-

Financial advisors are flooded with questions from panicked clients. Here's a field guide to answers.

March 21 -

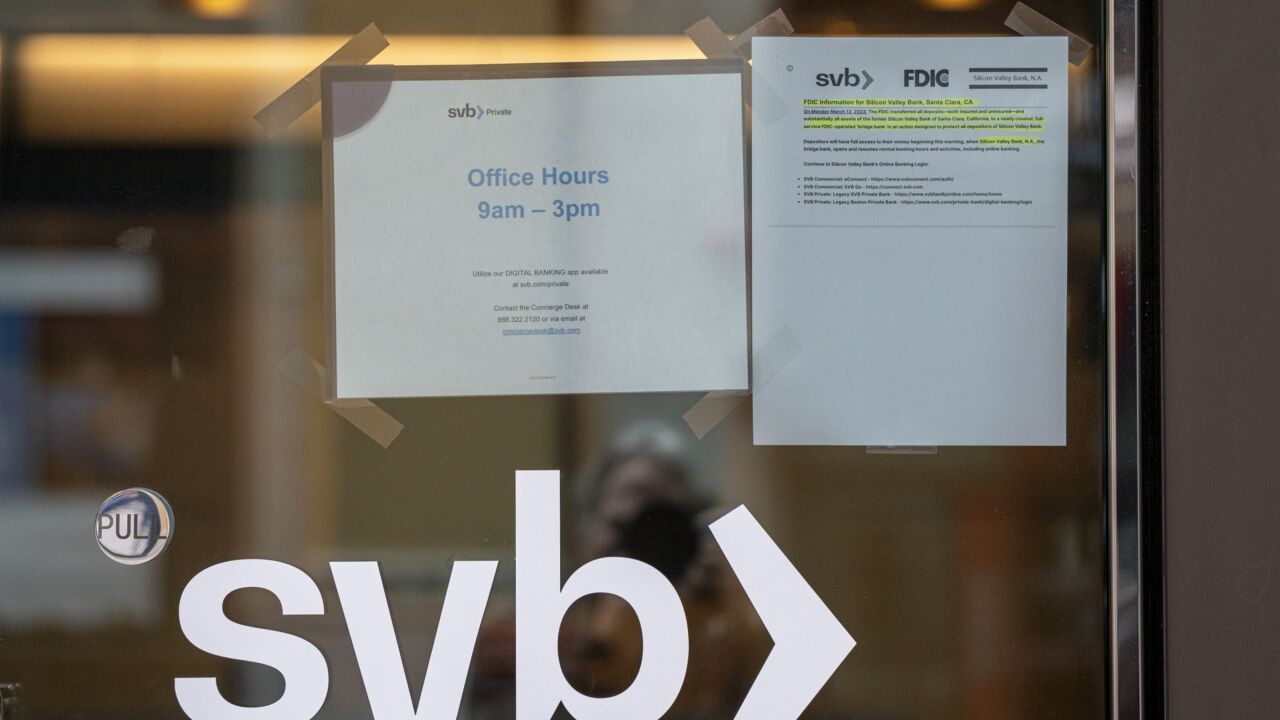

After three banks collapsed, a New York teacher wonders if the wreckage could reach her nest egg. Should she be worried?

March 16 -

The 4% rule isn't the only option. Plus, one counterintuitive idea says retirees can live larger this year.

March 14 -

A new study by FINRA and NORC offered encouraging signs that people who put money into stocks and bonds for the first time in 2020 are in it for the long run.

March 8 -

Contributions to 401(k)s and IRAs now can reduce your 2022 taxes soon due this filing season. Here's what advisors, many of whom can themselves benefit, need to know.

March 7 -

New data from Fidelity Investment shows disparate reductions in account balances for IRAs and employer-sponsored retirement plans last year.

February 26 -

A proposed amendment to the Investment Advisers Act would require planners to vet third-party custodians before entrusting them with clients' cryptocurrency, real estate or other alternative investments.

February 15 -

With 10 to 20 good working years left, financial advisors describe what their middle-aged clients are doing to get ready for a non-work life.

February 14 -

The federal regulator's annual list of inspection priorities shows particular concern that hybrid advisor/brokers aren't properly explaining to clients how they're compensated.

February 8 -

The SEC, FINRA and NASAA issued an investor alert warning of fraud, fees and tax complications for self-driven retirement accounts that invest in alternative assets.

February 7 -

Millions of the oldest members of the cohort have roughly 10 good working years left to stockpile for their golden years. And many are in trouble.

January 31 -

Additionally, one in three adults with long-term nest eggs pulled out money for daily living costs, a U.S. News & World Report survey found

January 10 -

The new year brings a new tax season and the opportunity to advise clients on ways to save money on their taxes.

January 5 -

Before it collapsed, the disgraced crypto exchange had its sights on a new target: retirement accounts.

January 5 -

Portfolio reviews and retirement contributions are at the top of to-do lists of Morningstar, AARP and industry groups.

January 2 -

Planners warn that clients still need financial education to understand the ins-and-outs of new plans.

December 8 -

Popular brokerage is letting investors put retirement money into traditional and Roth IRAs.

December 6 -

More tax savings means happier clients and potentially wealthier financial advisors.

December 1 -

A new Fidelity report showed that despite the pressures of inflation, most people with 401(k)s kept contributions steady in the third quarter.

November 17 -

While the new 10-year rule slams heirs, it may also afford some increasing largesse.

November 15