 36th annual survey revealed the significant level of business raked in by 46 wealth managers.

August 23 -

The delicate balance between the No. 1 IBD and its ‘critical clients’ is evolving as the industry changes.

August 23 -

Nicholas Spagnoletti, 52, had “images and videos depicting the sexual exploitation and/or abuse of a minor” on his phone, investigators say.

August 13 -

71 companies participate in corporate bonds issued by private prison firms, Adasina Social Capital found.

August 12 -

Steven Black was a board member of BNY Mellon when Wells CEO Charlie Scharf led the trust bank. He will become Wells Fargo’s fifth chairman in five years.

August 10 -

With such a massive number of deals and tens of billions of dollars in assets changing hands, even experts sometimes struggle to keep up.

August 6 -

Executives from Alliance Bernstein, Edward Jones and Kasisto discuss best practices and ways to improve the client experience.

July 30 -

Kristin Kimmell brings decades of experience and notable success as the replacement to the former head recruiter promoted only last year.

July 14 -

The reorganization includes the addition of five managers to focus on business goals and client engagement.

July 14 -

Banks and other institutions are driving significant recruiting moves while aiming to convince more members and clients to sign up for financial advice.

July 13 -

Strategic buyers and consolidators like Captrust are driving a record pace in overall transactions and those involving sellers with at least $1 billion in AUM.

July 12 -

Michele Dillon, a 30-year veteran of wealth management, started in April

July 12