Wall Street's downturn and persistent inflation are taking a toll on millions of Americans with retirement plans, a further blow to savers who have long worried that they don't have enough stockpiled for their golden years.

A new report by Fidelity Investments found savers markedly more pessimistic in the second week of September compared to a year ago.

Getting cranky

Nearly one in three individuals of all ages, or 32%, had "negative feelings about their finances," a significant uptick from 22% in the year-ago period. Only 30% felt positive about their financial situation, one-third fewer compared to a year ago.

Saving less

Rising consumer prices generally leave fewer dollars to put in long-term nest eggs. Two of five people, or 41%, saved less during the third quarter compared with the previous three months. In the second quarter, only 27% saved less.

Fidelity's data for the third quarter of 2022, which it considers a snapshot of consumer sentiment from July through September, comes from a survey of 1,513 Fidelity-sponsored retirement plan participants between September 8 and 17 and a review of 24,500 corporate defined-contribution plans and 22.1 million participants as of September 30.

Here are the other key upshots of

401(k) contributions mostly hold the line, but some savers slip

While the average retirement account balance has decreased, 401(k) plan savings rates are "strong" and the percentage of employees with plan loans remained low for a sixth consecutive quarter, the report said.

Still, the third quarter showed some workers dropping their contribution rates. Some 3.7% of savers reduced the amount of money they contributed to 401(k) and 403(b) plans in the third quarter compared to the April to June period (the latter plans are for teachers and public sector employees). The average reduction totaled 6.7%.

Overall, the majority of savers kept their rates the same compared to the prior quarter. But a sliver, less than 1%, stopped contributing entirely.

Boomers shovel dollars to employer-sponsored plans

Most workers, or 86%, kept their 401(k) contribution rates unchanged compared to the prior quarter; 7.8% increased their rate, by an average of 3.2%.

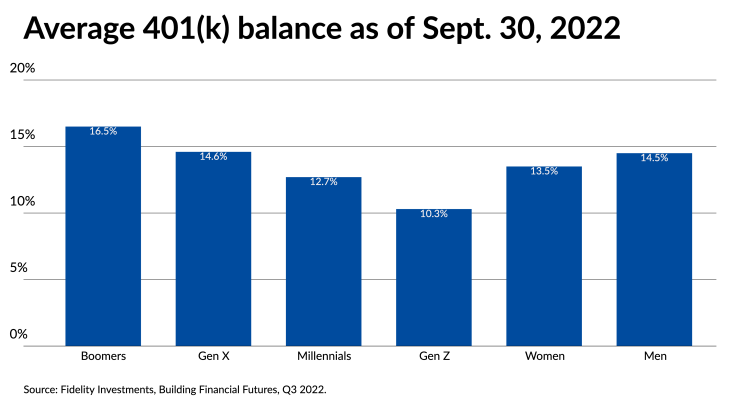

Men continued to save at higher rates than women (14.5% vs. 13.5%), while pre-retiree boomers saved at the highest levels (16.5%).

Gen Z participants nudged up their savings levels to 10.3% from 10%.

The average contribution rate across all ages remained fairly steady at 13.8% (compared to 13.9% in Q2 2022 and 14.0% in Q1 2022), which is just below Fidelity's suggested savings rate of 15% of pre-tax income.

"Despite a growing negative overall consumer sentiment,

Men continued to save at higher rates than women (14.5% vs. 13.5%), while pre-retiree boomers saved at the highest levels (16.5%).

Gen Z participants nudged up their savings levels 10.3% from 10%.

Millennial women are on it

The number of individual retirement accounts, both traditional and Roth, that are owned by female millennials grew by 25.5% in the third quarter compared to a year ago. Fidelity defines that generation as those born between 1981 and 1995.

Roths rule

Americans increasingly favor Roth retirement plans over traditional IRAs. The latter are typically funded with dollars on which taxes have not yet been paid, although savers can also kick in after-tax dollars. By contrast, Roths are funded with post-tax dollars, and withdrawals are tax-free.

"Across generations, Roth IRAs are the retail retirement savings vehicle of choice, with 61.0% of all IRA contributions going to Roth in Q3 2022," Fidelity said.

The number of Roth IRAs owned by millennials increased 5.8% compared to a year ago, but overall dollar contributions fell 4.2%.