Despite stagnating business and the dwindling number of insurance-owned wealth managers, a midsize firm is trying to catch up with its advisory-focused rivals and start growing again.

Penn Mutual Life Insurance hired veteran wealth management executive Aaron Gordon to be president of its independent broker-dealer, Hornor, Townsend & Kent, after a shakeup of its executive ranks and an investment by the insurer and asset manager in its wealth management arm. The Aug. 23

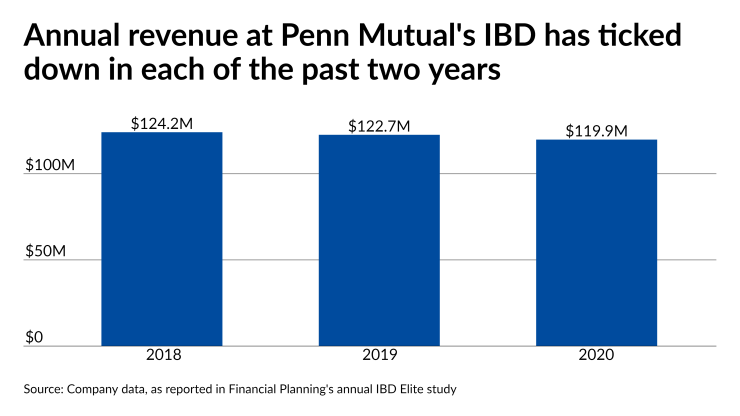

As regulatory, compliance and technology expenses have grown in recent years, many large insurers such as AIG, Jackson National Life Insurance and NFP have spun off their wealth managers while others like Penn Mutual, Northwestern Mutual, Equitable Advisors and Lincoln Financial Network have stayed the course. The industry’s record consolidation tells the story: Even though HTK’s annual revenue has slipped in each of the past two years, its

Gordon started his career as an Ameriprise representative before taking management roles at LPL Financial and Edelman Financial Engines and, most recently, at Lincoln as the firm’s vice president of managed account sales. He’s “very eager to uncover” the Horsham, Pennsylvania-based firm’s growth potential in advisory services, Gordon said in an interview.

“You've got to be able to have a very rounded product set in order to be able to help clients meet those end goals,” Gordon said. “Oftentimes the planning component is the most critical.”

With 62% of its $119.9 million in 2020 revenue attributable to commissions of $74.0 million, HTK has a long way to go to keep up with rivals that get more than 60% of their business from advisory fees. In addition, its ranks of producing representatives also dropped off by 10% last year to 562 advisors. HTK’s fee revenue did rise by 9% to $43.7 million, though.

Veteran IBD recruiter Jon Henschen views midsize HTK as similar to Waddell & Reed, an asset manager-owned wealth manager that

“This might be the definitive moment for Hornor, Townsend & Kent,” Henschen said. “If there isn't much improvement, then they could very well be on the block for sale. This is their turnaround time and, if they don't turn it around and see marked improvement, then I would expect them to go up for sale.”

HTK spokeswoman Stephanie Kensy didn’t provide any details about the cause of the lower headcount beyond agreeing with Gordon that there’s often an ebb and flow of advisors in the competitive industry. It’s unclear whether there was a major departure of a large practice or enterprise, or whether HTK has followed other firms in

Besides adding Gordon last month, HTK tapped Nick Leighton to be its new director of broker-dealer services and Erin Jagusak to be its director of investment advisory services, Kensy said in an email. The new hires replaced prior operations and product management executives.

The previous president and CEO of HTK, Tim Donahue, left the firm in March, and he’s now a principal with a strategy and operations consulting firm for wealth managers called Alacrity, according to FINRA BrokerCheck and his LinkedIn profile. He didn’t immediately respond to requests for comment on his departure.

Penn Mutual “made significant investments in HTK to further strengthen its value to” its two distribution units, the Career Agency System and the Independence Financial Network, Kensy said. “These investments in people and technology are moving HTK forward with modern digital tools, strong operations, seamless access to data and efficient processes that support our field offices and help our financial professionals and their clients achieve their financial goals.”

The wealth manager is “certainly a core element of the overall distribution strategy at Penn Mutual,” Gordon said. He rejects the idea that the advisors and clients leading the shift to fee-based advice and independence will necessarily gravitate away from firms that have more

“Investment advisory solutions and services are a trend that will continue to grow if not exponentially grow,” Gordon said. He added that he’s “looking forward to diving in and digging in and really leveraging my background in the broader industry to make sure that we are moving HTK forward.”