-

UBS brokers rack up expungements of Puerto Rico complaints

April 7 -

Jose Ramirez says he doesn't recognize the criminal mastermind portrayed in the SEC's complaint against him.

June 11 -

FINRA arbitrators ordered the wealth manager and closed-end funds manager to pay damages as it resolves outstanding claims stemming from the island’s fiscal crisis.

May 21 -

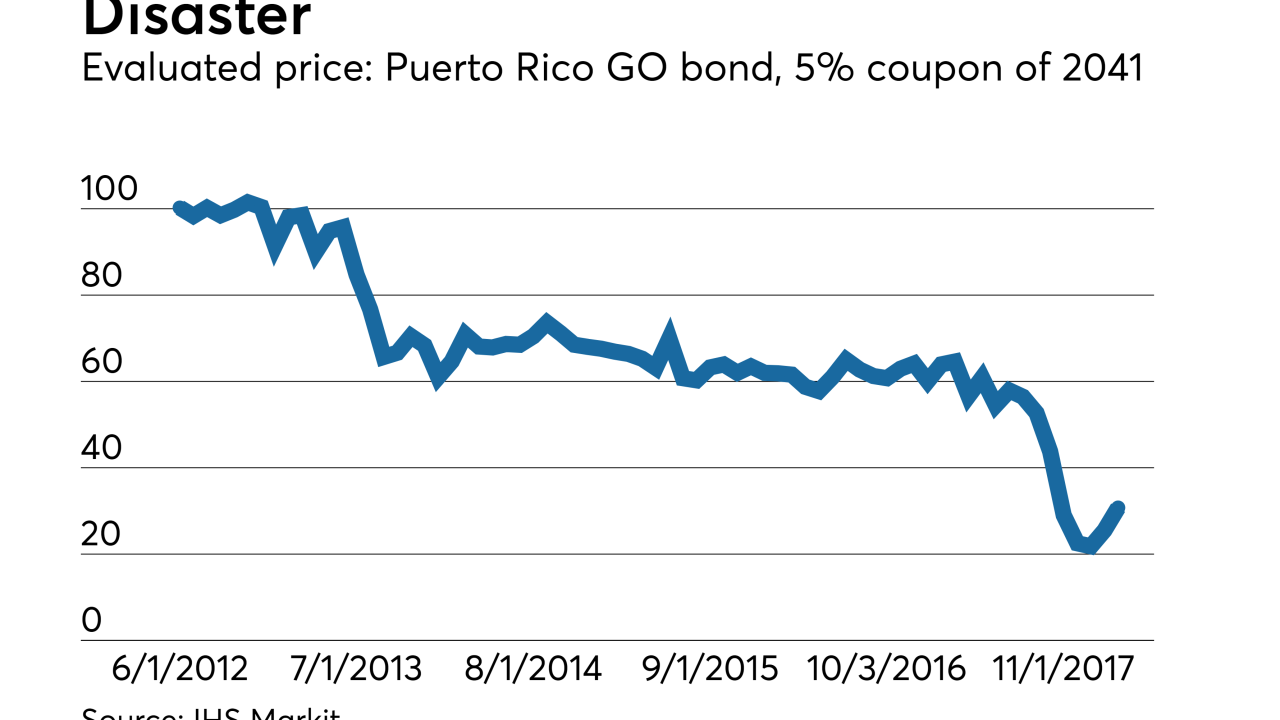

Puerto Rico's default is generating concern over mainland special revenue bonds and distressed issuers, and undercutting confidence in municipal credit nationwide.

March 22 -

The wirehouse alleges two arbitrators failed to disclose key information about their professional and personal histories.

January 9 -

An arbitration panel ordered the wirehouse to settle the latest dispute stemming from client investment losses tied to the island commonwealth's massive debt crisis.

December 6 -

A FINRA panel ordered the wirehouse to pay damages to two former clients who invested in Puerto Rican municipal bonds and closed-end funds.

November 29 -

With a debt restructuring likely, analysts see potential investment opportunities on the island, where clients from firms like UBS have sought to recoup losses on closed-end funds of municipal bonds.

March 29 -

In the latest in a series of cases, an arbitration panel has sided with a client against UBS, ordering the wirehouse to pay nearly $1.5 million in damages related to UBS' sale of Puerto Rican bonds and closed-end funds.

February 22 -

A FINRA panel ordered the wirehouse to pay a client $95,000 for losses relating to bonds issued by the island commonwealth. By contrast, UBS says it faces more than $1 billion in similar claims.

February 1 -

The firm suffered another arbitration loss this week to clients seeking damages related to the firm's closed-end funds of Puerto Rico municipal bonds.

September 1 -

An arbitration panel ordered the wirehouse to pay two former clients $250,000, a mere 10% of what they originally sought, in a case involving the sale of funds of Puerto Rican municipal bonds.

August 4 -

Now that its private-equity injection is almost a done deal, First BanCorp's natural next move would be to consolidate power in Puerto Rico. Unless it sells itself instead.

June 21