ORLANDO — Getting more women interested in financial planning careers is a recurring topic at industry conferences and an ever-expanding initiative across investment firms, brokerages and custodians.

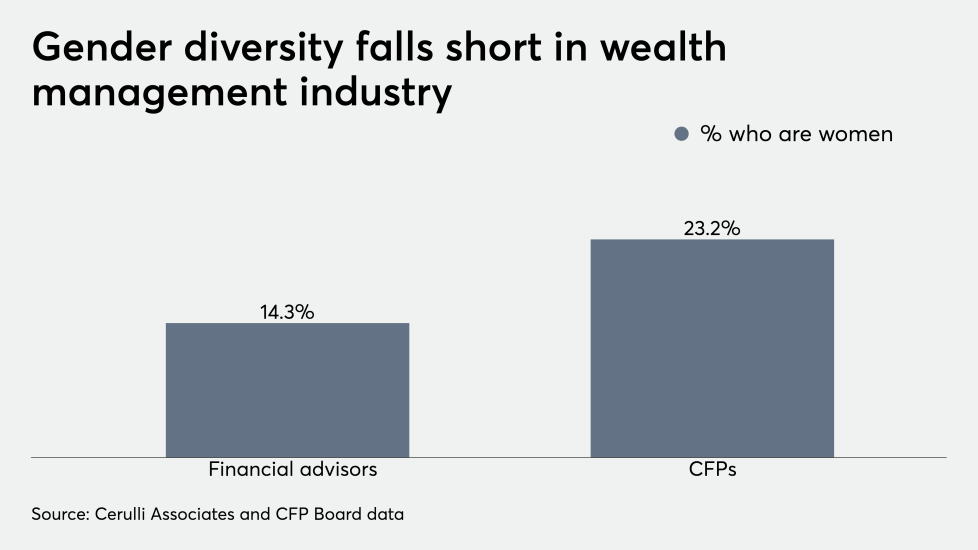

The numbers aren’t great. There are 44,513 financial advisors who are women — only a little over 14% of the profession, according to the latest Cerulli Associates data from year-end of 2017. What will give?

Awareness is a key hurdle, according to advisors, executives and operations officers who spoke with Financial Planning at Raymond James’ annual Women’s Symposium. Young women don't realize that financial planning is a profession, and there are misconceptions about what working on Wall Street entails, they say.

“When you say that someone's going to be a doctor or they're going to be a nurse, in your mind, you know exactly what that means, because every single person goes to a doctor. Every single person goes to a nurse,” says Jodi Perry, who leads the IBD division at Raymond James. “But when you start thinking about the financial industry, it means something different to every person.”

Educating young women about the financial services industry is happening too late, according to Lori Keith, portfolio manager of the Parnassus Mid Cap Fund. Even reaching out during college isn’t enough as many students have already picked their majors, she said on a panel at the conference.

“I think we've got to go earlier,” she said. “Maybe it's volunteering in a middle school — getting them early with the idea that they can do this job.”

While women in the industry are already investing time and resources into driving up interest in the field, young women still need to put in the legwork to become financial advisors and relate to clients.

“This is a hard industry to get into,” says Julia Reichard, an advisor at Dean & Masloff Financial Group, an RIA affiliated with Raymond James.

However, it does pay off, as it has for advisor Kayla Walter, who started working as a client service associate at SPC Financial in 2016 and is now a CFP and member of the firm’s financial planning team.

The advice she’s been given throughout: Stick with it, and it will be a great career path.

While women may be a minority in the field, they reiterate they’re here to help one another.

Here’s some of the advice women have for young women looking to get into the industry: