-

A new bipartisan bill would exempt retroactive Social Security payments from federal taxes, easing a surprise financial burden for millions of retirees.

February 20 -

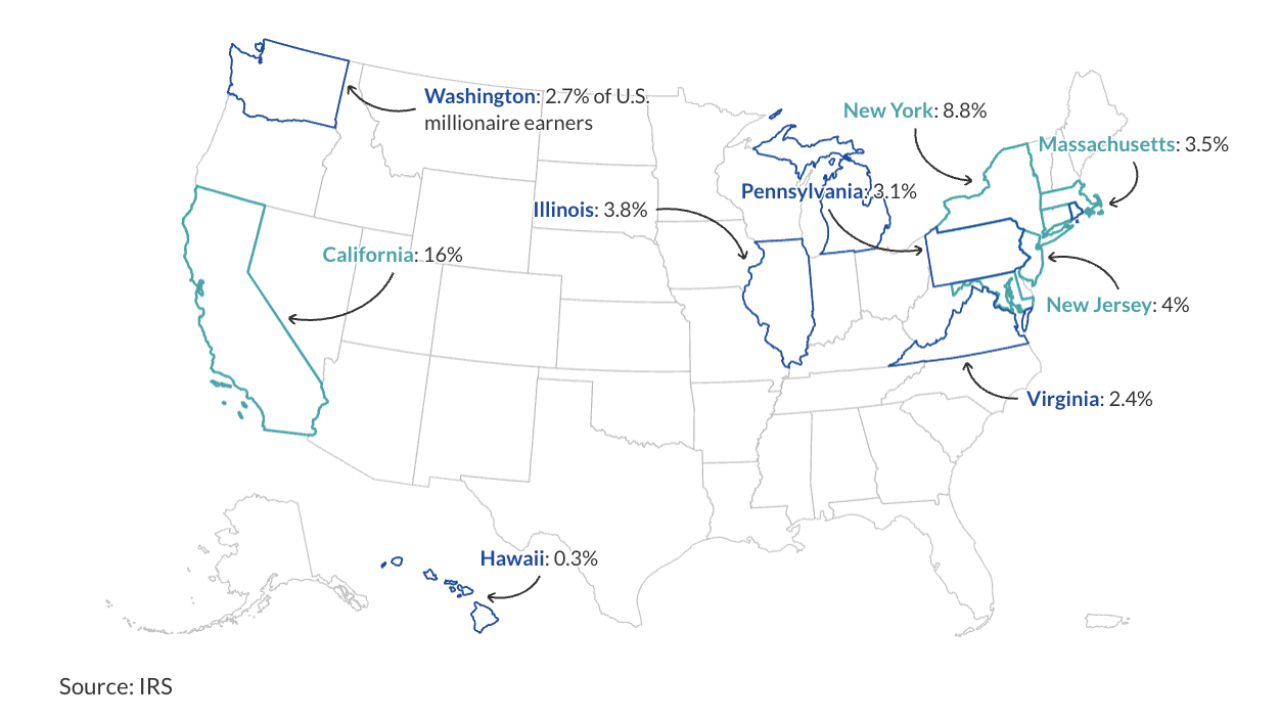

New proposals in seven states could soon subject over half of all U.S. millionaires to targeted high-earner tax rates.

February 13 -

Donor-advised funds should be temporary vessels, not permanent endowments. Here's how financial advisors can keep them from becoming philanthropic dead ends.

February 13 Building Impact Partners

Building Impact Partners -

After nearly a century of trying, Washington state Democrats could finally pass an income tax — a move that would hit 30,000 or so top earners.

February 12 -

Wealth management and tax planning stocks tumbled after Altruist launched an AI tool for tax strategies, stoking investor fears of disruption and fee compression.

February 10 -

The tax-filing season for individuals just opened recently, but businesses already got a head start on various tax incentives in the One Big Beautiful Bill Act.

February 6 -

Even though advisors doubt it will pass, California's proposed billionaire tax is already reigniting residency and wealth planning conversations.

February 6 -

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

Unlike equity investors, who must plan around the 31-day exclusion window, cryptocurrency holders can sell and repurchase in the same session.

December 26 -

With no guidance available, tax practitioners and their clients have to figure out how much risk they want to take.

December 16 -

The One Big Beautiful Bill Act makes the opportunity zone program permanent and also introduces some changes in the real estate investor tax breaks.

December 15 -

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3 -

The integration eliminates the need for a third-party intermediary between the two platforms, allowing for a direct connection between financial planning and tax, estate and insurance data.

November 18 -

Quant firm Dimensional Fund Advisors has received formal approval to adopt a fund structure that for two decades has been used exclusively by Vanguard.

November 18 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

Voters in 20 states will be asked to weigh in on ballot referendums and measures concerning an estimated total of $3.1 billion in potential tax hikes.

October 30 -

Nearly half of advisors are considering adding this service, according to the Financial Planning's October Financial Advisor Confidence Outlook.

October 27