Advisors and clients alike are growing increasingly apprehensive about the economic outlook, despite stock market gains. The aging of the bull market and political uncertainties are contributing to the anxiety, according to this month’s Retirement Advisor Confidence Index — Financial Planning’s monthly barometer of business conditions for wealth managers.

Advisors were also concerned about

“Nobody knows for sure how to handle the new rule, and every company is different,” one advisor said.

The looming regulation and tough pricing competition have generally lowered fees for retirement plans, advisors said. The rule could lead to higher fees in the long term, however, according to some planners.

“We are concerned about the increased regulations with DoL, since that may affect commission business, broker-dealer rules, class-action lawsuits and our overall cost of compliance and monitoring,” one advisor wrote. “This may require us to raise fees or drop small accounts, if necessary.”

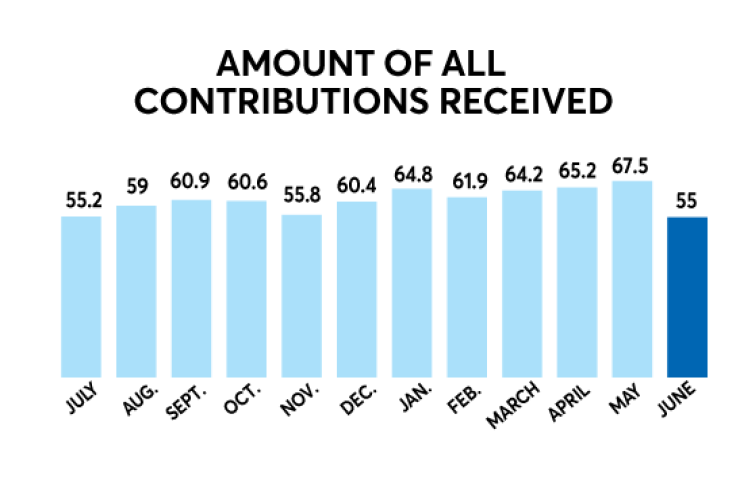

Retirement business dropped, as it has over the past four years in the month after Tax Day, advisors noted. The dollar amount of all contributions into retirement plans and total retirement products sold to clients both fell by double digits.

The turbulent political environment is also causing some jitters, one advisor said, noting that “international events give me the willies.”

Additionally, the aging of the bull market is putting some clients on edge. “They are concerned with the market, and believe that we could be headed for a correction soon,” one advisor wrote.

At the same time, the rise in equities has given some clients heightened performance expectations, which may account for the 1.6-point uptick in clients’ risk tolerance.

“People now have an expectation that the market will always go up, and expect to get at least the same returns as the major U.S. indices,” an advisor wrote. “This is actually causing us to want to be even more conservative, as valuations are stretched.”

The Retirement Advisor Confidence Index is composed of 10 factors — including asset allocations, investment product recommendations, economic and risk factors, taxes and planning fees — to track trends in wealth management. RACI readings below 50 indicate deteriorating business conditions, while readings over 50 indicate improvements.