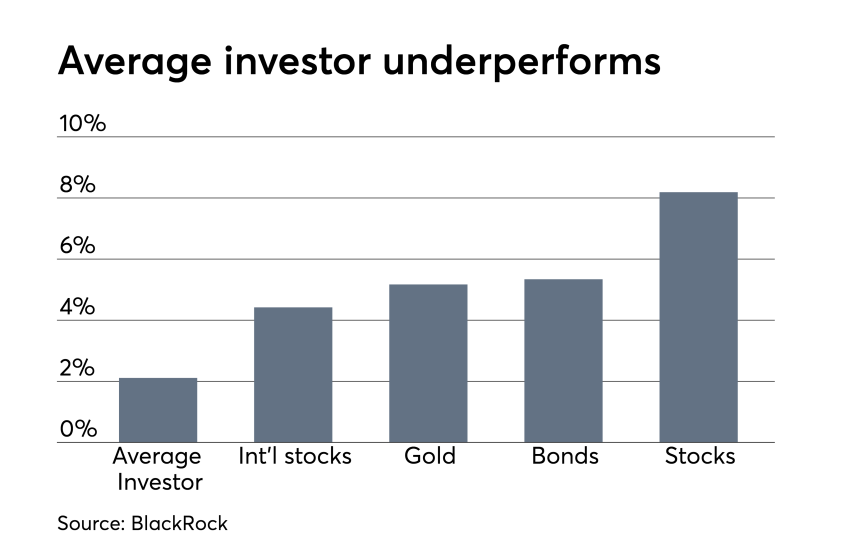

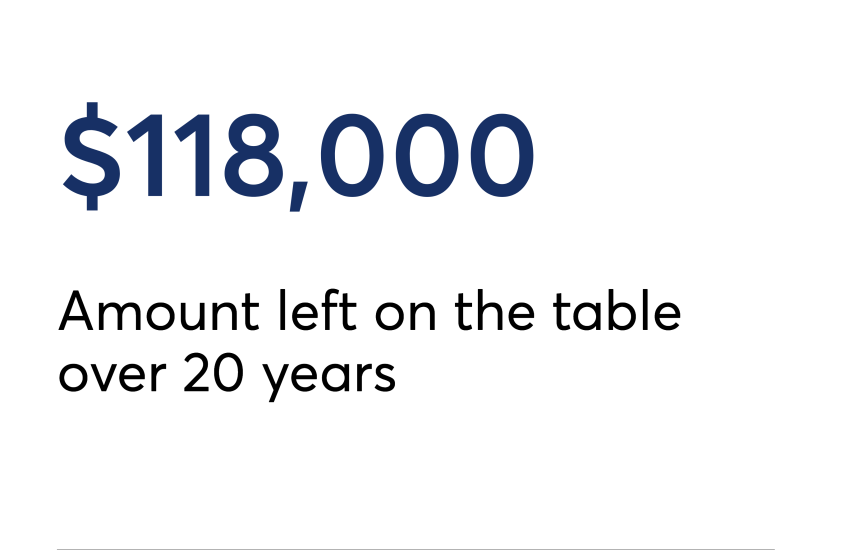

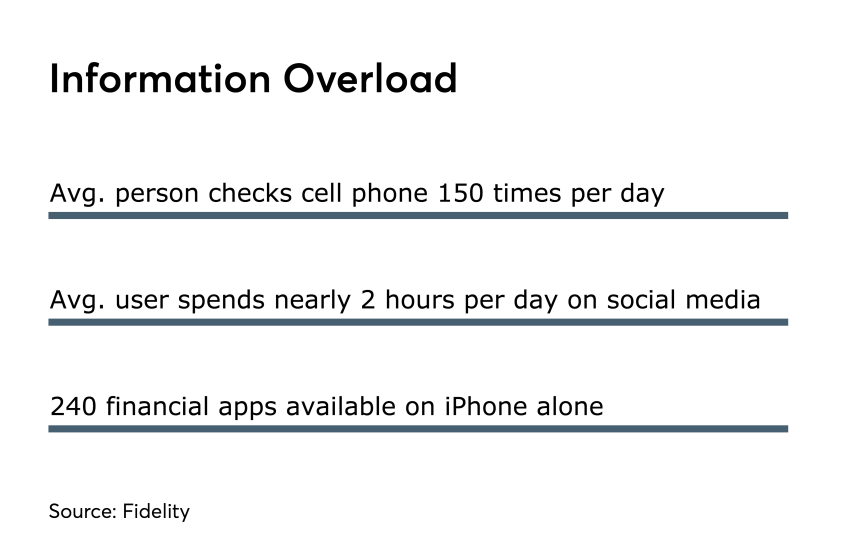

There are multiple reasons clients may see their portfolios lag the returns they see in the financial press. As we noted in our related Q&A article, sometimes it comes down to diversification (they also have holdings in asset classes with lower returns that they seem to forget when they see the dazzling numbers in the stock market). And sometimes it's because they sell their investments at the wrong time.

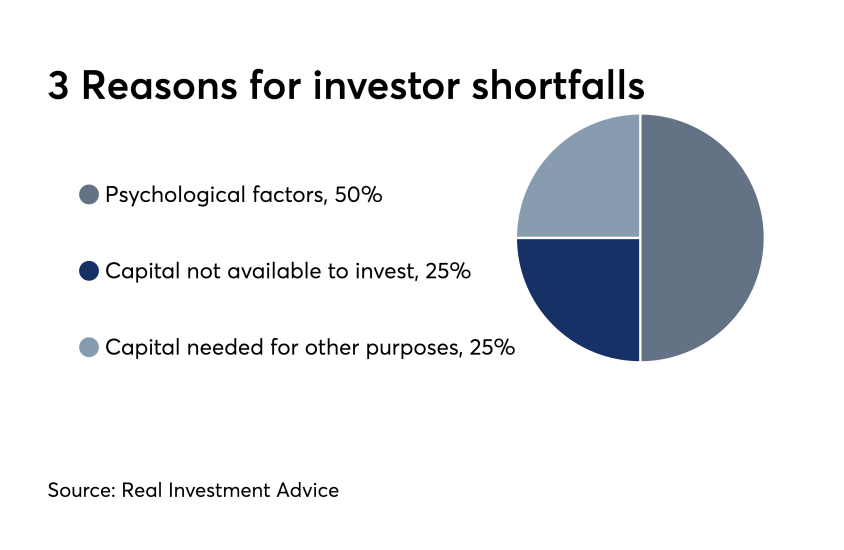

We've collected industry research showing various attempts to quantify the shortfall of what the typical investor makes compared to the markets, as well as some of the reasons why.

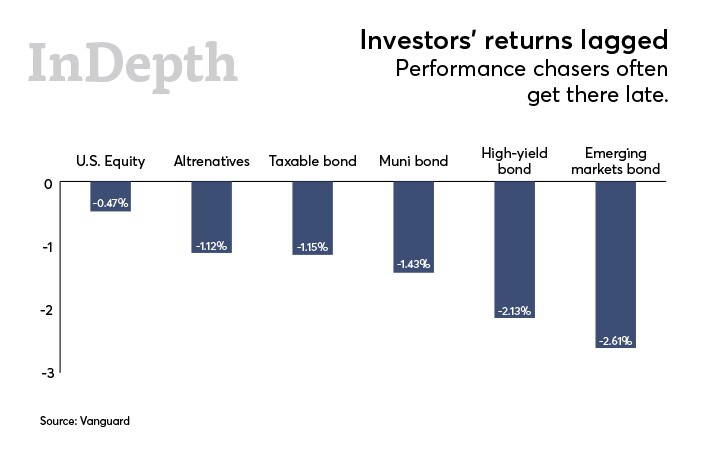

This cover slide shows how investors’ returns lagged their funds’ returns from 2002–2016, according to Vanguard's research.