-

The firm’s headcount declined slightly in the quarter, but advisors’ productivity remains strong and growing.

April 24 -

The regulator's proposal is set to remake compliance standards for brokers and advisors.

April 24 -

By requiring brokers to look out for clients’ best interests, the SEC is effectively requiring them to give financial advice, which distinguishes them from online brokers and should let them keep charging clients premium fees.

April 23 Unison Advisors

Unison Advisors -

Jamie Price doesn’t expect the firm's advisors to have any problem with a new standard after taking steps to comply with the more restrictive DOL rule.

April 20 -

"I still feel like NAPFA is one of the best kept secrets in the planning world and we want to change that," NAPFA CEO Geoffrey Brown says.

April 20 -

“The broker-dealer world has tried to hang their hat on suitability, and if you close your eyes a little and squint, they almost look like fiduciaries — but not really,” one advisor says.

April 20 Momentum Advisors

Momentum Advisors -

If it's not uniform, and it's not a fiduciary standard, then it is at best a modest step forward, investor advocates say.

April 19 -

It appears the regulator bought into the investor choice argument of sales reps right from the beginning.

April 19 Financial Planning

Financial Planning -

New rules recognize the fact that commission-based transaction services can be the most cost effective way for Main Street investors to receive financial advice.

April 19 Baird

Baird -

New rules would set standards of conduct for brokers, require new disclosures and offer interpretive guidance for fiduciary advisors.

April 18 -

"Vitriol" and "vileness" lead FPA national to take unprecedented "nuclear option" against New York chapter

April 18 -

The commission's approach stands a good chance of superseding the Labor Department's fiduciary rule.

April 18 -

Should advisors and brokers have plain-English job descriptions and be required to work in their clients’ best interest? Commissioners will vote on whether to move ahead with key proposals.

April 12 -

Instead of thinking about fiduciary purely as an obligation or regulation, advisors should envision it as something much bigger: a way of life.

April 6 Financial Planning

Financial Planning -

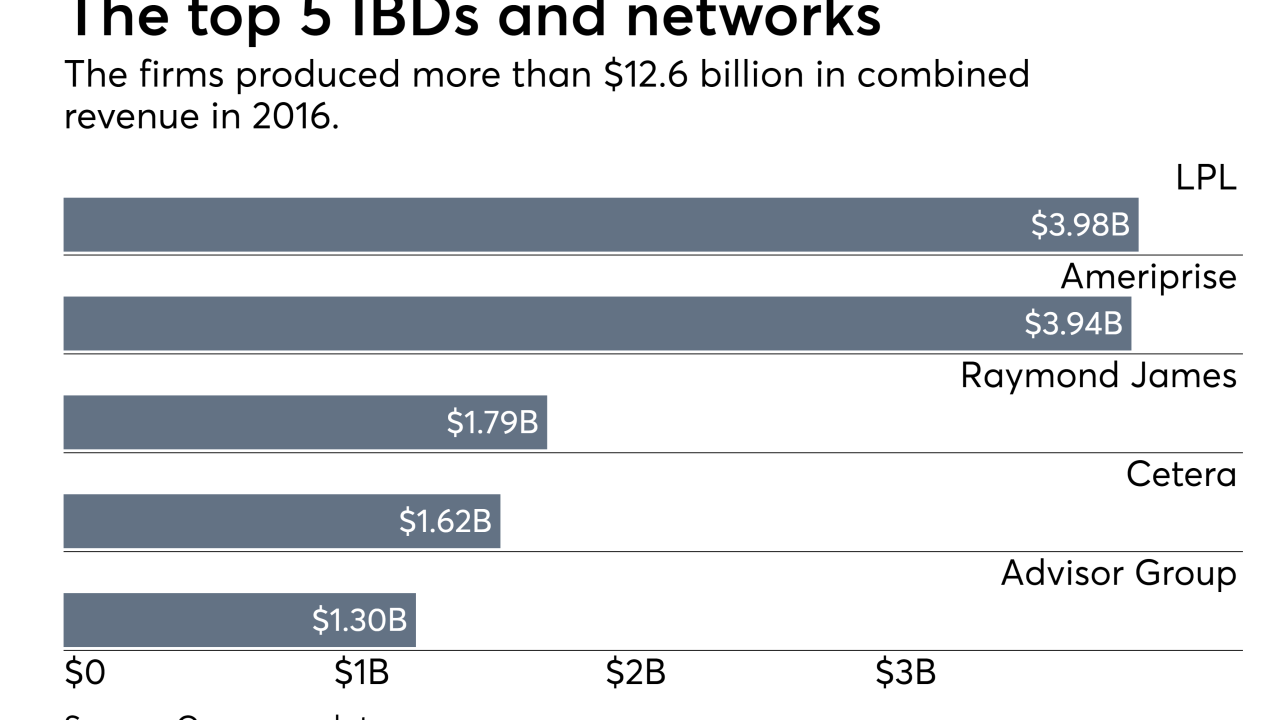

As the financial planning industry nears a fee-only, fiduciary world, independent broker-dealers will face some important choices about their future business models.

April 2 Financial Planning

Financial Planning -

The revised code of conduct will broaden fiduciary responsibilities for planners, but critics say the framework falls short on disclosures and conflicts.

March 29 -

Instead of harmonizing standards of client care across the industry, it may be better to re-differentiate them in light of the fiduciary rule's recent court loss.

March 22Institute for the Fiduciary Standard -

After a federal appeals court strikes down the fiduciary rule, a legal path forward seems uncertain, but the regulation has already made its mark.

March 20 -

Merrill Lynch, UBS and others made considerable alterations to policies and procedures in order to be compliant with the Labor Department regulation.

March 19 -

Industry insiders see the agency proceeding with its rule to harmonize standards for brokers and advisors.

March 16