Mobile technology will drastically alter wealth management, advisors told us in the latest

But that's the future. What about right now?

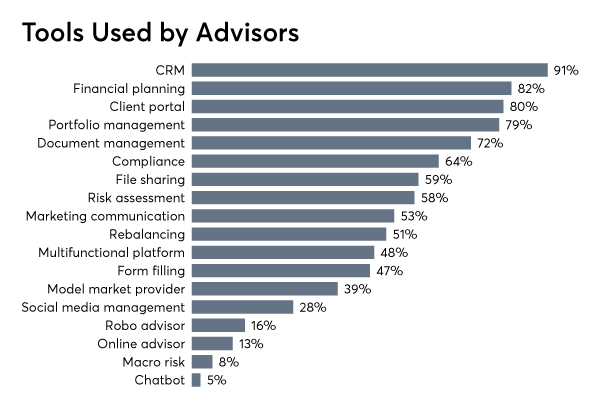

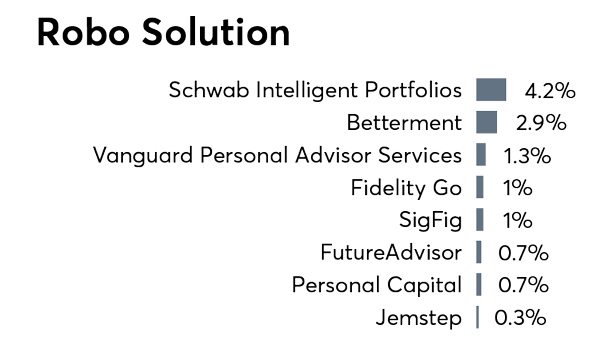

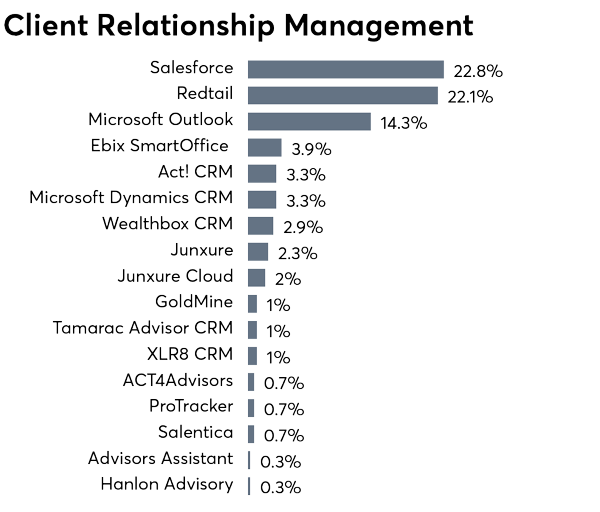

From financial planning software to CRM tools, financial planners opened up to share what they like, and don't.

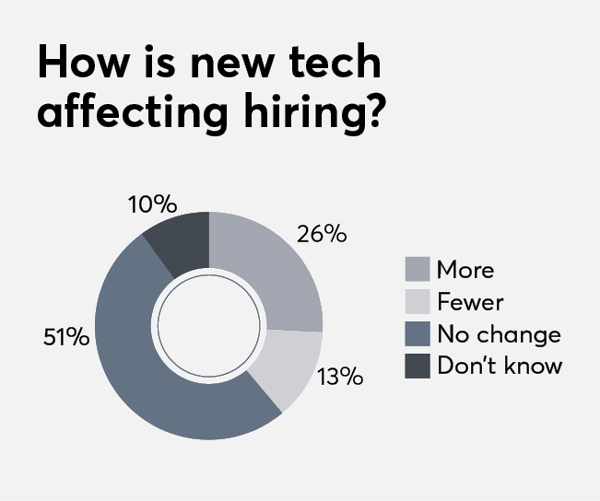

In addition, there are changes in the landscape of who provides these tools — large firms are absorbing fintech startups. But advisors still have more options than ever when it comes to deciding which software they want to use.

Scroll through to see what tools your colleagues across the industry are using now.

Of the 307 respondents to the survey, most of the advisors were between the ages of 45 and 54 (33%). About 23% of them were between the ages of 55 and 64, and 20% of them were between 35 and 44 years old. Only 1% of respondents were younger than 25.