Rising interest rates have dealt a tough blow so far this year to the returns of real estate funds — even among those with the highest yields over the past decade.

The recent rate hikes in response to rising inflation and other macroeconomic pressures have opened an

[See below for a listing of the top real estate funds]

“A lot of folks do not consider the home they live in as part of their ‘portfolio’, their net worth,” financial advisor Kashif Ahmed of Bedford, Massachusetts-based American Private Wealth said in an email. “So when they approach me to ask if we can add real estate exposure to their accounts, I remind them that RE is already the biggest portion of their NW.”

Ahmed avoids non-traded REITs but considers mutual funds and ETFs when real estate-tied funds could be a solution for clients, he continued.

“This gets them exposure without them having to become actual landlords — and not to mention diversified exposure versus simply buying one investment property, which is what they think is the only option,” he said. “This diversification and liquidity aspect and indirect exposure via mutual funds and ETFs resonates very well with investors.”

Still, Ahmed and Carson Group Chief Strategy Officer Burt White expressed no surprise that the top-earning funds each have negative returns for the year to date.

“Rising cost of capital as well as concerns of the Fed’s monetary policy brake slowing down the economy has created a stiff headwind for interest rate-sensitive sectors, like real estate. In addition, the sector’s strong performance over the past year was just ripe for some profit taking given the shift in the macro backdrop,” White said in an email.

“But despite the tough start to 2022,” he added, “real estate funds do offer some attractive portfolio benefits for investor portfolios, including low correlation to traditional equity sectors and, in many cases, an attractive income stream for investors wanting to diversify away from the impact of raising rates on their bond allocations.”

Other factors besides the higher interest rates are also playing a role in the negative returns in 2022 as well, according to Gene Balas, an investment strategist in the research department of Signature Estate & Investment Advisors.

“In the current economic environment where we have an economy growing faster than its potential — indicated by rising inflation — the Fed is moving aggressively to push rates up,” Balas said. “Looking ahead, even though the economy is growing robustly now, some investors may have concerns that the Fed can hike rates too far, too fast, leading to a weaker economy at some point in the future. That, in turn, can dampen demand for occupancy in buildings, and slower economic growth and lower inflation (courtesy of the Fed’s monetary policy tightening) may have the potential to limit future rent increases or demand for occupancy.”

Regardless, the higher rates represent the “primary issue right now” affecting real estate fund returns, Balas said.

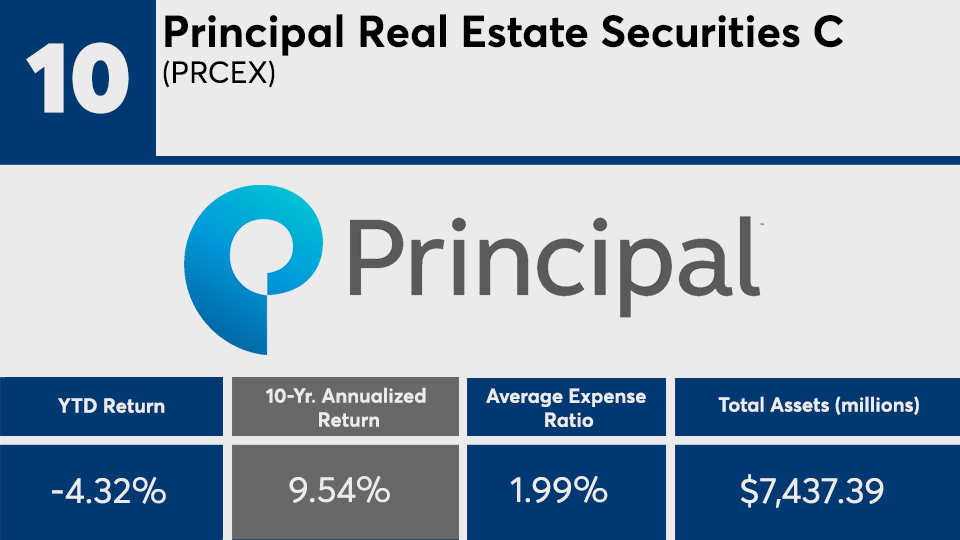

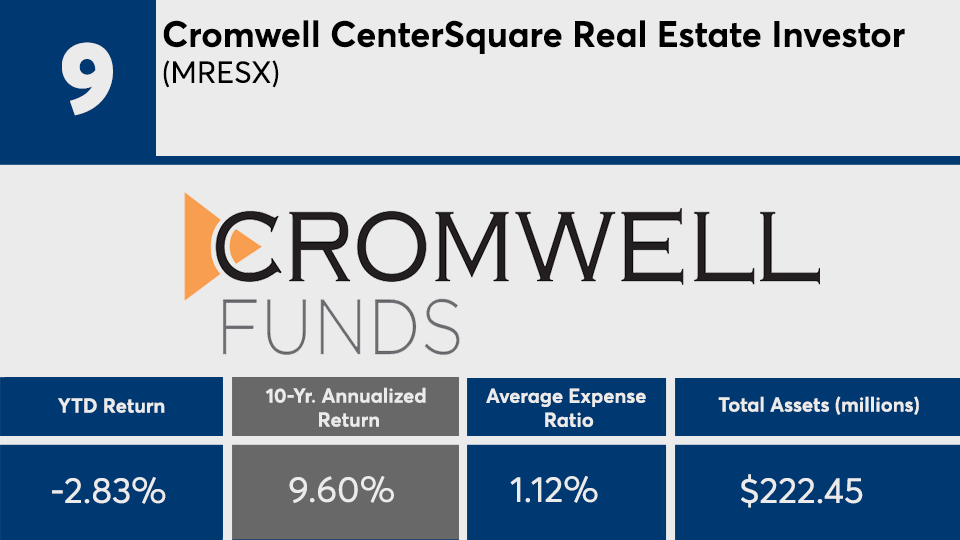

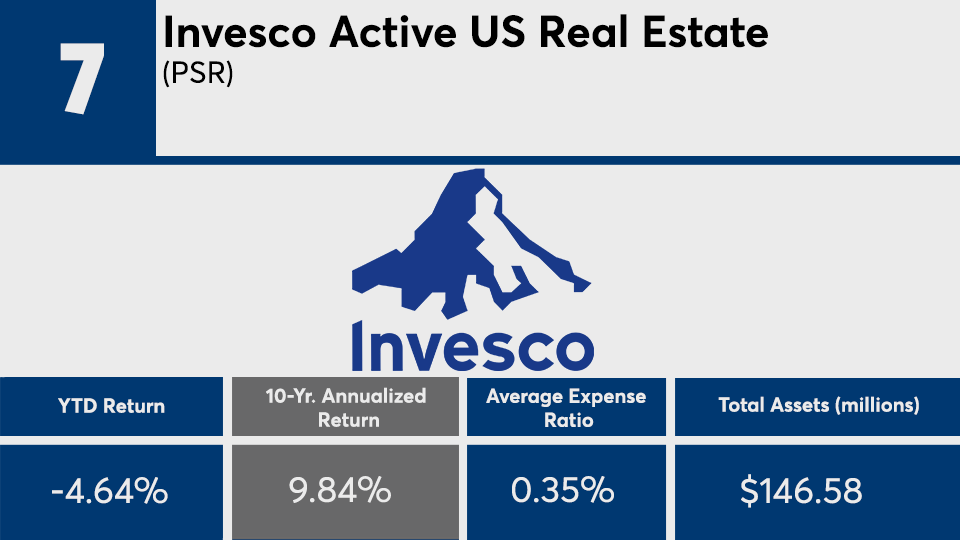

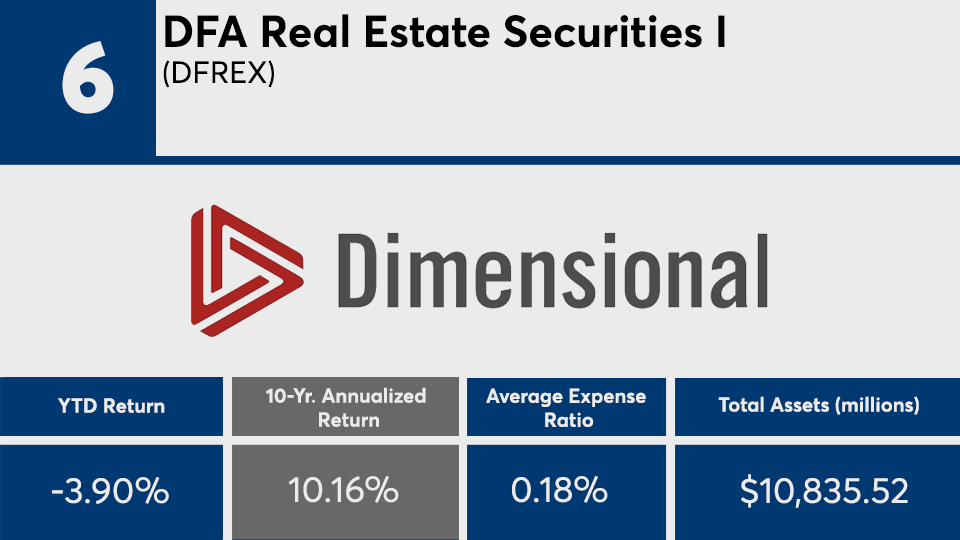

To see which 10 real estate funds had the largest gains over the past decade, scroll down our slideshow. For a look at the top-performing balanced funds of the past 10 years,

Note: All data is current through Monday, April 25, and all of the figures come from Morningstar Direct in the “real estate” category of mutual funds and ETFs. Funds with less than $100 million in assets under management and investment minimums over $100,000, as well as leveraged products and institutional share classes, have been excluded.