Investors were rattled as major market indexes began tumbling in the spring, with clients planning for retirement bolting from equities and quickly becoming highly averse to risk, according to the Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

"People are starting to get worried about the market and economy," one advisor said. "The market has had a nice run, and people seem to forget that it does correct at times. A lot of risk out there."

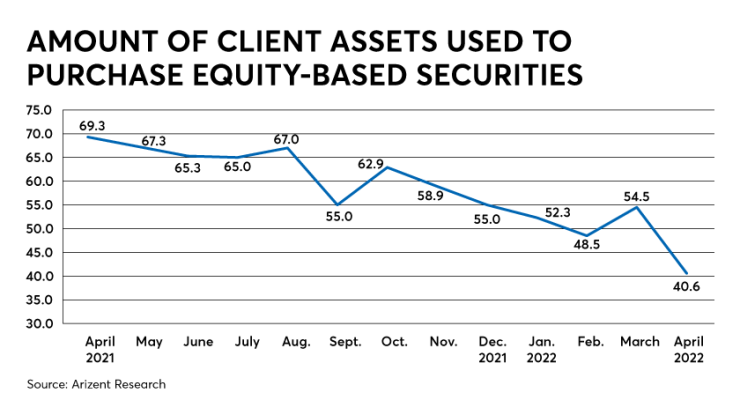

The component of RACI that tracks retirement investments in equities tumbled nearly 14 points from March to post a score of 40.6, the lowest mark since the onset of the pandemic in March 2020 and a whopping 28.7 points down from April 2021.

"We have drastically reduced our overall equity positions across all asset classes," one advisor said.

RACI scores below 50 indicate a decline in confidence, and scores above that mark signify that confidence is on the rise.

Overall, the RACI composite score checked in at 45, just the second score below 50 since May 2020. April's mark was off more than five points from March, and down nearly 12 points from the same month a year ago.

Inflation, rising rates, war in Europe and a snarled global supply chain are all weighing on investors' minds. Those factors have been of concern for months, but the market volatility that kicked into high gear now has some advisors and clients talking about the "R" word.

"It seems that we are heading toward a recession with inflation out of control, interest rates going up and the supply chains still not fully operational," one retirement advisor said. "It seems to all be adding up to a rough market environment in the short term."

Others are more inclined to view the issue in the present tense.

"We may already be in a recession," another advisor said.

Many advisors say that concerns about a recession are sapping investors' appetite for risk, another key metric that RACI tracks. In April, risk tolerance posted an anemic score of 28.5, the lowest level since December 2018. April's risk tolerance score was off 11.1 points from March, and an incredible 31.3 points from April 2021.

"Folks are worried about potential recession and risk averse right now," one advisor said.

Those same concerns may be reflected — though far less dramatically — in the component of RACI that tracks overall contributions to retirement plans. That metric dipped 5.3 points from March to check in at 56.2 – still above water, but off a little more than nine points from the year-earlier period.

That suggests that even if contributions have fallen off, workers are still saving but are looking to remove as much risk as possible from their retirement portfolios.

"The retirement business is rather stable, so long as client employees remain employed," one advisor said. "For the moment, we are working to be as defensive as possible while still sticking to our investment policy allocations."