-

The Financial Services Institute blasts the move and won't rule out legal action to reinstate the more favorable Trump-era regulation.

May 12 -

The nation’s largest independent broker-dealer will onboard a substantially higher share of assets and advisors than after its last comparable deal in 2017.

May 5 -

The LPL and Private Advisor Group financial advisor serves on the Connecticut Autism Advisory Council, and he’s an expert in disability planning.

May 5 -

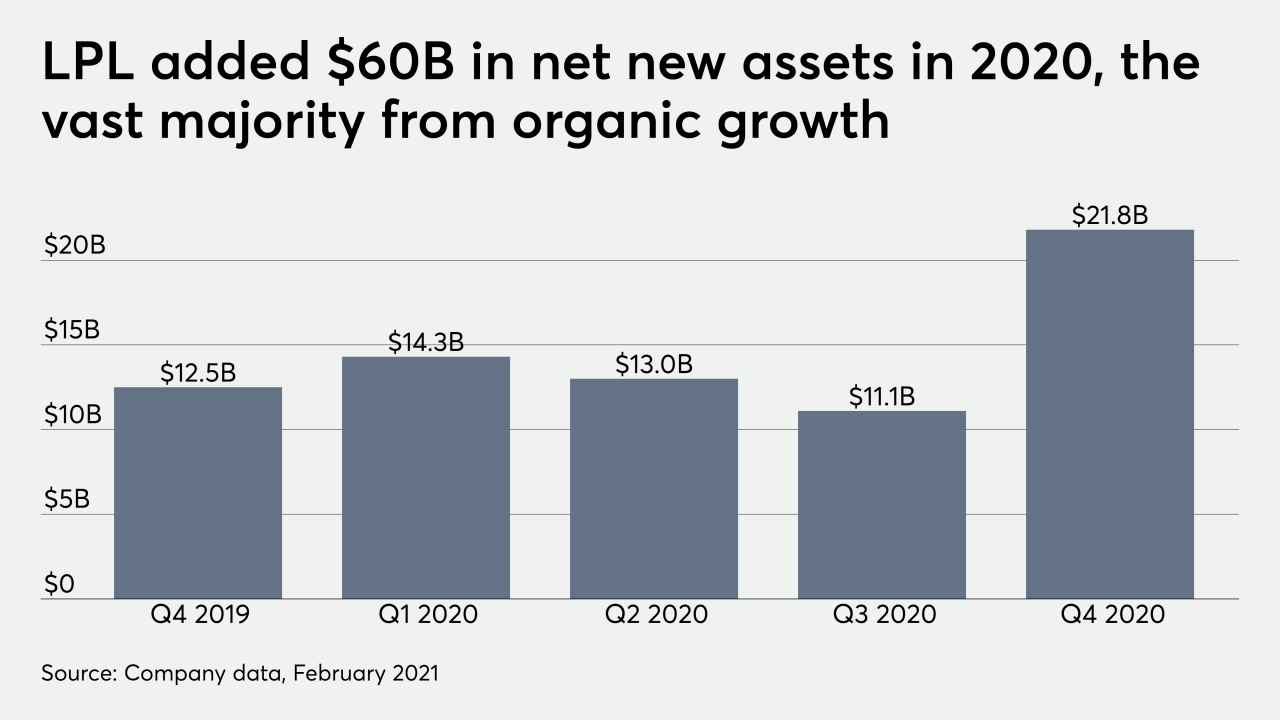

More growth is on the way: the No. 1 IBD has one more massive recruiting move and a $300M acquisition to complete.

April 30 -

Peggy Ho built the rival firm’s government relations team, and she’s joining the new firm at a pivotal time in wealth management regulation.

April 22 -

Advisor Kip Adams says access to the IBD’s trading platform and tools have “already improved how we open new accounts and manage our business.”

April 15 -

Former employee alleges financial-wellness guru’s firm selectively enforced “Christian” rules forbidding extramarital sex for staffers.

April 14 -

The quartet of advisors picked the nation’s largest IBD out of the increasing number of suitors available to ex-employee practices.

April 12 -

Financial advisor Christian D’Urso spends his mornings hiking, kayaking or biking, and his afternoons running a $110 million advisory business on the water.

March 25 -

The brokers are offering their practice management lessons and resources as scale becomes increasingly crucial to wealth managers.

March 24 -

Denika Tokunaga of Maven Wealth Management answered FP’s queries about challenges, opportunities and growing during the coronavirus.

March 10 -

Questions about job losses and real estate are adding more complexity to the usual post-deal issues involving advisor retention and company consolidation.

March 5 -

The fintech firm says use of the loans grew 10% last year among its client base.

February 22 -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17 -

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

A team that has grown through acquisitions dropped the No. 1 IBD after the institution purchased another one for more than $600 million.

January 27 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

LPL Financial and indie rivals like Raymond James, Wells Fargo FiNet and Kestra Financial completed at least 17 recruiting grabs of $800 million or more this year.

December 18 -

Waddell & Reed had been working in recent years to transform its “proprietary broker-dealer into a fully competitive independent wealth manager.”

December 10 -

Homogeneous industries and male executives are the primary target clients of the new consultancy, Kathleen Zemaitis says.

December 9