-

There are red flags that may be pointing to elder fraud in a client account.

July 30 -

The bank will pay $1.25 million for alleged supervisory failures.

July 29 -

Advisors and their firms should be prepared for how they will respond to expanded fiduciary responsibilities under new standards.

July 26 -

The SEC and FINRA say they’ve held a series of discussions with market participants on how decades-old custody rules might apply to virtual coins.

July 10 -

The chairman says the commission is working closely with FINRA on inspection plans to hold brokers to account.

July 9 -

Summit Brokerage Services wasn’t feeding the notifications into the transactions blotter while its ownership went into flux, according to the regulator.

July 5 -

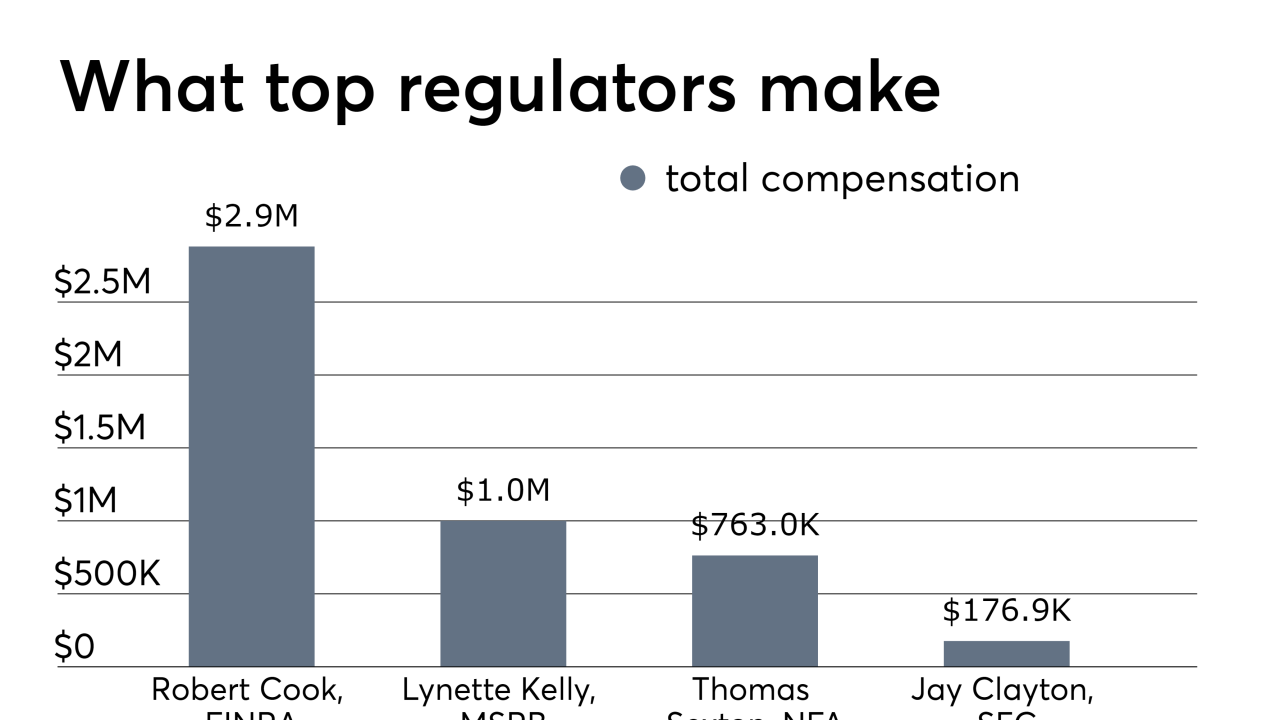

Robert Cook’s pay far outshines that of other SRO chiefs.

July 2 -

A PKS rep allegedly sold $190 million worth of non-traded REITs and BDCs without disclosing the commissions.

June 28 -

Listening to a customer service call produced a big surprise. It also showed how firms can take one position to fight complaints in private, but another in public.

June 13 -

A Financial Action Task Force note on digital asset oversight is “one of the biggest threats to crypto today,” a research executive said.

June 12 -

FINRA Rule 3210 typically requires permission for brokerage accounts.

May 29 -

With brokerage firms lining up in support of the SEC proposal, fiduciary planners aim to keep their differences from the BD channel intact.

May 17 -

The regulator and one of its largest members, LPL Financial, engaged in a back-and-forth on the controversial initiative.

May 16 -

The decision comes a decade after the collapse of the infamous scheme.

May 16 -

Under a FINRA proposal, firms with histories of misconduct would be required to set aside funds for anticipated arbitration awards.

May 6 -

The SEC is giving serious side-eye to firms with part-time or underqualified compliance officers.

April 30 Cipperman Compliance Services

Cipperman Compliance Services -

The SEC and FINRA have launched groups focused on better understanding this growing area of the industry.

April 29 -

An advisor was terminated after accepting money from a brother, who was also a client. Is such a loan allowed?

April 29 -

Increased captive insurance coverage due to expanded business in 2018 was a primary driver of a three-year high in regulatory spending, the firm says.

April 24 -

Key tips for navigating the regulatory landscape.

April 12