-

The two announcements hours apart came after at least 33 firms with $1 billion or more in client assets changed hands in the first quarter.

July 1 -

The wacky performers can teach us how to grow our businesses, writes Chip Munn.

June 14 Signature Wealth Group

Signature Wealth Group -

The four largest U.S. banks face investor pressure to deliver the returns of smaller rivals, but they complain that the federal deposit cap and capital rules make that difficult. So they're pouring money into wealth management, payments and digital banking to seize more market share in existing businesses and fend off nonbank challengers.

June 9 -

Cypress Trust in Palm Beach is poised to pull off a rarity: the conversion of a wealth management firm into a community bank. It’s simply another way to take advantage of the ongoing melding of the two financial services sectors, CEO Dana Kilborne says.

May 22 -

Peter Mallouk’s firm made its second multi billion-dollar deal in three months after its first private equity infusion last year.

May 5 -

The brokers are offering their practice management lessons and resources as scale becomes increasingly crucial to wealth managers.

March 24 -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17 -

It may seem simple enough, but identifying how advisory firms are growing is a bit more elusive, John Furey writes.

February 10 Advisor Growth Strategies

Advisor Growth Strategies -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

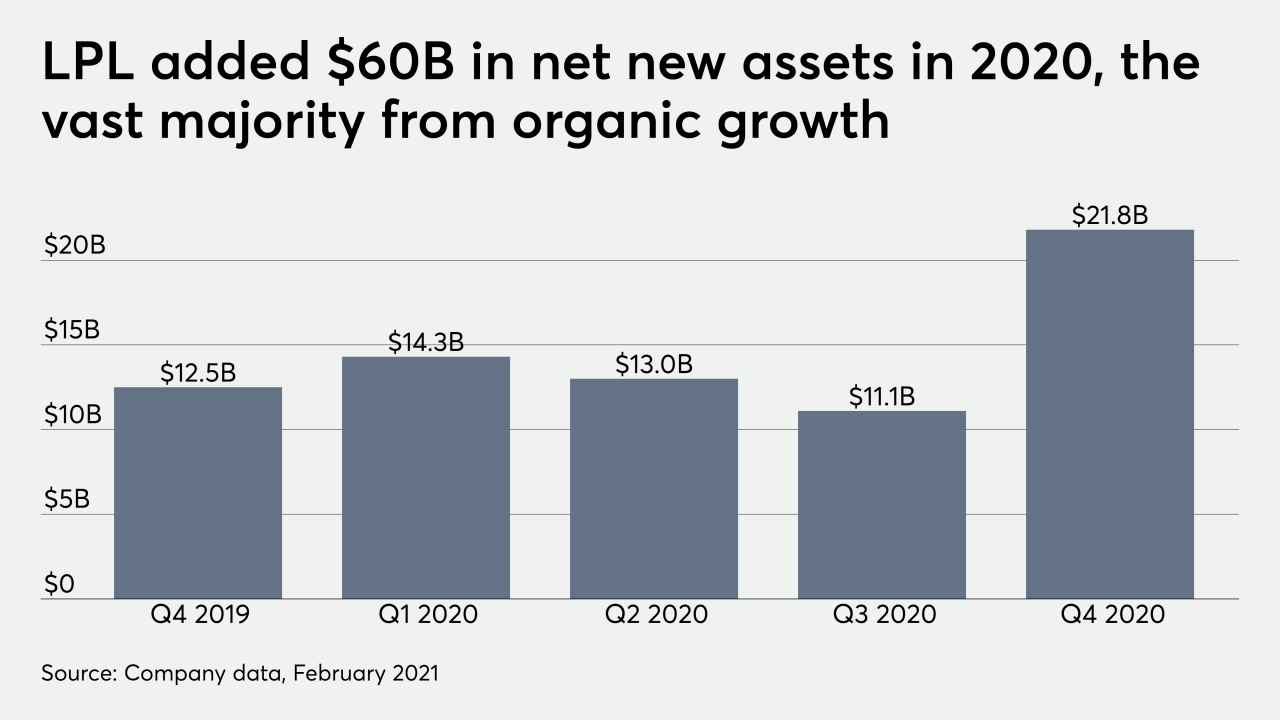

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

The practice received a recommendation from a surprising source and wound up picking its suitor after only a three-month search.

February 5 -

The acquisition of another midsize wealth manager will boost the holding company above 2,500 reps with nearly $95 billion in AUA.

February 3 -

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

A team that has grown through acquisitions dropped the No. 1 IBD after the institution purchased another one for more than $600 million.

January 27 -

Arete Wealth’s niche focus on alts for HNW and UHNW clients has given it a strong foothold in a fractured sector, experts say.

January 22 -

-

The California company, which focuses on technology companies and entrepreneurs, will make a big push into wealth management as part of the proposed acquisition.

January 4 -

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

The private equity-backed firm’s bottom line has been less affected by coronavirus-related low interest rates than its rivals, Moody’s says.

November 4 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30