-

Market volatility spurred clients into cash during the fourth quarter.

January 17 -

Brexit, worries about trade wars and rising interest rates have prompted a selloff in developed country stocks.

January 16 -

It's unclear how automated investment platforms will perform during a major market downturn and what that could mean for advisors' bottom lines.

January 16 -

“The thundering herd is on the move,” boasts Andy Sieg, head of Merrill Lynch.

January 16 -

Money managers would be better off selling holdings at random, a study suggests.

January 16 -

Institutional withdrawals amounted to nearly $35 billion in the fourth quarter.

January 16 -

Nearly all of the outflows came from mutual funds and ETFs that posted losses.

January 15 -

The firm has lost more than 1,100 advisors since a phony accounts scandal came to light in 2016.

January 15 -

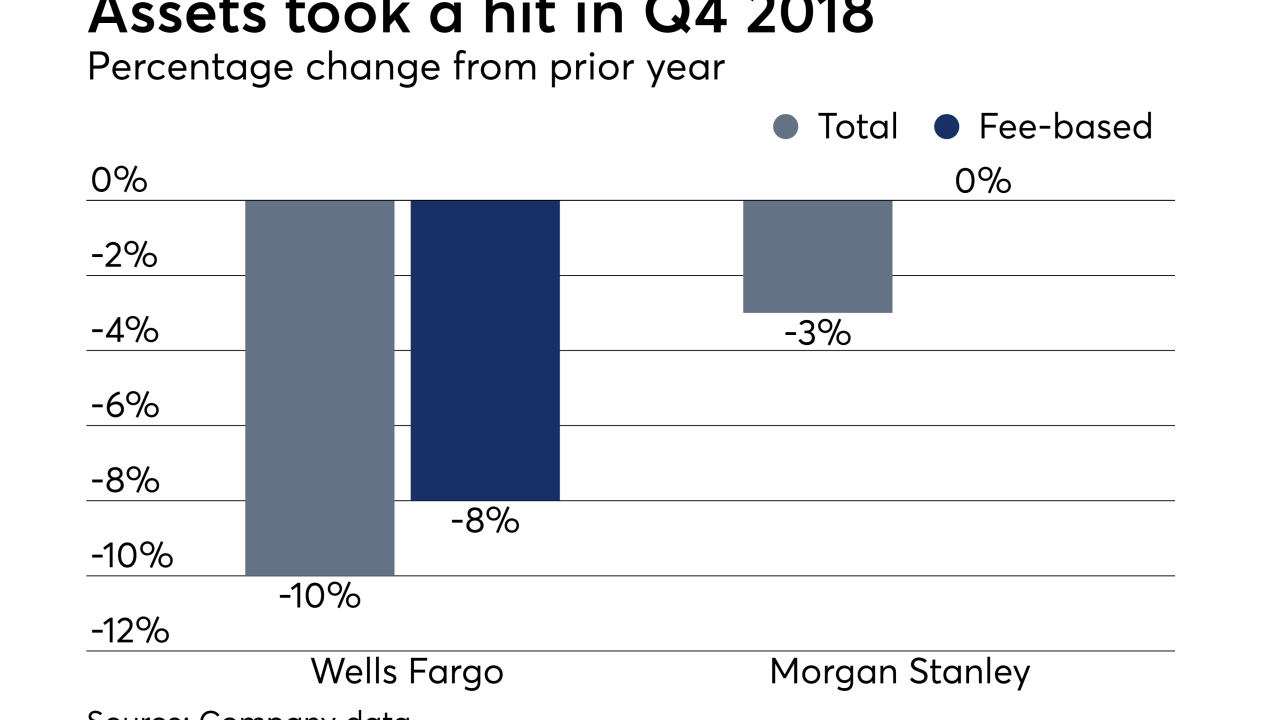

For investors who were hoping for a turnaround quarter, better luck next time.

January 15 -

A growing body of research is looking into whether the expanding influence of passively managed funds is making companies less willing to compete.

January 15