LPL Financial’s latest FINRA settlement feels like deja vu.

The nation’s largest independent broker-dealer agreed to pay $6.5 million after FINRA investigators found many of the same kinds of supervisory failures that the regulator cited in cases roughly five years earlier,

LPL had paid a settlement of $11.7 million in a May 2015 case alleging the firm failed to reasonably supervise its registered representatives’ consolidated reports. Under separate settlements in December 2016, the firm paid $1.7 million after FINRA said it failed to properly retain records and send clients their required account notices every three years.

The Dec. 31 case revolves around retention of records and the same 36-month notices, as well as fingerprinting of staff members. It also alleges that LPL’s failures involving consolidated reports serviced by third-party vendors were instrumental in enabling an ex-advisor to send clients false account statements in

Federal securities laws and FINRA rules require broker-dealers to maintain client records “in a form and manner designed to prevent their loss, alteration, or deletion,” according to the letter of acceptance, waiver, and consent. “Protecting the integrity of these required records is an essential obligation for broker-dealers because review of such records is the primary means by which regulators protect investors and examine for misconduct.”

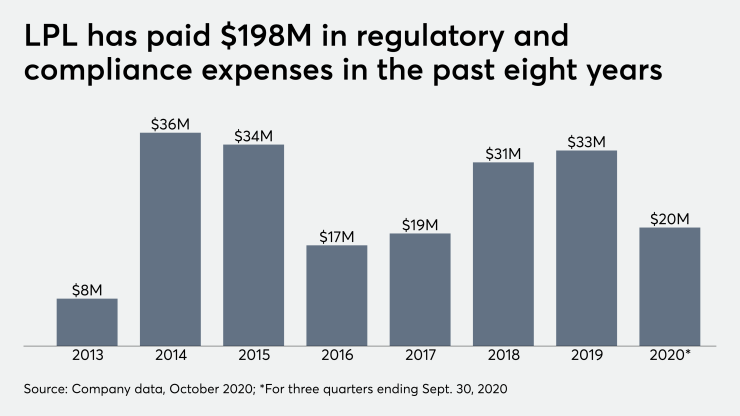

LPL didn’t admit or deny FINRA’s findings in agreeing to the settlement. The firm’s regulatory charges rose 5% year-over-year to $8.3 million in the third quarter,

“We take our compliance obligations seriously, and have been proactive in identifying, reporting and remediating these issues,” LPL spokeswoman Lauren Hoyt-Williams said in an email. “We’ve made significant investments to strengthen our capabilities related to this important work.”

LPL’s third-party compliance vendors and foreign technology staffing received scrutiny from FINRA investigators in the case, which faulted the firm for failing to fix some problems even after settling the earlier allegations.

The 2015 settlement restricted reps to using LPL’s proprietary systems or approved third-party vendors for consolidated reports. However, FINRA alleges that the vendors allowed reps to enter values for assets held away from LPL manually and send clients “draft” or “non-finalized” reports without getting them verified by the firm. LPL executives don’t know how many went out this way between the firm’s latest FINRA case and the earlier one, investigators say.

One specific vendor deleted 1.5 million client communications LPL was obligated to maintain for at least three years, according to the settlement. The company didn’t properly store some 87 million records between January 2014 and September 2019 and failed to send the 36-month notices to 1 million clients between December 2017 and December 2019, FINRA says.

Most of the 7,000 employees that LPL didn’t fingerprint as non-registered associated persons in the past seven years worked outside the U.S., according to investigators. In one case when the firm did take fingerprints and submit them to FINRA for an FBI background check, the regulator informed LPL that the employee had been convicted of a misdemeanor involving forgery, the document states. LPL allegedly kept the employee on staff for nearly two more years.