An analysis of the shifting annual business of independent brokerages displays one of the key changes in wealth management

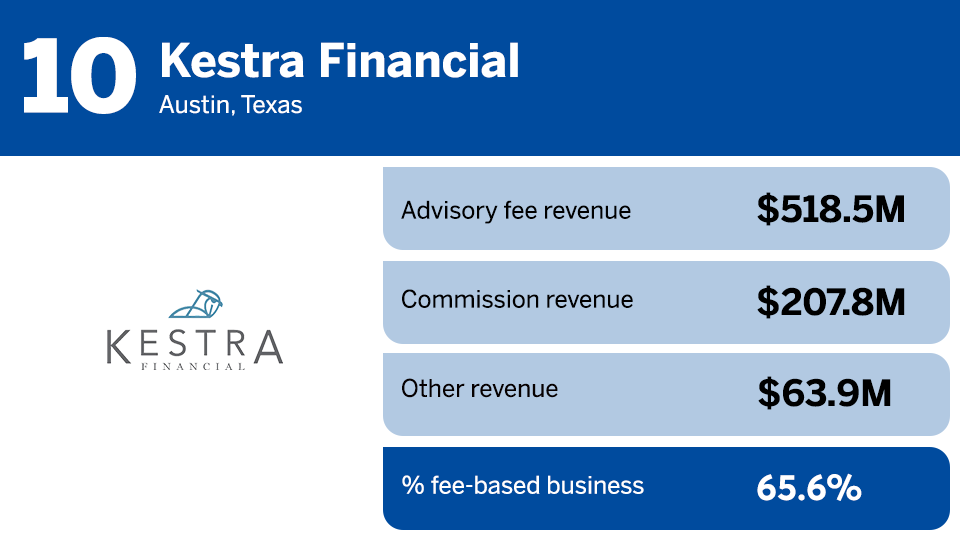

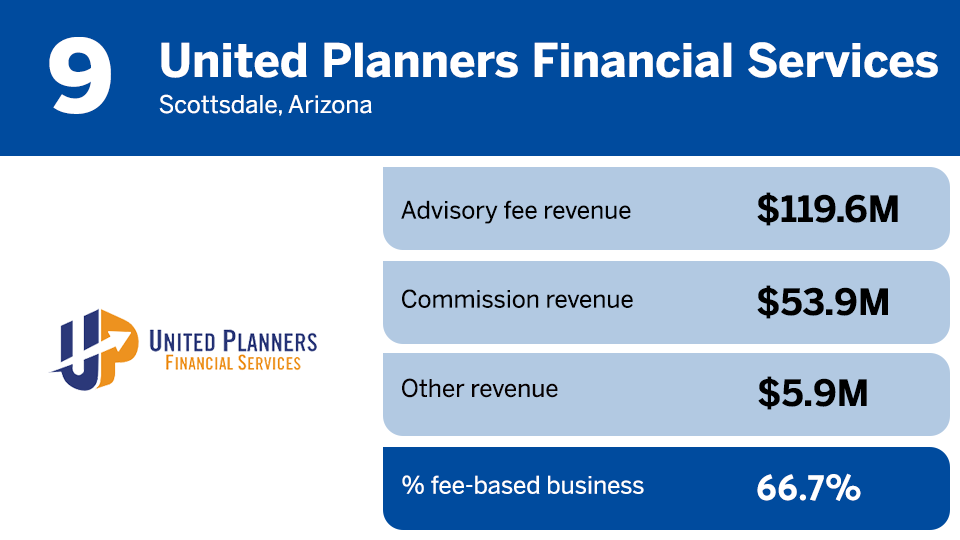

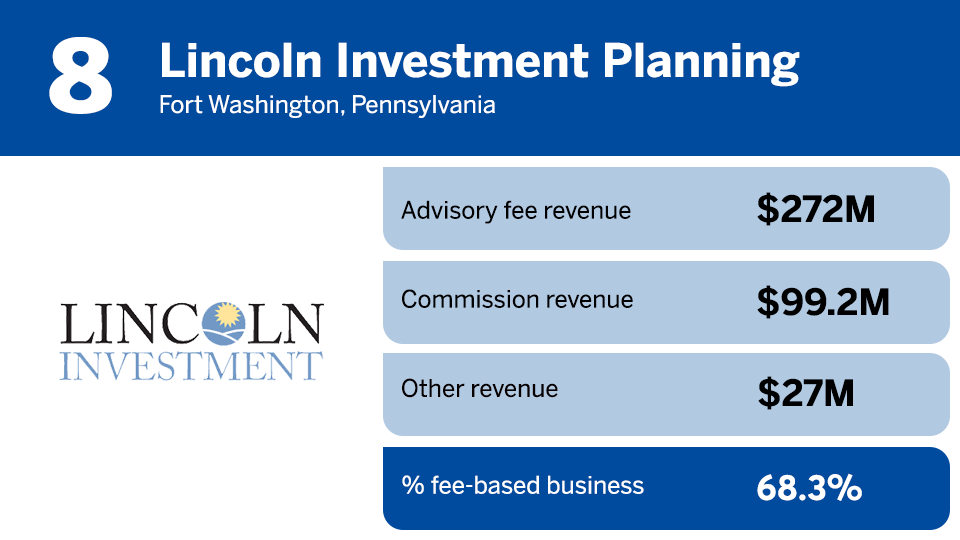

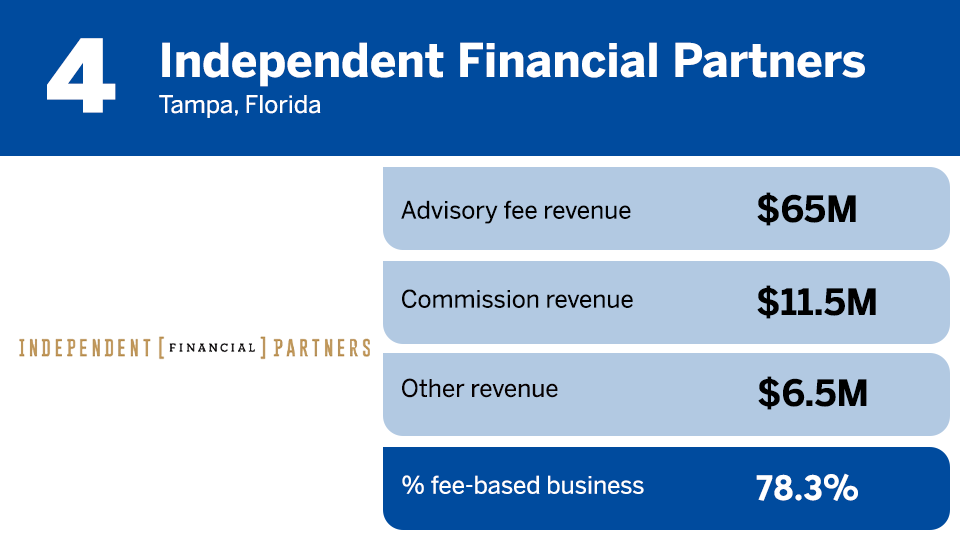

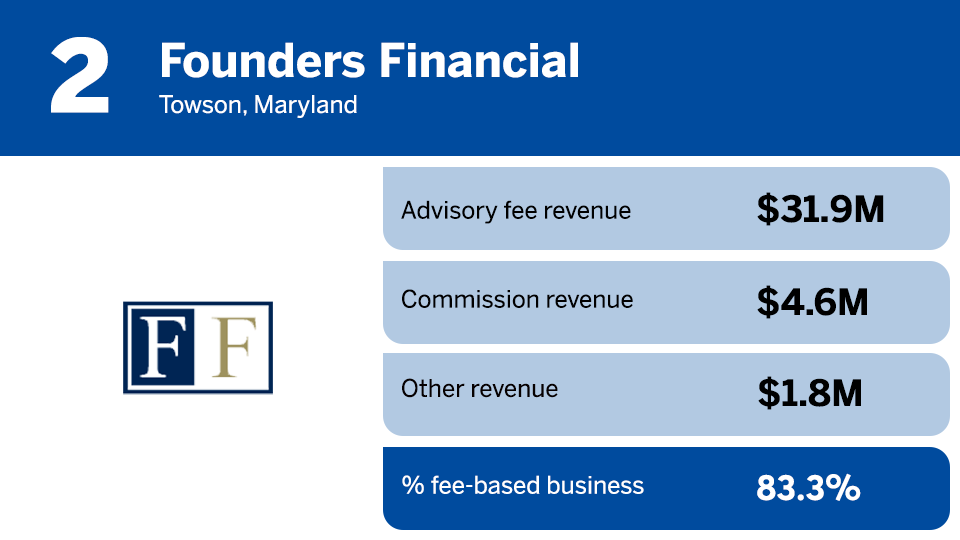

The below list provides the ranking of the 10 firms in the channel that generate the highest portion of their revenue from advisory fees rather than commissions or other business lines, according to companies' self-reported data from

In 2007, the biggest firms in the channel derived 68% of their revenue from commissions and 23% from advisory fees, according to data from the survey. Last year, the group attributed only 28% of their revenue to commissions and 48% from advisory fees.

"Firms are recognizing the value of being fee-based — with that comes the ability to encourage advisors to be fee-based and to give them the tools and resources," said Stephen Caruso, a senior analyst in the wealth management practice of research and consulting firm

The ranks of

To make a commissionable sale in a brokerage account, the firms must make recommendations in a client's best interest. However, in an advisory account, they're subject to the tougher scrutiny of a fiduciary duty requiring them to place a client's interest first. So these 10 firms are leading their peers in driving the ongoing move to fee-based advisory business. In that sense, they're blurring the traditional dividing line between RIAs and brokerages, Caruso noted.

"The shift has been strong," he said. "The industry is shifting toward that fee-based, fiduciary model. For a long time, the fiduciary duty was a key differentiator. It's getting to the point where that differentiator is no longer as strong as it once was."

Scroll down the slideshow to see which independent brokerages earn the largest share of revenue from advisory fees.

And see other IBD Elite coverage:

The 15 largest independent brokerages in wealth management The 10 firms with the largest percentage of women among their financial advisors Cover story: What the heck is an OSJ? Deep dive into independent wealth manager data

Notes: The companies are ranked below by their percentage of 2022 revenue attributable to advisory fees, as reported by the companies themselves. FP relies on each firm to state its metrics accurately. The figures for advisory fees, commissions and any other types of revenue are rounded and may not add up exactly to the overall annual business of each firm.