-

Financial advisors say they are increasing client portfolio allocations to international stocks in the latest Financial Planning survey.

February 10 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

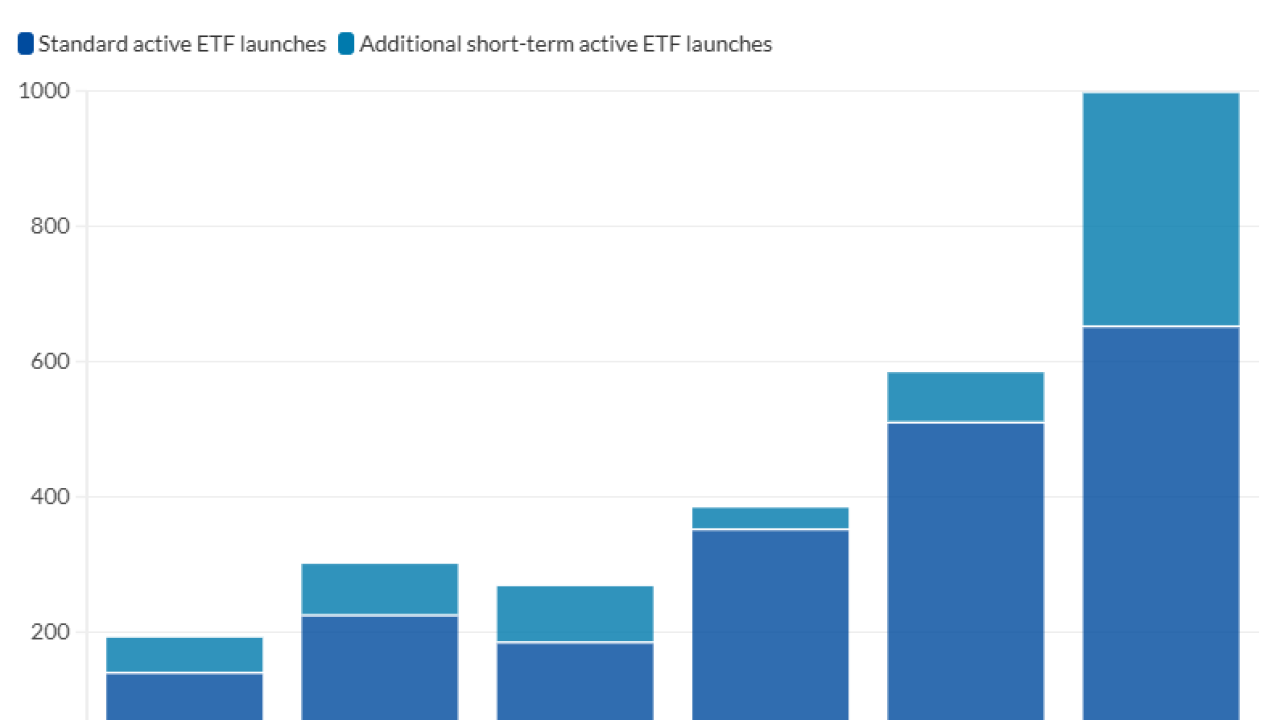

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Falling client risk tolerance and domestic turmoil may mean that these international equity funds could be more attractive to investors looking for diversification.

November 20 -

Glide paths may not deliver the highest returns, but experts say they account for behavioral limits that other strategies overlook.

November 19 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

Two studies from Morningstar dive into the subtleties across the various categories of funds and the sources of the gap between actual and total investment returns.

September 18 -

A vast majority of plan sponsors say that actively managed funds can beat the market, according to a new BlackRock survey. Research suggests otherwise.

September 12 -

Older Americans hold a higher allocation of stocks than they would like, according to the Center for Retirement Research. Researchers say that could be a positive, though not all advisors agree.

September 12 -

Private assets promise potentially greater returns and more diversification for investors, but financial advisors say their opaque and illiquid nature makes them less than ideal for most 401(k) plan participants.

August 8 -

Panelists at the Morningstar conference acknowledged the difficulties, even as they pointed out the ongoing opportunities from active management.

July 11 -

Impact investment through municipal bonds is generally perceived as risky. But it doesn't have to be that way.

June 30 -

A new TIAA Institute survey found that a vast majority of 401(k) plan participants are interested in accessing fixed annuities through their retirement accounts. Plan providers are listening.

June 23 -

The industry is awaiting SEC approval for dozens of applications, even as Vanguard's shareholder case highlights some of the tax complexity of the looming shift.

June 23 -

Net of expenses, many financial advisors and investors could find similar yields and exposure for their portfolios elsewhere, according to a Morningstar study.

June 12 -

With the industry awaiting the regulator's looming actions, the index fund giant is seeking to apply its dual share class structure to actively managed strategies.

June 12 -

A unique mutual fund type is gaining ground with advisors, according to the FPA's newest survey. Advisors say the data points to a broader trend of planners shifting away from investment management.

June 6