Wealth management is racing to try to stay ahead of the fallout from the coronavirus pandemic.

COVID-19 has taken thousands of lives, stalled the economy and put an end to a decade-plus bull market. In the process, it’s upended the way wealth management operates. In response, the industry is rushing to support advisors, clients and the larger community they serve.

As businesses across the U.S. close their doors and business continuity plans kick into gear, advisors are offering

Support from across wealth management has included free services for financial advisors from a variety of vendors as they make difficult decisions about conference schedules and the fraught process of maintaining operations in the middle of a global health and economic crisis.

Advisors themselves are doing their best to give back. Being a financial advisor comes with duties beyond making money, notes Steve Tenney, CEO of Great Diamond Partners, a Portland, Maine-based RIA. “We are a leader in this community and we have responsibility to lead, especially in difficult times like these,” he says.

Tenney's RIA kicked off a $25,000

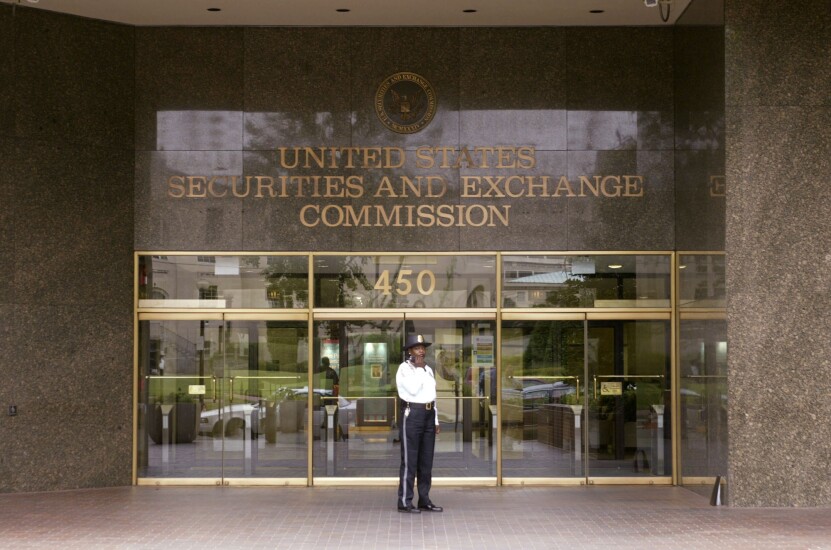

Scroll through to see how wealth management firms, organizations and regulators are responding to the coronavirus pandemic.