The biggest fund families reported tens of billions of dollars in outflows in the first half of a year roiled by coronavirus-driven market volatility.

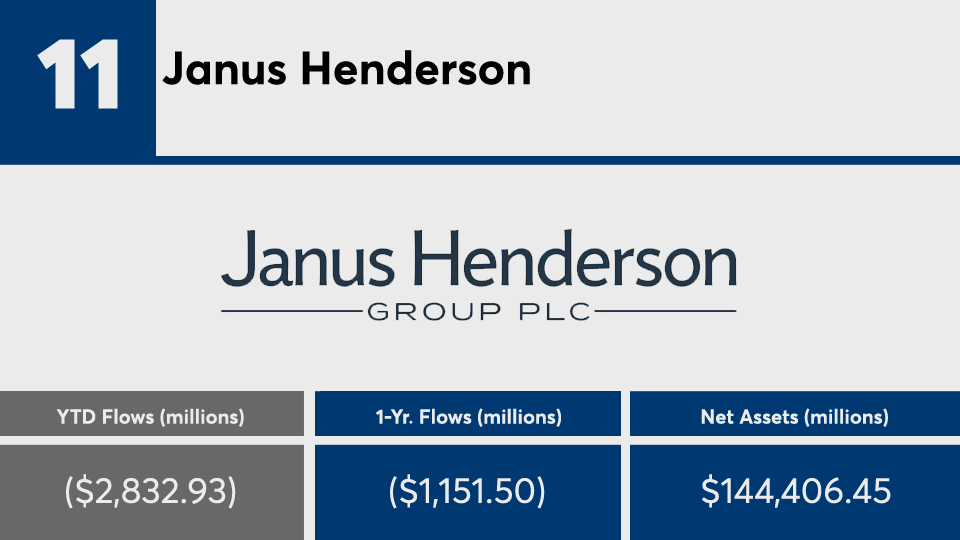

From January through May, 12 of the 20 largest U.S. fund families reported net outflows from mutual funds and ETFs of approximately $154 billion in combined assets under management, according to Morningstar Direct.

Eight reported net inflows of $89 billion through June 1.

“The passive game and the low fees have been gathering the lion's share of assets over the last three years,” says Marc Pfeffer, CIO of CLS Investments.

To be sure, half of the 20 biggest fund families reported net outflows from their actively managed products while just six reported outflows from passive, according to Morningstar data. Those with net inflows, however, managed to accumulate more net cash for active than passive.

Many clients “are starting to get fed up with fees,” Pfeffer says. “If you're going to buy an S&P 500 fund, why not just go with the cheapest? But if you're looking at active management, you need to look at more than just expense ratios.”

The largest fund family, Vanguard, reported net U.S. assets of more than $5 trillion, data show. The firm, which has seen the biggest net inflows of the largest fund families, has also experienced net inflows to both its passive and active lineups this year of $4 billion and $3.5 billion, respectively.

For clients deciding where to park their long-term investments, advisors must stress a multilayer approach to analyzing their holdings, Pfeffer says.

“You have to look at the composition of funds, risk tolerance and whether or not the funds meet the goals that the client has,” Pfeffer says. “That should be taken into consideration above anything else — the expectations from the client must be met.”

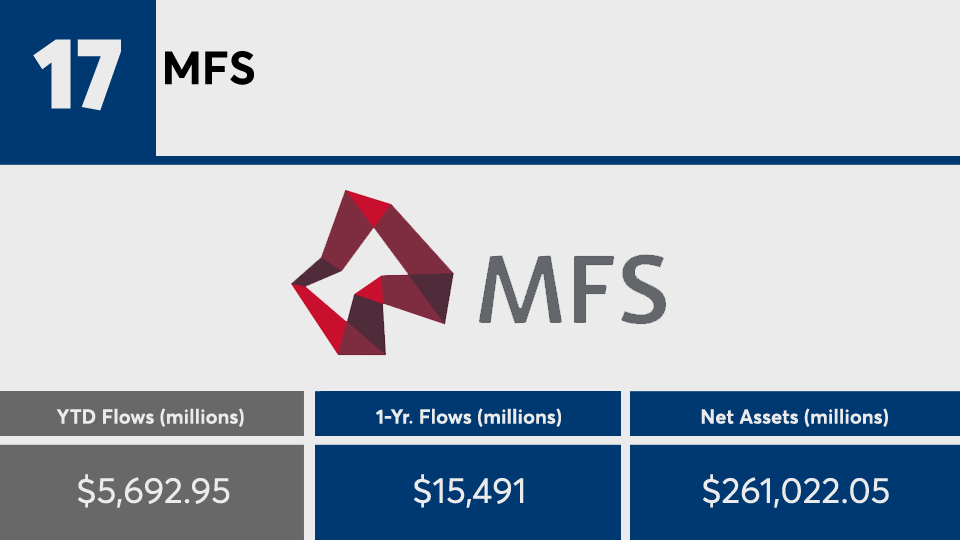

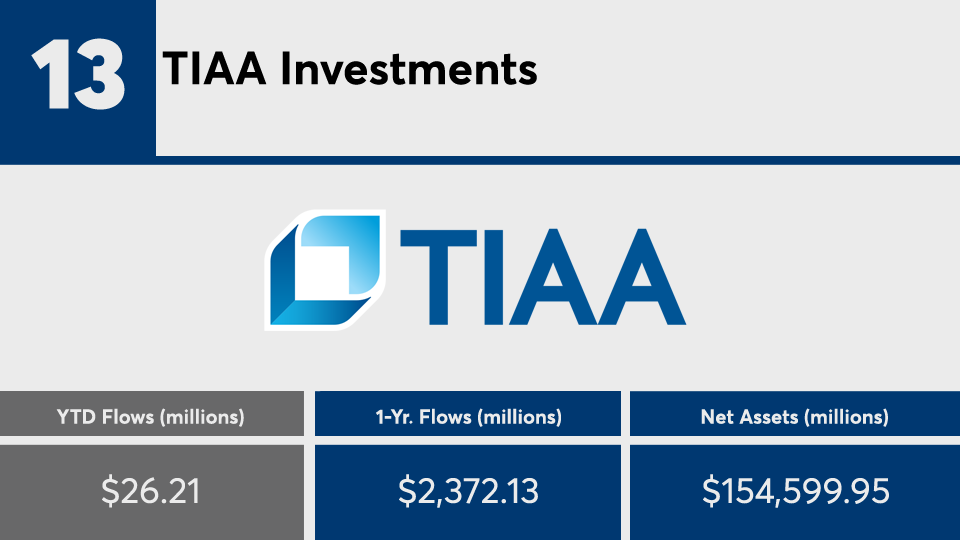

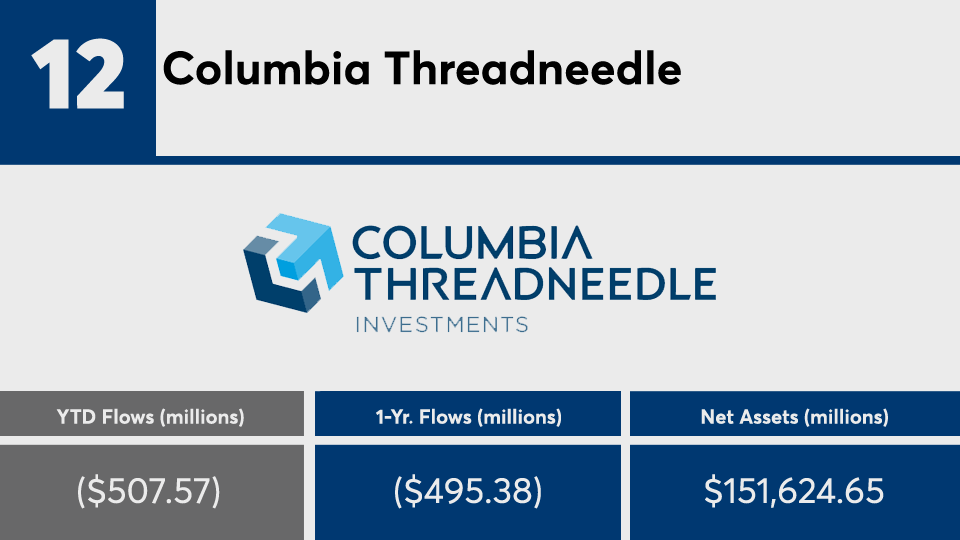

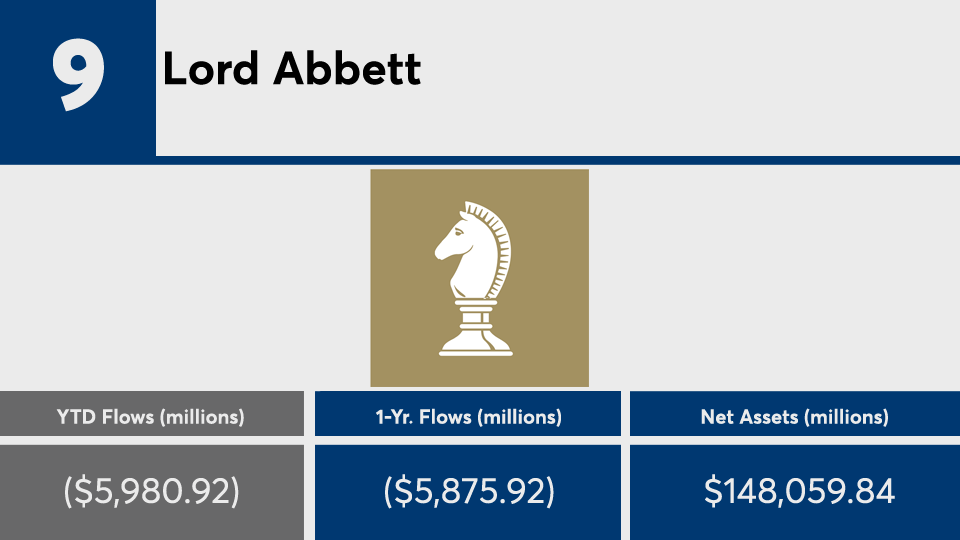

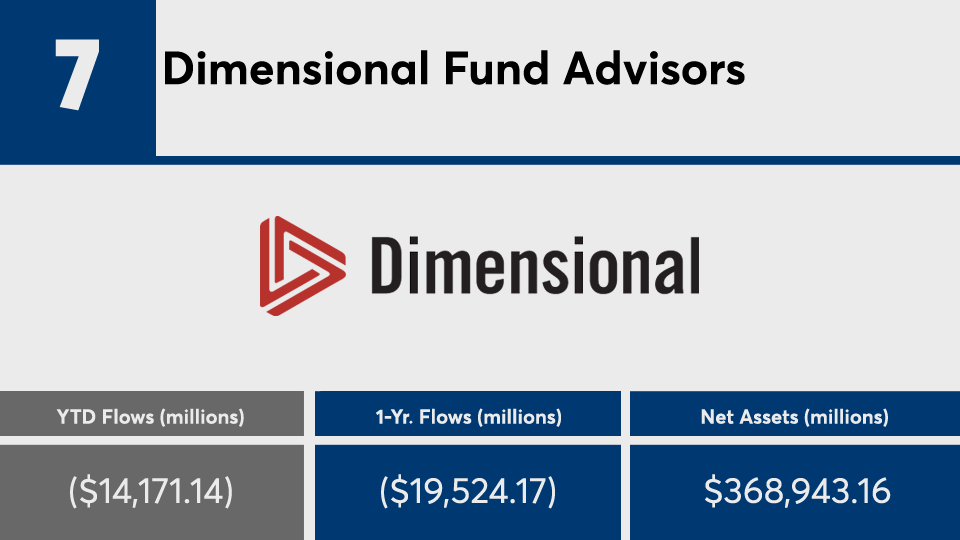

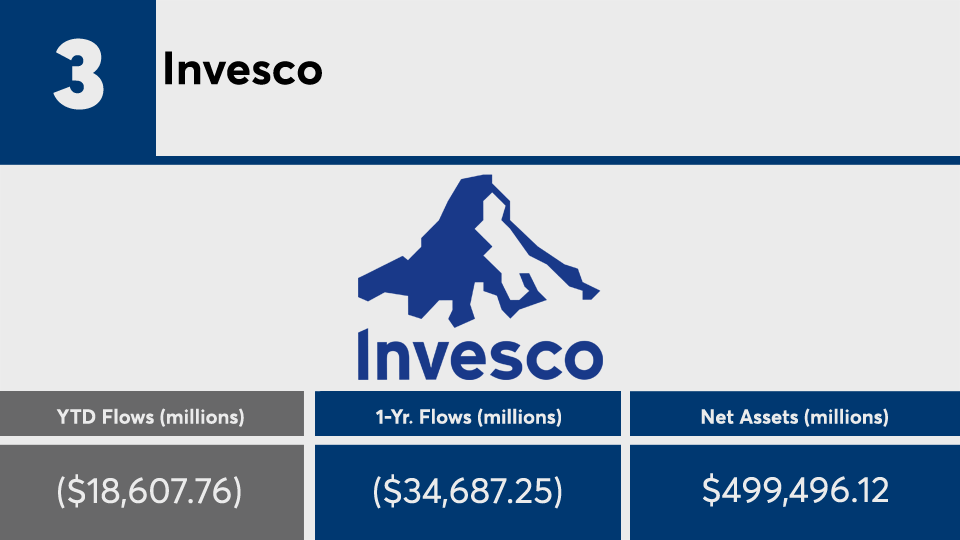

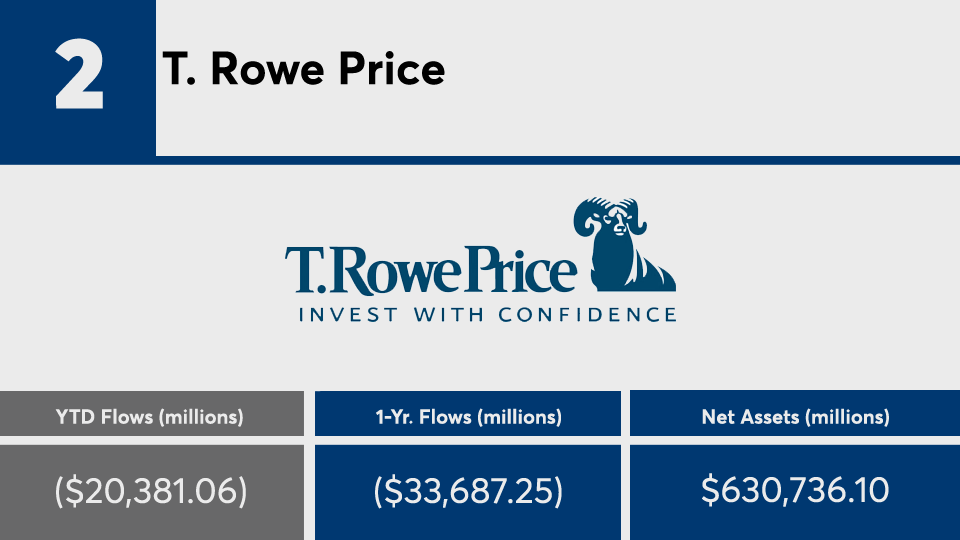

Scroll through to see the 20 largest fund families by U.S. assets ranked by their year-to-date outflows through June 1. Active and passive flows are listed for all. The data excludes assets from money market funds and fund-of-funds. All data is from Morningstar Direct.