Buoyed by one of the largest recruiting moves in the independent broker-dealer sector, Kestra Financial has added incoming advisors with at least $3.5 billion in client assets this year.

The private equity-backed firm recruited at least 63 advisors in 2020, including a billion-dollar team that

For the third quarter, Kestra recruited 15 teams with $2.2 billion in client assets, the firm

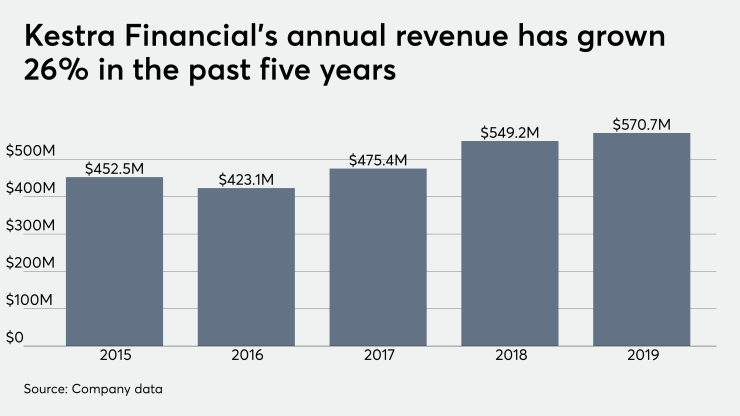

After a review by Moody’s Investors Service, the ratings agency cited Kestra’s “strong revenue growth supported by advisor recruiting,” but also its higher debt related to a recapitalization of the firm

“Despite the firm's elevated leverage, Kestra's rating is supported by a revenue base that is more shielded than peers from the low interest rate environment, with a greater portion of its revenue coming from advisory fees earned on clients' assets,” Moody’s Assistant Vice President Fadi Abdel Massih

Industrywide, lower wealth management earnings due to the economic impact of the coronavirus haven’t significantly stalled recruiting moves.

RS Will Wealth Management is one of 10 practices and enterprises with at least $1 billion in client assets to switch their BD affiliation this year.

“While we are pleased with the momentum from this past quarter, we know it is not coincidental,” Daniel Schwamb, Kestra’s executive vice president for business development, said in a statement. “We have quickly adapted to the new normal and worked diligently to provide the technology, industry expertise and back-office assistance needed to thrive in the current environment from anywhere, anytime.”

But Kestra’s rivals aren’t pulling back from their efforts, either. Also in the third quarter, the firm