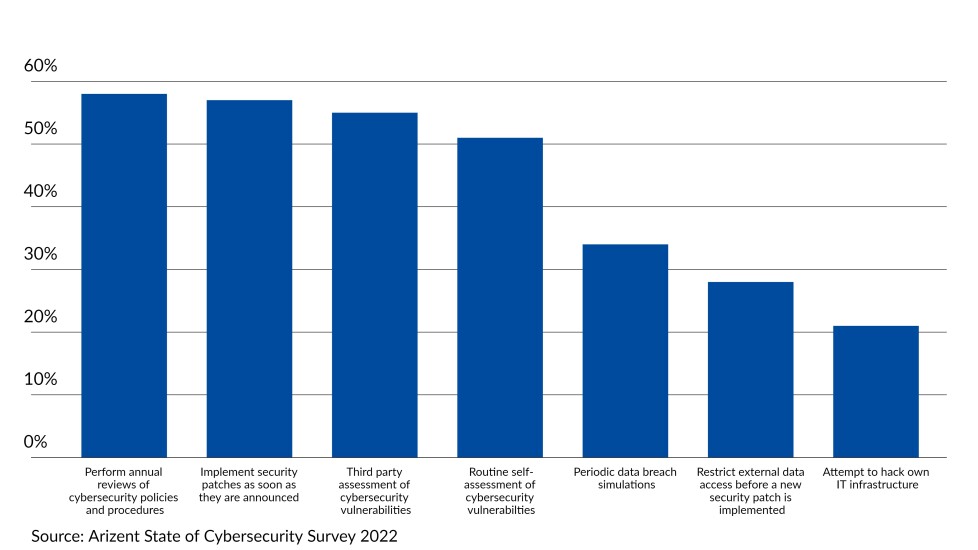

Wealth management executives are reassessing cybersecurity policies and procedures as they prepare firms for the future.

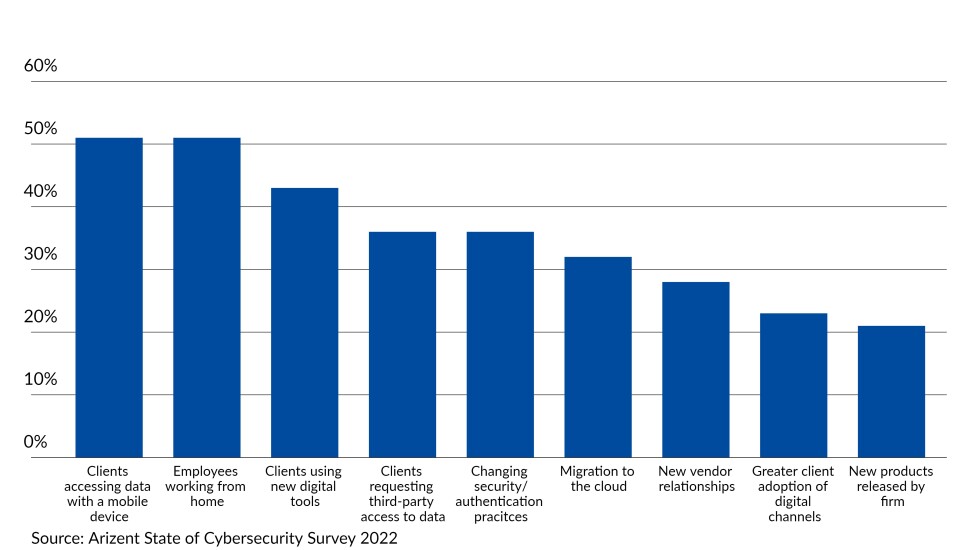

Growing demand for third-party access data — from both customers and technology vendors — is increasing threat vectors, as is the growing use of mobile devices. These aren’t new trends, but the shift to remote working caused by the coronavirus pandemic has accelerated the influence of these forces. For example, fintech companies initially created to reach younger investors are now embraced by clients of all ages.

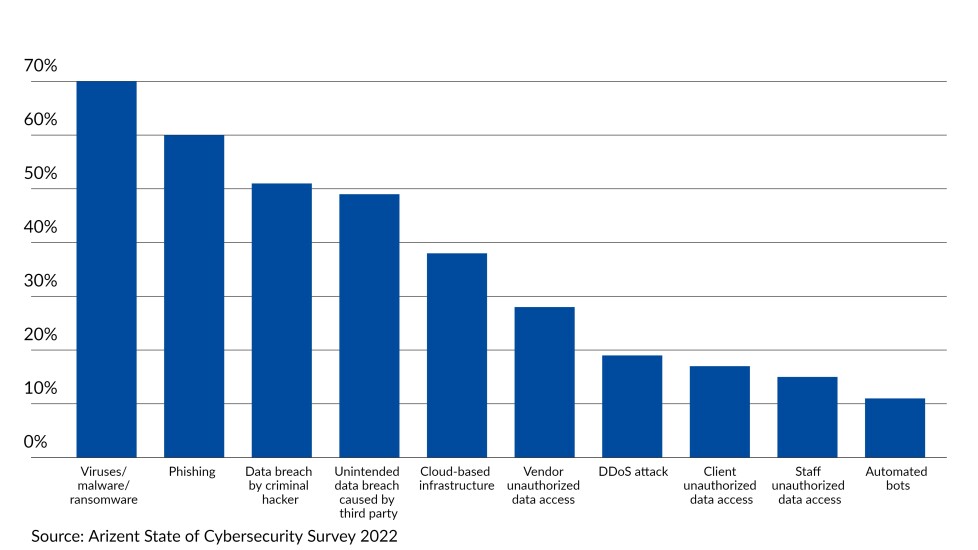

It’s more complex than ever for firms to manage and protect client data, and increased complexity has opened the door for increased crime. New research conducted by Arizent, Financial Planning’s parent company, explores the state of cybersecurity across the financial services industry and how leaders are working to protect clients while allowing their firm to innovate.

Here are 10 highlights from the research’s findings on the wealth management industry. The entire report