An industry that once flirted with double-digit gains has been one of the hardest hit by the coronavirus pandemic. By some estimates, overall global real estate investments have

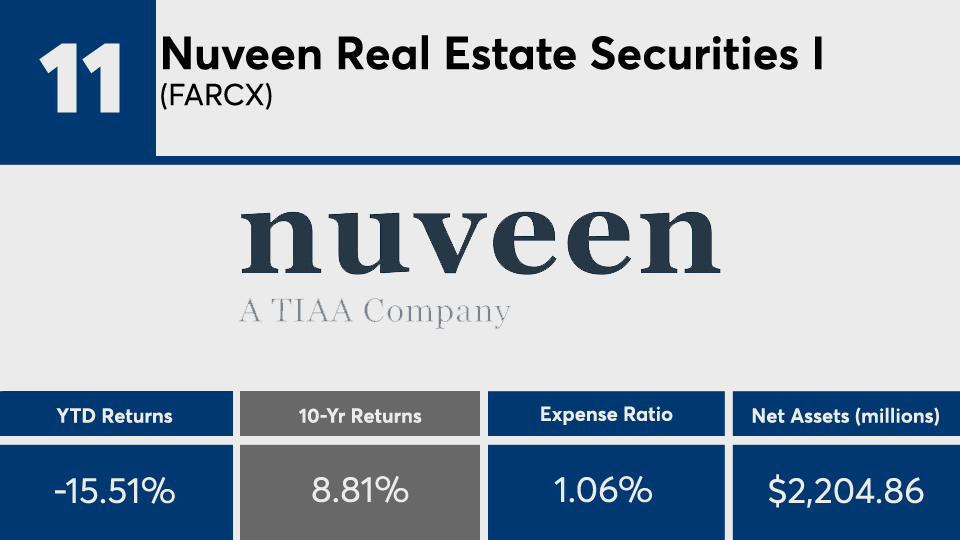

After delivering an average loss of more than 15% in the first six months of 2020, the decade’s top-performing real estate sector funds returned just under 9% over the period, according to Morningstar Direct data.

Following unprecedented market volatility largely driven by losses in commercial real estate, the 20 best-performers have now undershot index trackers like the SPDR S&P 500 ETF (SPY) and SPDR Dow Jones Industrial Average ETF (DIA), which posted 10-year gains of 13.97% and 12.75%, respectively. This year, SPY has managed a gain of 1.97% while DIA recorded a 5.28% loss, a win by many standards, data show.

In fixed income, the iShares Core US Aggregate Bond ETF (AGG) managed 10-year and YTD gains of 3.77% and 7%, respectively.

“This pandemic has hit all types of business differently,” CLS Investments CIO Marc Pfeffer says when analyzing real estate fund performance data. “We’ve seen that it's possible to make gains … but no one could have envisioned what this virus was going to do to the commercial real estate space, and that’s reflective in these short-term numbers.”

Read more:

The price for the sector’s underperformance was high. With an average net expense ratio of nearly 80 basis points, the long-term leaders carried fees well above the 0.45% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey. Pfeffer says the wide range of costs associated with the top-performers suggests management style and holdings have been the biggest differentiators.

“Depending on the names that you own and given how concentrated these funds are, it's not necessarily going to be related to expense ratios,” Pfeffer says. “You have some charging as little as 8 basis points, but most of these are charging 50 to 100 basis points.”

Scroll through to see the 20 real estate Morningstar category funds with the biggest 10-year gains through July 20. Funds with less than $100 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as year-to-date and one-, three-, five- and 10-year returns are listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.