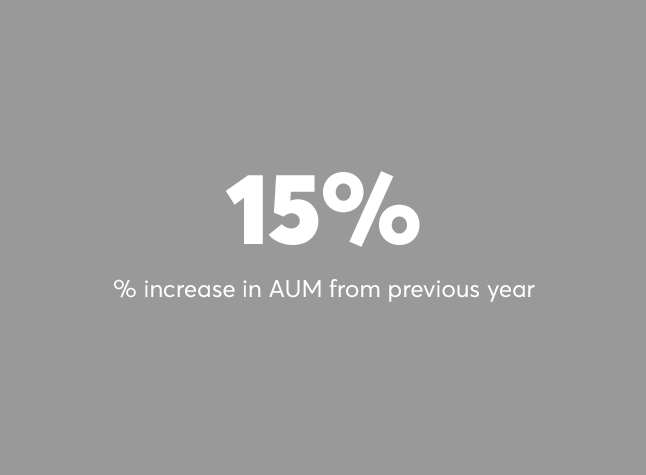

Next week, we'll unveil our annual top bank advisers ranking. In the meantime, we’ve illustrated a hypothetical average adviser on our list. Our list uses several different variables (not just AUM or 12-month production) so while we feel it is a well-rounded consideration of an adviser's business, it's purely a quantitative measure and does not reflect the strength of client relationships. But on those quantitative metrics, here you can see how you measure up to the best in the bank channel. -- Lee Conrad