The uncertain tax and legislative environment means that year-end tax planning is more important than usual. The possibility of major tax reform opens up powerful planning opportunities that can save clients on taxes if completed before year’s end. To help clients and businesses prepare for filing season, Grant Thornton released a collection of

<BR>

“The potential for tax reform makes year-end tax planning more important than ever for individuals and public and private companies,” says Dustin Stamper, director in Grant Thornton’s Washington National Tax Office. “Tax filers should look for ways to accelerate deductions into 2017 while rates are high, and defer income into future years when rates might be lower.” He also stressed that the potential to lose deductions or tax incentives as part of tax reform should also factor into year-end planning. “It’s important to remember that good tax planning goes beyond what has happened. You also have to account for what may happen in the months to come.”

To help individuals and businesses prepare for filing season, Grant Thornton LLP has released a collection of

1. Take a closer look at state residency status

2. Use itemized deductions before they’re gone

3. Tread carefully with estate planning

4. Make up a tax shortfall with increased withholding

5. Leverage state and local sales tax deduction

6. Accelerate deductions and defer income

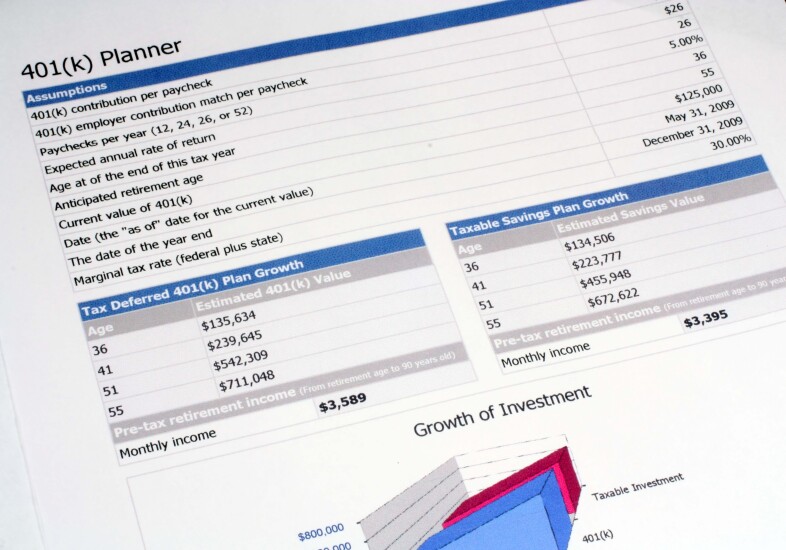

7. Leverage retirement account tax savings

8. Document KEY business activities