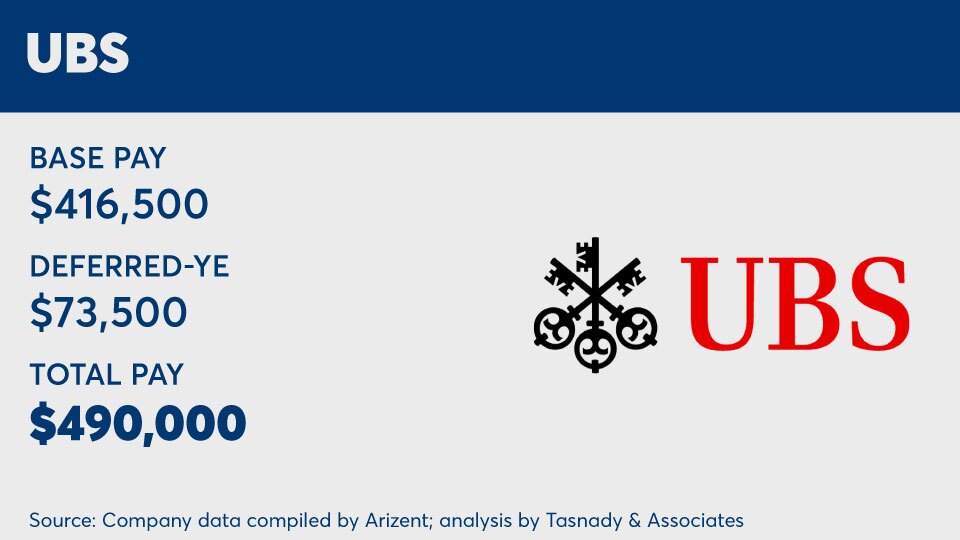

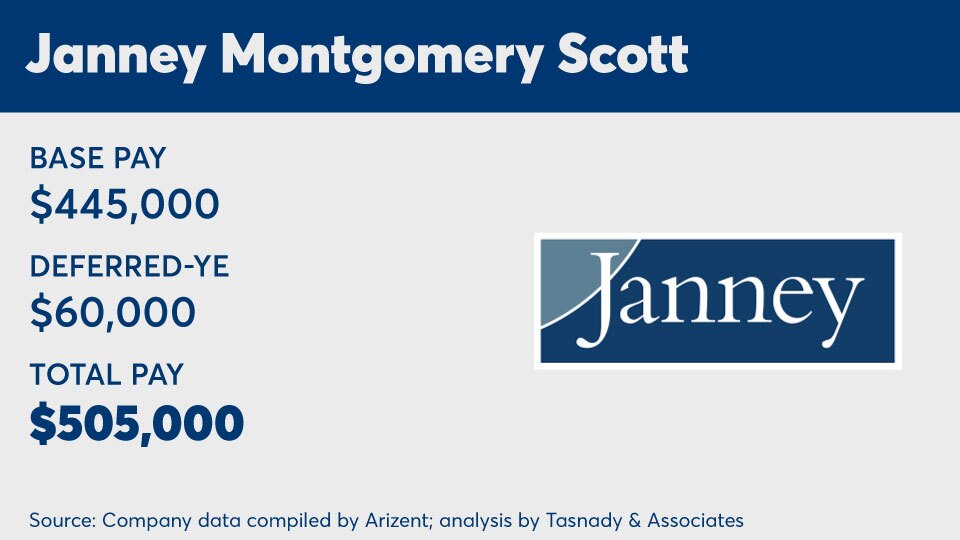

Financial Planning continues its annual analysis of base pay for advisors by looking at payout rates for those with $1 million in production in 2023.

Scroll through to see where each firm stacks up.

To see last year's data, please

This is the third part of our four-part annual survey. Pay comparisons at other production levels in the survey include:

Data was collected by Arizent and analysis conducted by compensation consultant Andy Tasnady and his firm,

A note about this year's analysis: A number of special policies are not included because they do not affect 100% of the advisor population evenly and therefore are too variable to compare. Individual results can vary dramatically based on the mix of business and policies at each firm. For example, pay can increase from special bonuses and fall from penalties such as discount sharing, small client limits and ticket charges.

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds; 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no impacts from bonuses based on growth, asset-based bonuses or other behavior-based awards.

- Excludes voluntary deferral matches, 401(k) matches or profit-sharing contributions, unless otherwise noted.

- Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.

*All data is provided by the companies featured and compiled by Arizent, with analysis by Tasnady & Associates. Data from Edward Jones is average data, individual FA experience may vary. Edward Jones provides average office profit instead of deferred compensation.