One of the year's largest wealth management M&A deals will yield tens of millions of dollars in cash for Ladenburg Thalmann’s largest shareholders. But it's not clear whether any of the proceeds will trickle down to advisors in the form of retention bonuses.

Ladenburg's Miami-based parent firm agreed last week

Based on the shares listed in

For advisors wondering if they'll receive retention bonuses after the five IBDs change hands, the sellers say they haven’t made any final decisions. However, the

The respective cumulative limits would double if the deal doesn’t close by the end of the first quarter. Executives, board members and other major shareholders would collect $3.50 per share for common stock and the excess between the purchase price and their options at close.

In addition to the acceleration of the stock options, preferred stockholders would get the opportunity to convert some or all of their holdings into cash. Debt securities issued by Ladenburg would transfer to the combined company upon completion of the deal.

Substantial shares in Vector could also pose an impact on the amount of compensation. Frost is the largest shareholder of the Douglas Elliman Realty parent and tobacco company owner, while Lorber and Lampen have executive positions there,

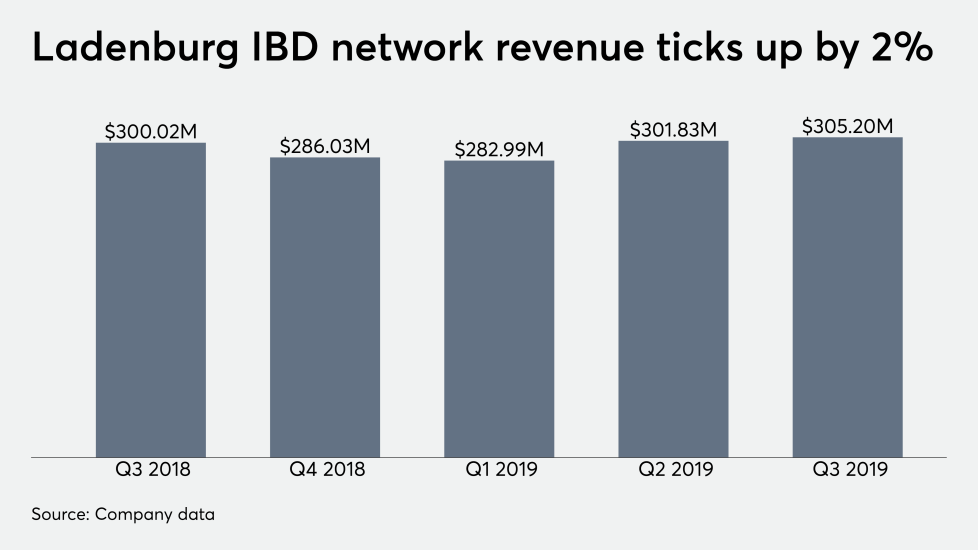

Advisor Group CEO Jamie Price — who is slated to lead the merged company of nine IBDs with 11,500 advisors — had cited the fact that there

But Ladenburg COO Adam Malamed followed up with an emailed statement noting that the transaction process is still “in the early stages.” He and other executives focused their public statements about the deal on the IBD subsidiary structure the networks have in common.

The two firms “have highly complementary capabilities that will enable us to strengthen technology, practice management and service for financial advisors across our combined platform,” Malamed said. He added that advisors will recognize the strength of the merged resources as they “continue to learn about this transaction.”

Ladenburg intends to play a big role in that educational process. The seller must “assist the parent in its efforts to retain the company’s financial advisors following the closing,” according to the plan of merger.

The mandatory retention push includes in-person meetings with “key” advisors and “reasonably prompt notice” to Advisor Group should Ladenburg become aware of any departures by senior executives or representatives with more than $300,000 in annual gross dealer concessions.

Shareholders stand to make significant amounts any time a company sells — and the board members who voted unanimously in favor of the deal face a binding fiduciary obligation to consider any offers. Plaintiff law firms have also issued

A higher price would have meant even bigger payouts. The tab of $3.50 per share already constitutes a 25% premium over the stock’s closing price from its prior trading day and a multiple of 2.1x on Ladenburg’s stated book value at the end of the third quarter, according to a note by analyst Alexander Paris of Barrington Research.

The multiple represents “a premium to the 0.9x price/book average among small cap broker-dealers,” according to Paris. He noted that the stock is trading “within pennies of the agreed-upon purchase price” in reducing its rating to “market perform” after the sale agreement.

Executives stand to make a lot from the deal. CFO Bret Kaufman and Joseph Giovanniello, Ladenburg’s senior vice president for corporate and regulatory affairs, could also make an additional $550,000 in severance pay if they lose their positions after the merger.

In agreeing to buy back most of the stake held by Frost for $130 million when he

For a full recap on the announcement of the deal, check out “