The top-performing index funds of the year nearly doubled the gains of the broader markets.

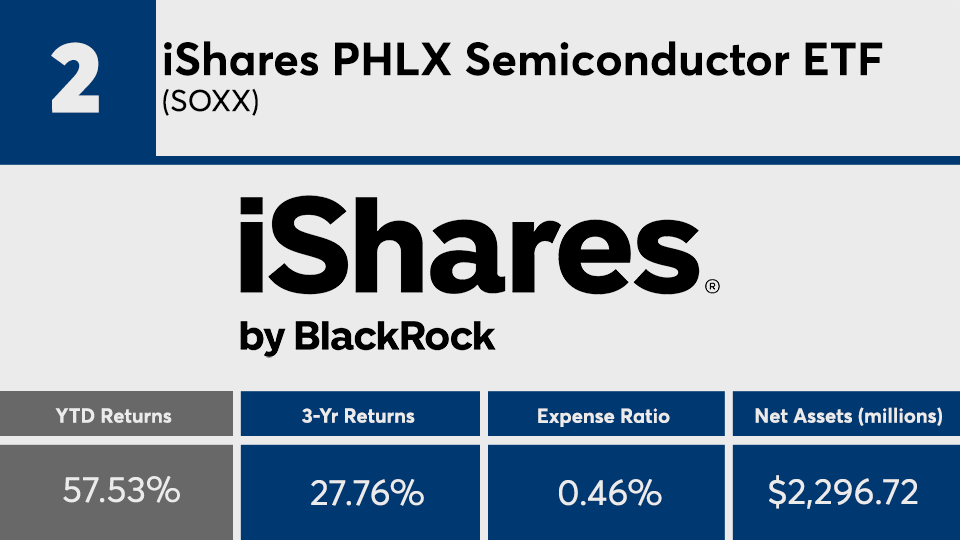

Home to a combined $86.45 billion in combined assets under management, the 20 index funds with the largest year-to-date returns benefited from their category weightings, Morningstar Direct data show. As technology funds outperformed the broader industry with a 35.11% combined category gain, it’s no surprise funds tracking the sector dominate the top-performers list — 12 of the top 20 funds were from the tech category; followed by industrials and consumer funds, which posted gains of 29.33% and 24.15%, respectively.

“While passive investing isn't perfect, it is not a bad idea to let the market work for you,” Morningstar’s director of passive strategies for North America, Alex Bryan, wrote in a recent report. “The competition for market-beating performance is a zero-sum game, where the benefits largely accrue to the firms charging the fees. If you don't work on Wall Street, the rise of passive investing isn't something to fear.”

With an average gain of more than 40%, market-beating performance is just what these funds delivered. For comparison with the broader markets, the Dow posted a 23.89% gain, as measured by the SPDR Dow Jones Industrial Average ETF (DIA), and the S&P 500 had a 29.65% gain, as measured by the SPDR S&P 500 ETF (SPY), over the same period. The Barclays Capital U.S. Aggregate Bond Index, as measured by the iShares Core US Aggregate Bond ETF (AGG), reported a YTD gain of 8.48%.

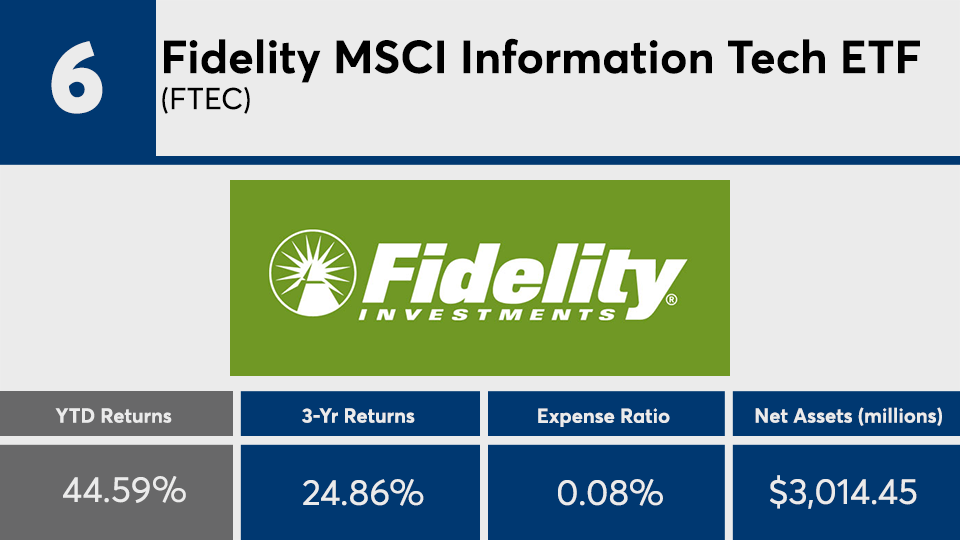

Fees, as expected, are lower than the rest of the industry. With an average net expense ratio of 0.43%, they were 5 basis points cheaper than the 48 basis points investors were charged, on average, for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The industry’s largest fund, the $874.5 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) — ranked among the top 20 funds by YTD inflows with more than $10 billion of net inflows — had a 0.14% expense ratio and a 26.84% YTD return, data show.

“Low-cost products make a ton of sense in retirement simply because holding more cash and bonds will tend to lower a portfolio's return potential; keeping expenses low helps ensure that a higher share of the returns flows through to the investor,” Morningstar’s director of personal finance, Christine Benz, wrote in a report on index funds earlier this year.

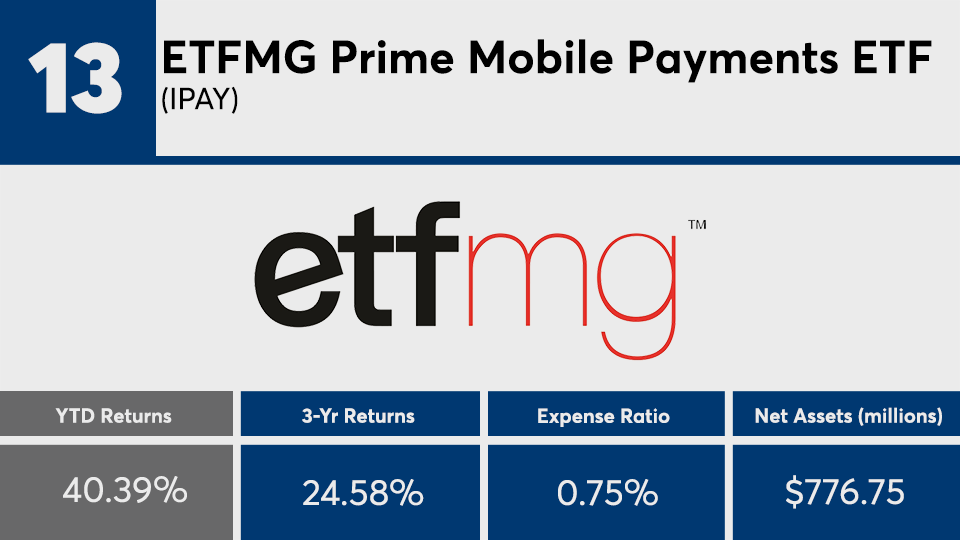

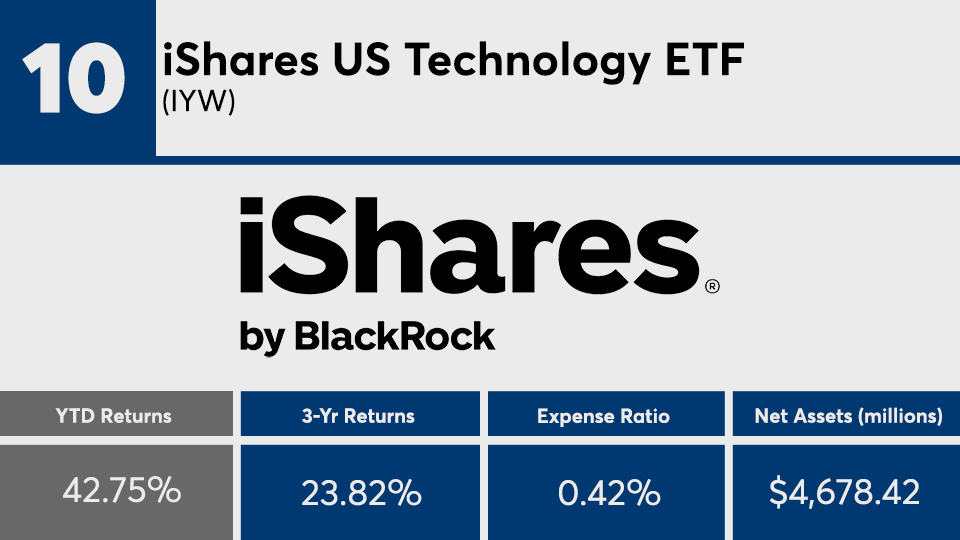

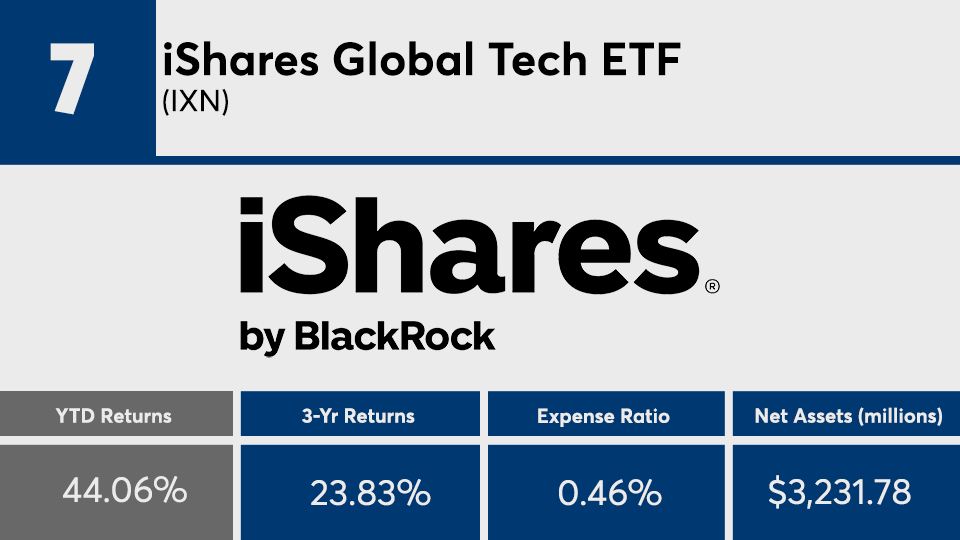

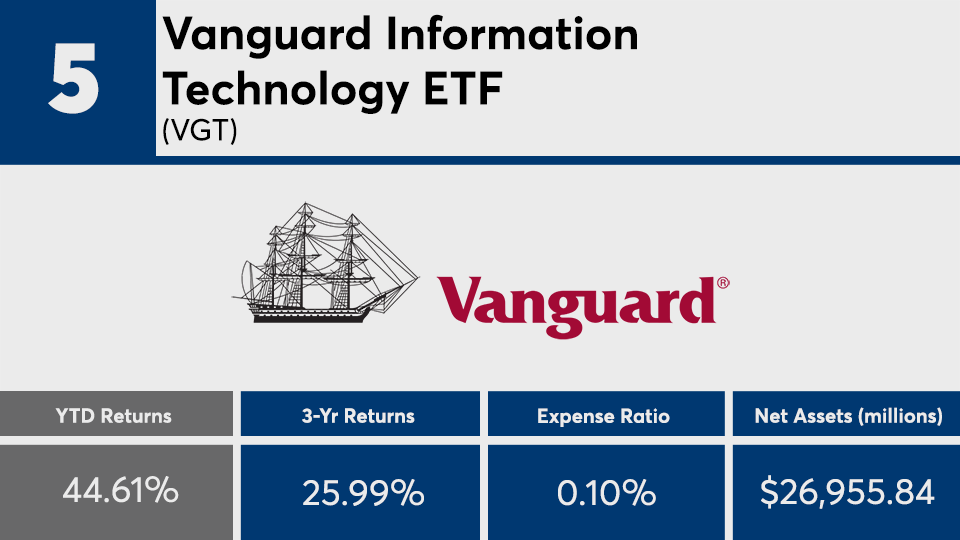

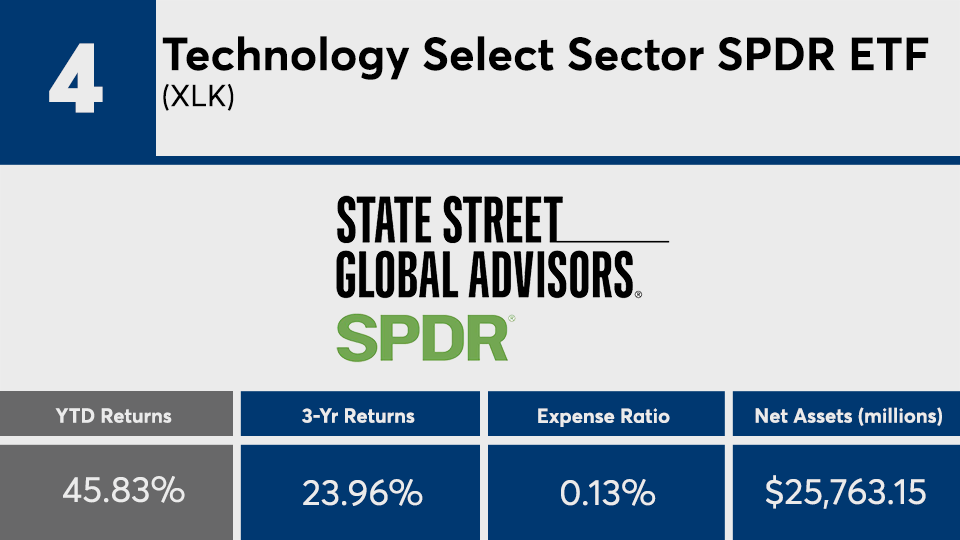

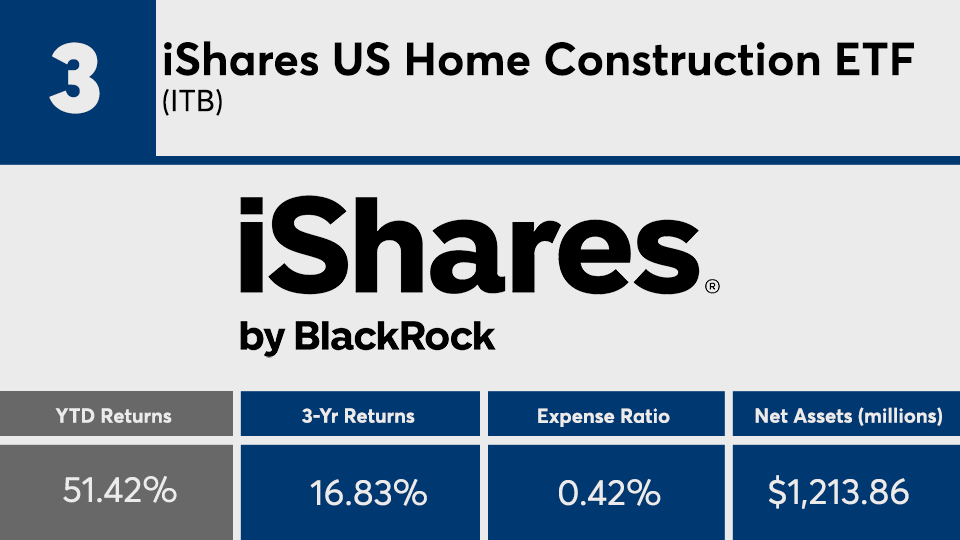

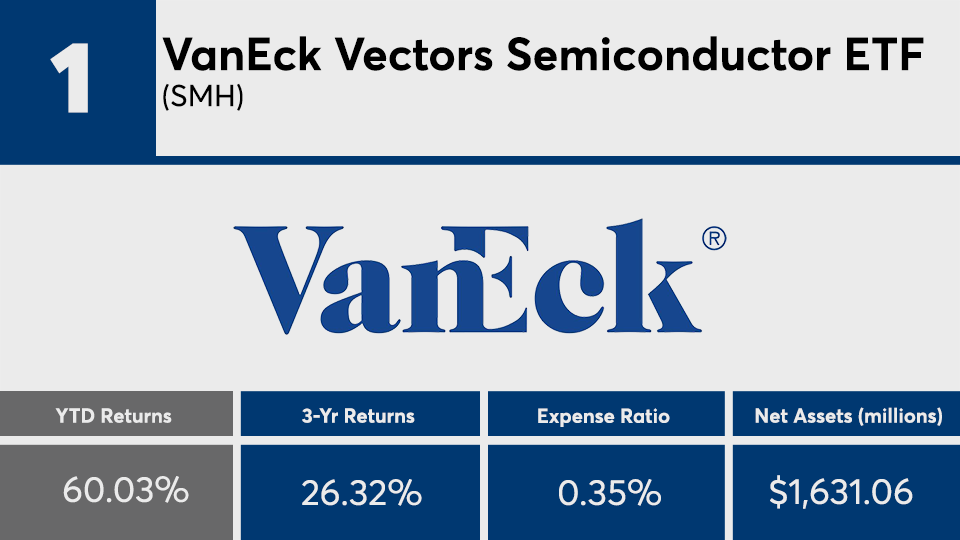

Scroll through to see the 20 mutual funds and ETFs with the largest gains as of Dec. 13. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as three-year net flows and year-to-date returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.