Even the world’s largest money manager BlackRock felt pressure as markets convulsed at the end of 2018.

The New York-based firm saw fourth quarter assets under management dip below $6 trillion as institutions and retail investors withdrew money from its wide array of products. That’s a 5% decline from a year earlier and a drop from records BlackRock achieved earlier in 2018.

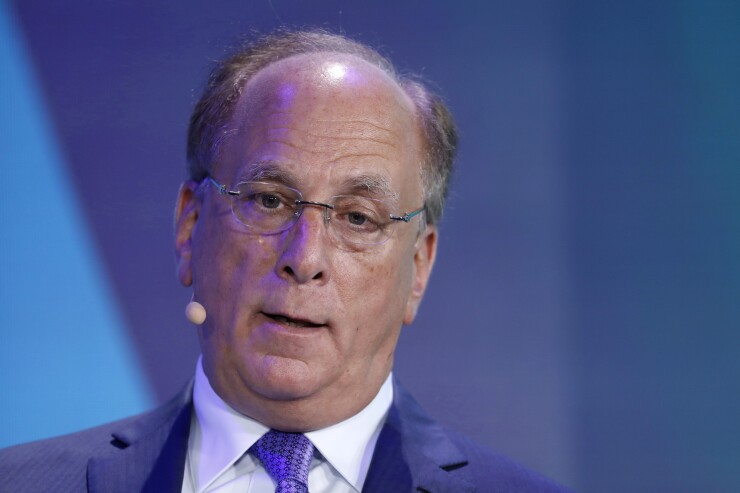

"The year was a year of records, good and bad records," said BlackRock CEO Larry Fink. He noted that market volatility is weighing on the asset management industry. "We’re seeing the seeds of a global slowdown," he said.

Institutions withdrew $34.6 billion from BlackRock’s active and passive investment products in the period, the firm said Wednesday in a statement. That was the third straight quarter of institutional outflows. And as the S&P 500 slid at year-end, retail investors also ducked for cover. They wrenched $3.2 billion out of BlackRock’s funds, marking the first quarter of outflows since 2016. Overall, long-term net flows came in at $43.6 billion for the quarter.

Fink said that a resolution in global trade tensions could result in a surge of investing in 2019. The company has already seen customers putting money to work in January, he said.

BlackRock shares rose 4.9% at 9:54 a.m. in New York.

-

This environment allows advisors to demonstrate their value to clients.

June 29 -

At some point, stock price gyrations became synonymous with bad performance. Actually, it’s "only a reflection of volatile movements in the market.”

April 16 - Enthusiasm for equities is coming back after a slowdown tied to heavy volatility early in the year.Sponsored by ADP Accounting

The firm was buoyed by the strength of its massive ETF business. Despite conventional wisdom that passive products look less appealing in market downturns, BlackRock’s iShares division shone with record inflows of $81 billion in the fourth quarter. That result was achieved as its U.S. iShares products had two consecutive months of record inflows in November and December. ETFs account for about one-third of BlackRock’s assets under management. It is the world’s largest provider of the products.

Gary Shedlin, BlackRock’s chief financial officer, said that he was encouraged by the performance of iShares, and in the firm’s alternatives inflows. Still a relatively small piece of the business, net flows into alternatives totaled $4.9 billion in the fourth quarter.

“In the context of all this storm, we put up solid growth," Shedlin said. “We saw a record on both sides of the barbell.”

Nearly all of the outflows came from mutual funds and ETFs that posted losses.

Yet the mounting market forces were hard for BlackRock to escape and ultimately contributed to firm reporting a 66% decline in full-year net inflows. Active investments suffered, with clients pulling $12.3 billion from those products in the quarter.

BlackRock appears to be reevaluating its business amid market uncertainty. Last week, the company announced plans to cut 3% of its global workforce, or 500 jobs. That’s the firm’s largest round of dismissals since 2016. The decision resulted in a $60 million charge in the quarter.

Fink also made some key management shifts earlier this month in part to accelerate growth outside the U.S. Mark Wiedman, previously the head of BlackRock’s powerhouse ETFs business, was appointed to new global strategy role and Fink said more leadership changes are on the way.