The past 12 months have been a boon for municipal bond funds with the best returns over three years.

With a combined $74 billion in assets under management, muni products with the biggest three-year gains and at least $100 million in AUM had an average return of 5.55%, according to Morningstar Direct. That's roughly 2% more than the Bloomberg Barclays U.S. Aggregate's 3.24% return — as measured by the SPDR Portfolio Aggregate Bond ETF (SPAB) — over the same period. In the past 12 months, those same products more than doubled their gains to an average of 11.02%.

“The combination of low rates, curbs on state and local tax deductions, and consistent economic expansion have been a nice tailwind for the performance of municipal bonds, particularly those of weaker credit quality that pay higher yields,” Greg McBride, senior financial analyst at Bankrate, said of their performance this past year.

Beth Foos, senior analyst at Morningstar, agreed that investors have started to find gains in the high-yield space. “You’ve seen muted new issuance in the market … and you’ve also seen some key credit issues, particularly in Puerto Rico, start to resolve,” Foos said, adding that investors “are still looking for yield in this historically low-yield environment and turned to the high-yield muni space because of that.”

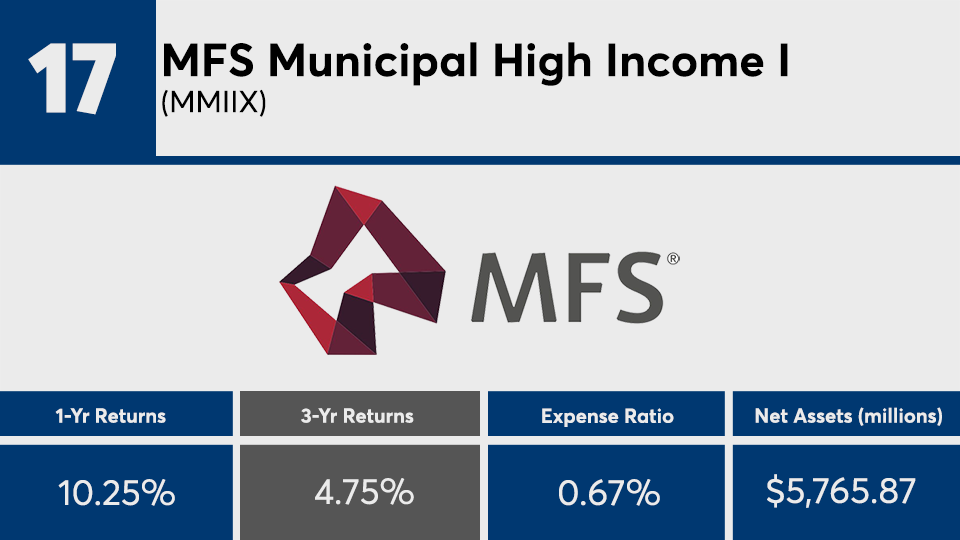

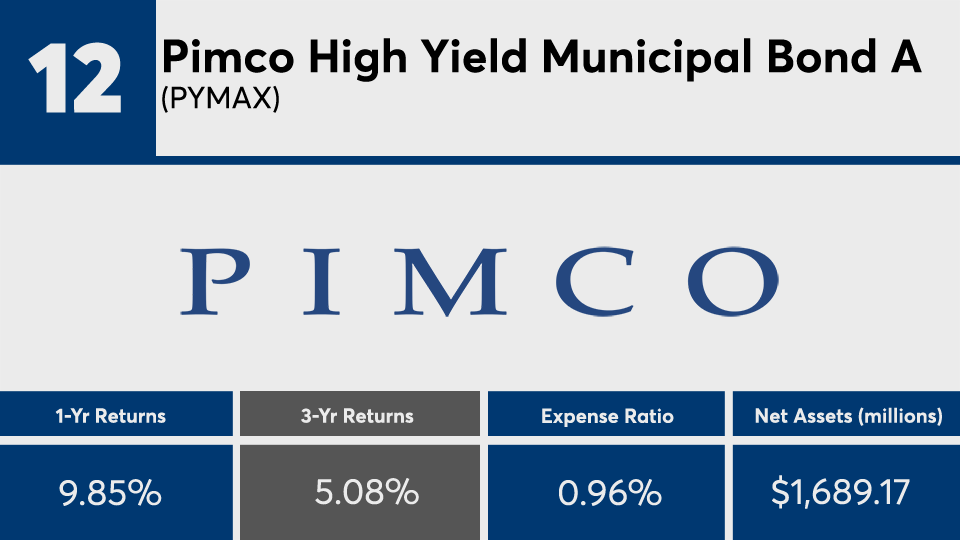

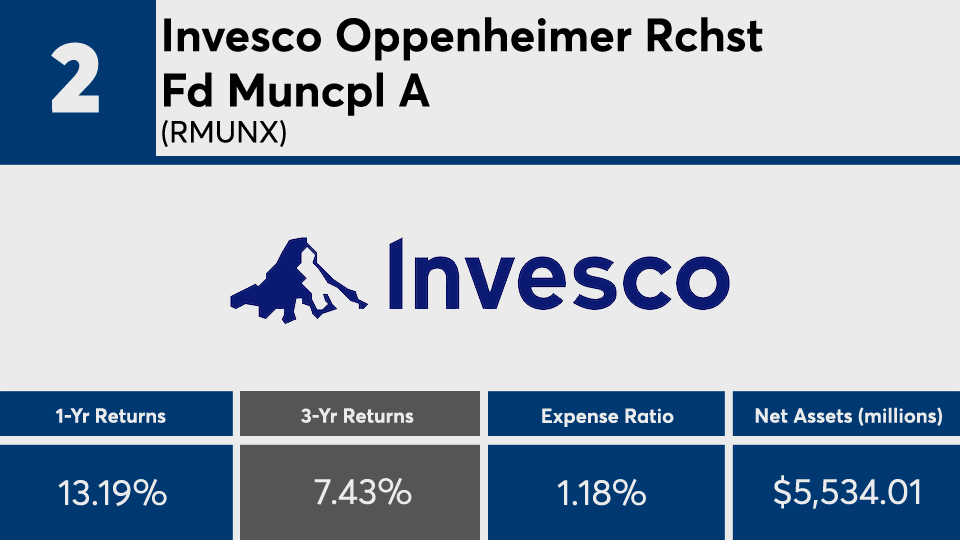

Muni funds with the biggest gains carried higher fees than the average fund. With an average net expense ratio of 0.81%, they are roughly twice the 0.48% investors paid on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. For comparison, the industry’s largest muni fund, the $70.6 billion Vanguard Intermediate-Term Tax-Exempt Fund Admiral Shares (VWIUX), has an expense ratio of 0.09%, a three-year gain of 3.09% and 1-year gain of 8.98%, data show. The industry’s largest fund, the Vanguard Total Stock Market Fund (VTSAX), has $827.1 billion in AUM, a 0.04% expense ratio and 12.01% gain over the same period.

Like anything in the fund universe, Foos says advisors are always responsible for looking below the surface. “When folks are focused on the muni space, they should know the teams and the resources behind those funds, and of course the prices that they’re paying,” Foos said.

Scroll through to see the 20 top-performing muni funds (with at least $100 million in assets under management) ranked by 10-year annualized returns through Oct. 4. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as one-year daily returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.