-

SEC Commissioner Robert Jackson Jr. said his office studied 15 years of data to assess how the firms utilized their power on hundreds of proposals.

November 19 -

“The market is actually using proxies for understanding ESG data,” says BlackRock’s global head of sustainable investing.

November 19 -

Banks are hoping strategies like technology-enabled portfolio trading will help them grab a bigger slice of the shrinking fixed-income pie.

November 18 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Financed by their personal savings, the team behind the machine-learning fund have harnessed their engineering acumen to invest in developed markets.

November 13 -

The metal’s price has dipped from its high in September amid a raft of good news that has boosted investors’ risk appetite.

November 12 -

Asset managers who flocked to safety in utilities and dividend stocks at the end of 2018 have seen their pain compounded by the latest risk-on rally.

November 8 -

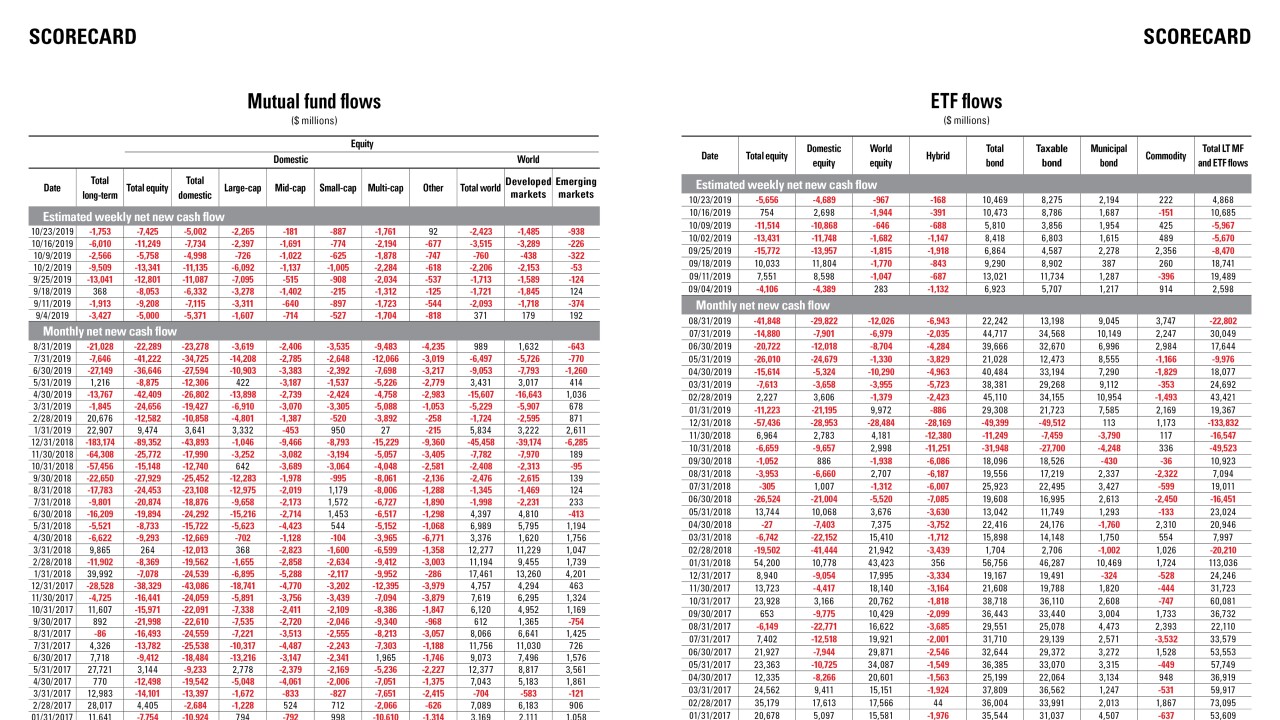

Data reported by the Investment Company Institute.

November 7 -

The SEC's recently passed ETF modernization rule is just one regulatory change industry leaders expect will impact asset management in the years ahead.

November 7 -

An extension from the agency comes amid warnings from brokerages that breaking out stock and bond analysis would threaten their own research businesses.

November 6 -

As the sector grows to over $30 trillion in Europe, North America, Japan, Australia and New Zealand, one popular approach consists of excluding offenders.

November 5 -

The large number of closures in equities and “other” categories could not be offset by new additions, Index Industry Association research shows.

November 4 -

It's no exaggeration to say rock-bottom fees are an existential threat to many asset managers. However, technology could still save the day.

November 1 Broadridge

Broadridge -

Appetite for cyclical plays like financials has picked up as trade negotiations between the U.S. and China show signs of progress.

October 31 -

The move comes amid years of mediocre returns posted by hedge funds, prompting investors to pull money and demand lower fees.

October 30 -

Many lenders have started to scale back as the fund industry copes with reduced demand for research following MiFID II.

October 29 -

Given that almost one-third of leveraged loans are just a downgrade away from triple-C, even a modest slowdown could create a snowball effect of sorts.

October 28 -

The downside for their clients, however, is it may obscure just how much credit risk they’re exposing themselves to.

October 25 -

The NHL team owner and famed asset manager’s challenges illustrates how the appetite for hedge funds has changed since he first got into the business.

October 24 -

The $10.1 billion fund’s star manager, well known for his contrarian investments, held on to a short position against U.S. Treasurys even as bonds rallied.

October 24