All but two of the industry’s largest fixed-income funds have experienced losses this year. With few places left providing shelter from unprecedented levels of volatility, analysis shows high-quality credit is best equipped to forestall losses.

The 20 largest bond funds hold more than $1.3 trillion in combined assets under management, Morningstar Direct data show. With an average year-to-date loss of 2.29%, the biggest have underperformed the Bloomberg Barclays US Aggregate Bond Index's return of 0.42%, as measured by the iShares Core US Aggregate Bond ETF (AGG). With five of the top seven carrying AA ratings, Megan Trask, managing advisor and investment committee director at Connecticut Wealth Management, says it’s no surprise which bond funds topped the list.

“It is important to be aware that when investing in bonds through funds there are added liquidity risks, even if the underlying holdings of the bond are high quality,” Trask says. “Bond fund managers can’t control when investors decide to sell for cash, so when we see this level of panicked selling, there is a liquidity premium to pay in the form of declining prices.”

To be sure, investment-grade funds lost a record $35.6 billion in the week ending March 18, blowing past the previous record of $7.27 billion, set one week earlier, according to Refintiv Lipper data.

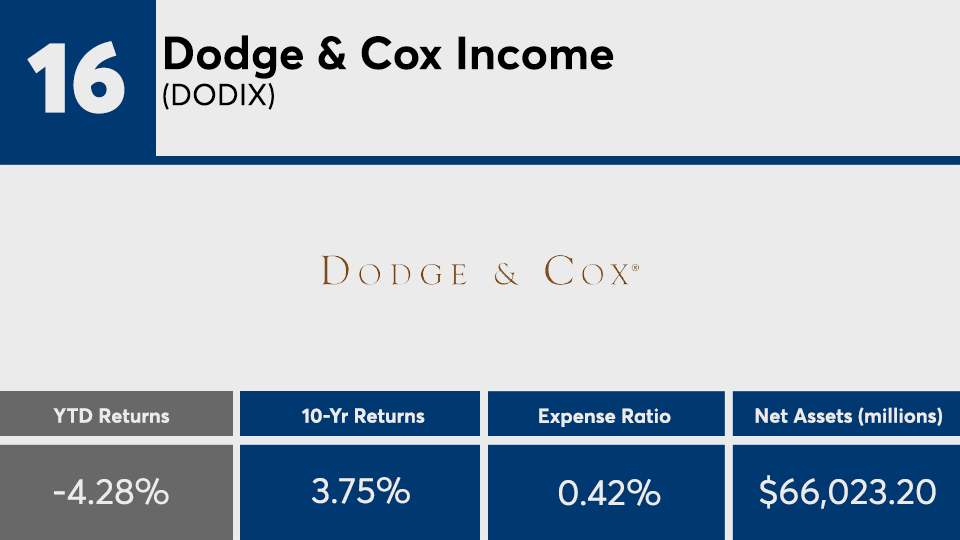

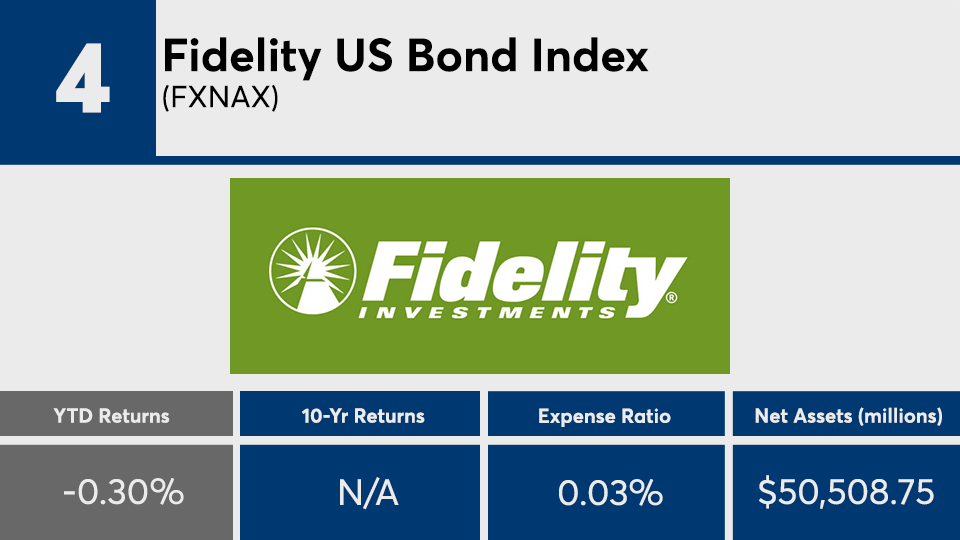

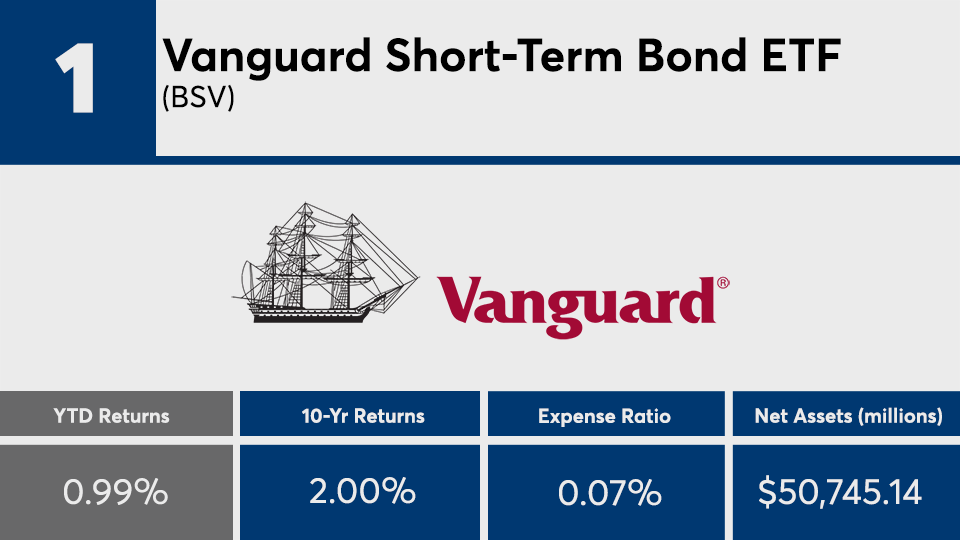

Fees at the top are low. At an average of 20 basis points, the industry’s largest funds carry fees over half the 0.48% investors paid on average, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The industry’s largest bond fund, the $269 billion Vanguard Total Bond Market Index Admiral Shares (VBTLX), which has a 0.05% expense ratio, posted a year-to-date gain loss of 0.28% and 10-year gain of 3.44%, data show. On the equities side, the largest overall fund, the $840.9 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), which as a 0.14% expense ratio, posted a YTD loss of 26.62% and 10-year gain of 9.42%, data show.

“The potential bright side of this indiscriminate selling, however, is that there may be some real opportunities for managers to find inexpensive credits with total return potential,” Trask says.

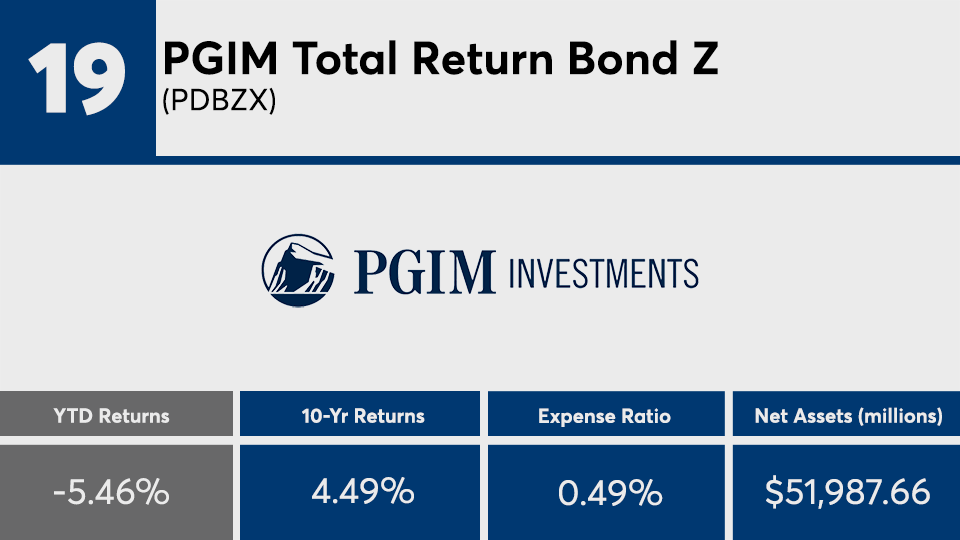

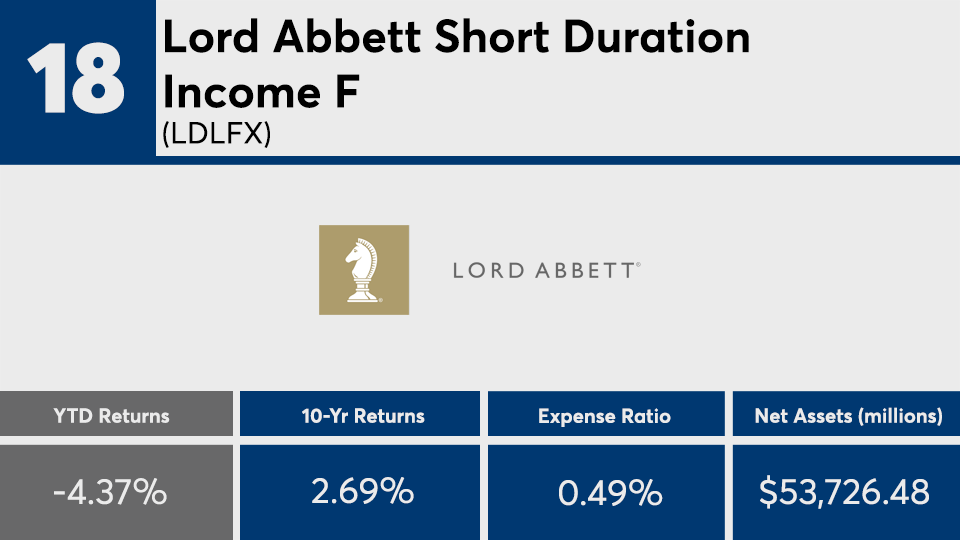

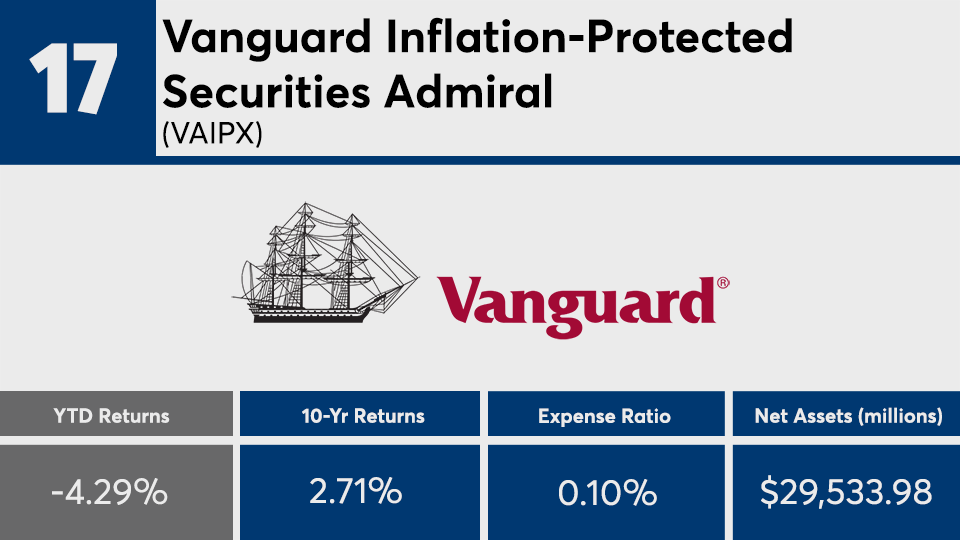

Scroll through to see the 20 largest fixed-income funds ranked by their year-to-date returns through March 18. Funds with less than $500 million in assets under management and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios are listed for each, as well as one-, three-, five- and 10-year returns. The data show each fund's primary share class. All data from Morningstar Direct.