And with the rapid evolution of the business, advisors need all the help they can get for a competitive edge.

To bring you the best insights, we’ve compiled a list of books for advisors based on recommendations from your fellow advisors as well as industry experts.

Scroll through to see their best suggestions.

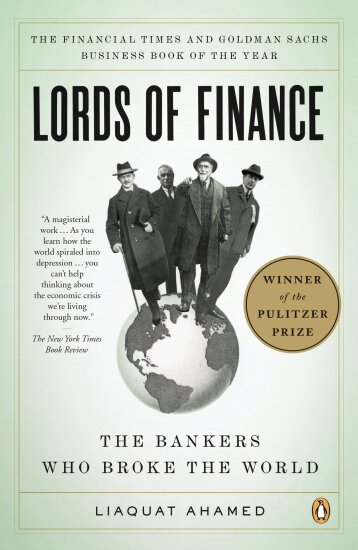

Lords of Finance: The Bankers Who Broke the World

Recommended by Theodore R. Haley, president, Advanced Wealth Management

“It is not a new book, but a fascinating read, and describes a period in time that has similarities to our current challenges. In order to help clients understand current events and to make realistic assumptions it is important to have a deep understanding of history.”

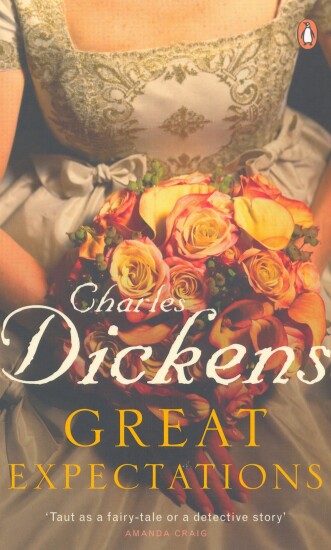

Great Expectations

Recommended by Kent Schmidgall, wealth advisor, Buckingham Strategic Wealth

“We spend way too much time reading finance books, when in actuality we gain much more empathy by reading fiction. 'Great Expectations’ is a wonderful book drawing on themes of greed and contentment, and will be in our memories much longer than the typical finance book.”

The Checklist Manifesto

Recommended by Michael Resnick, senior wealth management advisor, GCG Financial

“It is applicable to so many businesses but is a very entertaining read as well. Using checklists is a simple way to organize the complexity of our lives and our thoughts and Gawande uses examples that paint a vivid picture of their importance. Who would believe that stories about checklists could be so fascinating?”

Private Wealth Management: The Complete Reference for the Personal Financial Planner

Recommended by David N. Bize, financial planner, First Allied Securities

“Many financial advisors focus solely on investments and investment performance without considering their client's' overall situation. This book provides a comprehensive knowledge base that allows financial advisors to understand their client's situation in greater detail, minimize knowledge gaps and provide better solutions for their clients.”

Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tilt the Odds in Your Favor

Recommended by Stephanie Genkin, founder, My Financial Planner

“The book makes a strong case against stock picking and market timing using data and simulations. There's great stuff in here to share with clients, particularly when markets head south. Good behavior is handsomely rewarded for investors with long-term horizons. I quote from it often.”

Thinking Fast and Slow

Recommended by Jeff Camarda, CEO, Camarda Wealth Advisory Group

“It is a fascinating book at the hardwire underpinnings of much of human behavior, including the behavioral finance issues that impact our clients and our practices. For a psychologist to win a Nobel in economics for such work flags what a big deal it is — a must read.”

The Fred Factor: How Passion in Your Work and Life Can Turn the Ordinary into the Extraordinary

Recommended by Liz Miller, president, Summit Place Financial Advisers

“Our whole team read, 'The Fred Factor,' this past year. We would read a couple chapters each month and then get together to talk about it. Our advisors and support team alike loved this book and felt it was inspirational to both work and life.

"Fred is a mail carrier. The story of Fred, though, is one of work-life passion and exceptional customer service. Fred is committed to his responsibilities and takes a deep interest in the people he serves. The book shares stories of how Fred continually makes a difference in the lives of many people by going just a little further. The book is an easy read and though the premise may sound corny, we all felt it delivered a powerful lesson on how easy it can be for each of us to take the extra moment at work and in life to delight those around us.”

Half the Sky

Recommended by Amy Hubble, founding principal, Radix Financial

“While not a book specifically on investments, it will radically change how you view charity, investment and economic development around the world. This book is not for the faint of heart, as it includes several intense and graphic depictions of female mistreatment around the world. Although often heart-wrenching, it is ultimately a compelling triumph of how microfinance is revolutionizing the world.”

The Undoing Project

Recommended by Mitchell Kraus, co-founder, Capital Intelligence Associates

“Economists have stated for decades that people and markets are rational. Behavioral finance shows why people are not rational and understanding this, an advisor can help clients make better decisions. The book shows as humans we act against our own best interest. Using this knowledge advisors can help their clients come to better decisions to create better long-term outcomes.”

Tools of Titans

Recommended by Mark Shone, president, Shone Asset Management

“The book focuses on the tactics, routines and habits of highly successful people covering the areas of healthy, wealthy and wise. I love the book because it is not meant to be read as a story but instead as a series of inspirational, informative and action-based things that successful people do and you can replicate if it speaks to you. Just a little bit a day and you will pick up some things that can make a big difference in your life if you put them into practice.”

Thank You for Being Late

Recommended by Dennis Stearns, president, Stearns Financial Group

“It profiles many stories of how powerful trends— technology, globalization and demographics in particular — are influencing politics, geopolitics, the economic recovery, jobs, careers and investments. Lots of great insight into how large companies are using these ‘Super Trend’ tools to drive profit growth even as top line revenue growth is less robust. We’re using snippets from the book to help our clients understand why the world is spinning in a different way and prepare them (and their career or business) better for the even bigger change that lies ahead.”

Stretch: Unlock the Power of Less — and Achieve More Than You Ever Imagined

Recommended by Eric E. Schaefer, president, Financial Planning Club, University of Illinois at Urbana-Champaign

“This book discusses the benefit of relying on resourcefulness rather than the accumulation of additional resources, by embracing constraints and maintaining a frugal mindset in order to optimize one’s inner potential. The book also expresses the crucial role that diversity in experiences can play in solving problems that conventional solutions often fail to do. This book would surely empower any career changer in this young industry and validates the need for their unique perspectives in order to facilitate future growth.”

Strangers in Paradise: How Families Adapt to Wealth Across Generations

Recommended by Christine Gaze, president, Purpose Consulting Group

“I just reread this classic book that offers great insight on the deficiencies in knowledge and psychological preparedness that thwart the newly wealthy or “Immigrants to the Land of Wealth”, as Grubman so elegantly defines them. Regardless of whether you work with clients that have $5 or $30 million, if they were raised in the middle or working class, they are often ill-prepared to help their family effectively navigate. This book provides insights on the psychological challenges and unproductive behaviors toward wealth that can thwart high-net worth investors.”